Everus Construction Group (ECG): Assessing Valuation After a 29% One-Year Share Price Gain

Everus Construction Group (ECG) has quietly outperformed the broader market this year, with the stock climbing about 29% over the past year and nearly 8% in the past month. Investors are starting to notice.

See our latest analysis for Everus Construction Group.

The latest leg higher, including a solid 1 month share price return of roughly 8% and a 1 year total shareholder return of about 29%, suggests momentum is still building as investors grow more comfortable with Everus Construction Group’s growth profile and valuation.

If Everus’s recent run has you thinking about what else could be gaining traction in this space, it is worth exploring aerospace and defense stocks as a fresh hunting ground for ideas.

Yet with earnings still growing double digits and the share price sitting around a 10% intrinsic discount and nearly 20% below analyst targets, is Everus a genuine value opportunity, or is the market already pricing in its future growth?

Price-to-Earnings of 25.1x: Is it justified?

Everus Construction Group trades on a price-to-earnings ratio of 25.1 times, which screens as good value against both direct peers and the wider US Construction industry, even after the latest share price rally.

The price-to-earnings multiple measures how much investors are willing to pay today for each dollar of current earnings, a key yardstick in capital intensive, contract driven businesses like construction and infrastructure services where profitability and cash generation can be cyclical.

With ECG, the market appears to be paying a lower multiple than both its peer group average of 28.7 times and the US Construction industry at 32 times, despite the company delivering 11.2 percent annual earnings growth over the past five years and accelerating to 24.4 percent in the most recent year, which suggests investors might still be underpricing the durability of its earnings profile and the quality of its earnings stream.

On top of that, the current 25.1 times multiple sits below the estimated fair price-to-earnings ratio of 28.5 times, indicating there is room for the valuation to move closer to levels implied by the fair ratio if Everus continues to execute on its current trajectory and sustain its 31.6 percent return on equity.

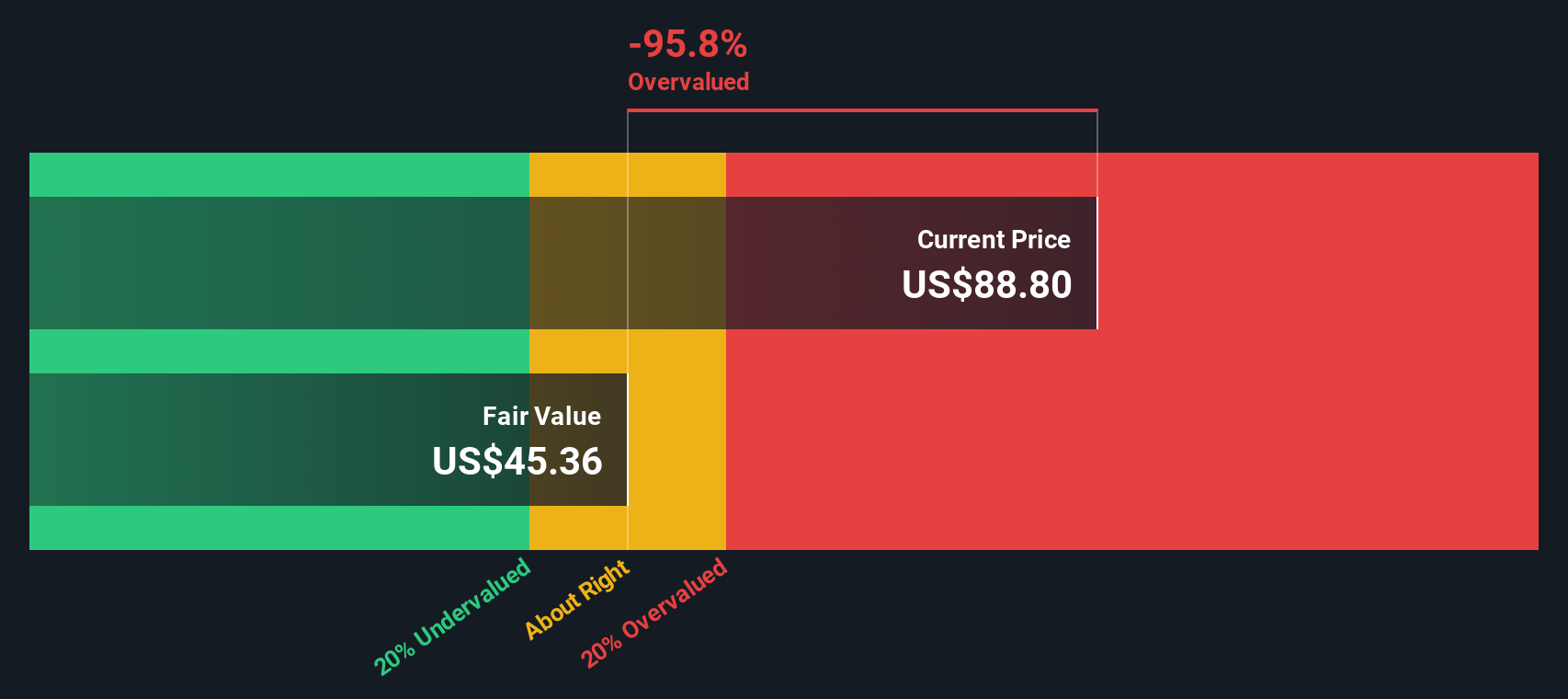

Explore the SWS fair ratio for Everus Construction Group

Result: Price-to-Earnings of 25.1x (UNDERVALUED)

However, risks remain if infrastructure spending slows or large utility customers delay projects, which could pressure Everus’s double digit growth and dent investor confidence.

Find out about the key risks to this Everus Construction Group narrative.

Another View: What Does Our DCF Say?

Our DCF model suggests Everus Construction Group is worth about $98.88 per share versus the current $89.03, implying roughly a 10% upside and a modest undervaluation. If cash flows track forecasts, is the market giving investors a reasonable margin of safety, or just a small cushion?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Everus Construction Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Everus Construction Group Narrative

If this perspective does not quite align with your own, or you prefer to dig into the numbers yourself, you can build a personalised view in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Everus Construction Group.

Ready for your next investing edge?

Before you move on, you may wish to explore your next potential idea by scanning targeted stock candidates on Simply Wall St’s screener, which is built from real fundamentals.

- Look for early-stage opportunities by reviewing these 3628 penny stocks with strong financials that already show balance sheet strength and signs of improving business momentum.

- Explore the AI theme by tracking these 24 AI penny stocks that may be exposed to rising demand for intelligent automation.

- Search for potential value opportunities by focusing on these 899 undervalued stocks based on cash flows where current prices may be low relative to certain cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal