Assessing Amprius Technologies’ Valuation as Korea Battery Alliance Expansion Boosts Defense-Focused Growth Prospects

Amprius Technologies (AMPX) just expanded its Korea Battery Alliance, adding three more contract manufacturers and pushing contracted capacity above 2 GWh. This is a strategic move aimed at defense-aligned, aerospace, and critical infrastructure customers.

See our latest analysis for Amprius Technologies.

That supply chain push comes after a huge run, with the share price up roughly 227 percent year to date and a 392 percent total shareholder return over 12 months, even as the stock has pulled back in recent weeks. This suggests momentum is cooling, but expectations for long term growth remain elevated.

If this kind of defense focused story has your attention, it might be a good time to see what else is taking off among aerospace and defense stocks.

With revenue surging but losses still mounting, and the share price far above where it started the year yet well below analyst targets, is Amprius still an underappreciated growth story, or has the market already priced in its future?

Most Popular Narrative: 45.5% Undervalued

With Amprius Technologies last closing at $9.35 against a narrative fair value near $17.17, the valuation case leans heavily on aggressive growth translating into future earnings power.

The industry's increasing need for lightweight, high energy density battery solutions (for drones, electric aviation, and next gen vehicles) enables Amprius to maintain premium pricing and outperform on gross and net margins due to its demonstrated product performance advantages, evidenced by record energy density and recent customer wins (e.g., AALTO/Airbus and U.S. Army).

Want to see what kind of revenue surge and margin transformation would need to materialize to back this rich future earnings multiple? The narrative quietly stacks layered growth assumptions, profitability inflection, and a lofty earnings valuation that would not look out of place among market darlings. Curious how those pieces fit together into a single fair value number?

Result: Fair Value of $17.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentration in aviation and drones, along with potential production scaling setbacks, means even minor contract losses or delays could quickly undermine this upbeat outlook.

Find out about the key risks to this Amprius Technologies narrative.

Another Angle on Valuation

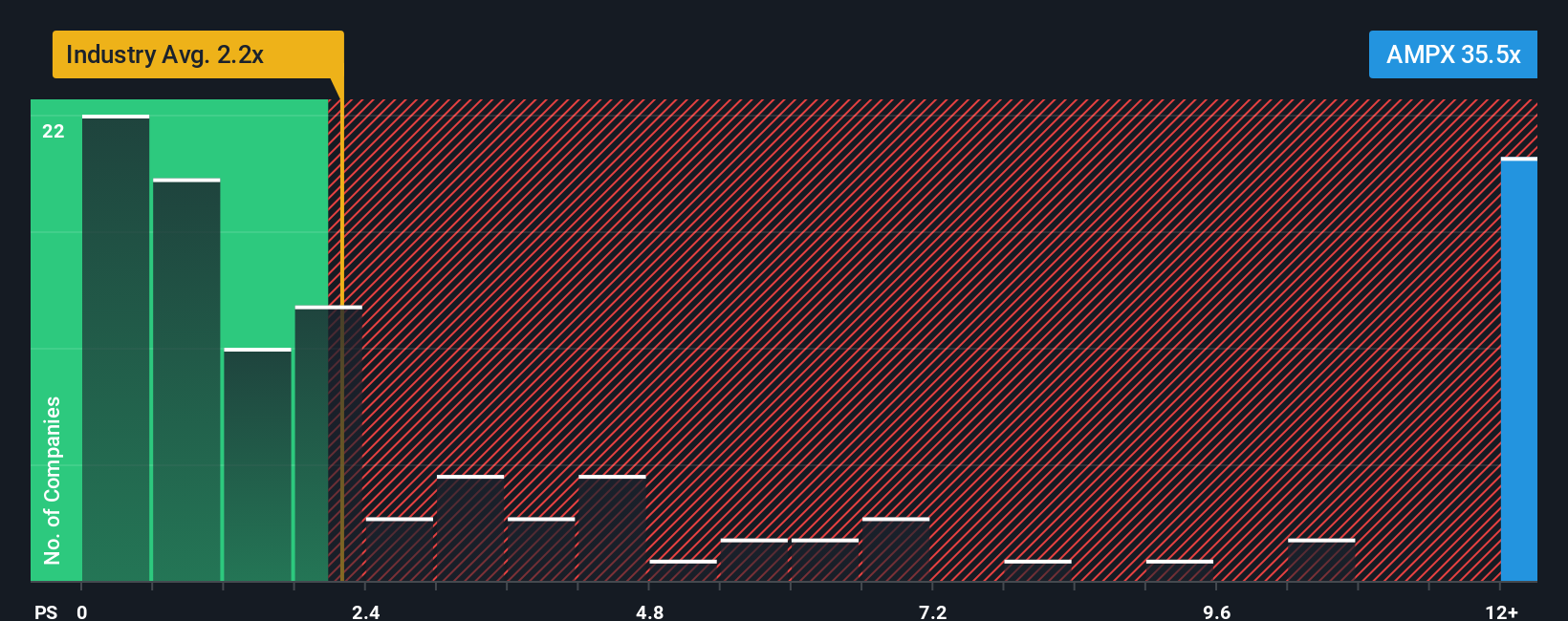

On a price to sales basis, the story looks very different. Amprius trades around 20.9 times sales, versus roughly 2.3 times for the US Electrical industry and a fair ratio near 2.5 times. That points to a rich valuation that could unwind quickly if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amprius Technologies Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes, Do it your way.

A great starting point for your Amprius Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before markets move on without you, put Simply Wall Street’s powerful Screener to work and line up your next wave of high potential opportunities today.

- Target resilient income by reviewing these 12 dividend stocks with yields > 3% that can potentially strengthen your portfolio’s cash flow through changing market cycles.

- Capture early technology trends with these 24 AI penny stocks positioned to benefit from accelerating demand for real world AI applications.

- Hunt for mispriced opportunities across markets with these 899 undervalued stocks based on cash flows that may offer upside if sentiment catches up to fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal