Assessing OGE Energy’s (OGE) Valuation After Its Recent Share Price Pullback

OGE Energy (OGE) has quietly slipped about 4% over the past month and roughly 5% in the past 3 months, even as its one year total return still sits near 7%.

See our latest analysis for OGE Energy.

At around $42.50 per share, OGE’s recent pullback reflects cooling short term sentiment even as its one year total shareholder return of about 7% and five year total shareholder return near 69% point to steadier, long term momentum.

If OGE’s slower moving utility profile has you wondering what else is out there, this could be a good moment to explore fast growing stocks with high insider ownership for more dynamic opportunities.

With shares trading at a modest discount to analyst targets but a premium to some intrinsic value estimates, is OGE Energy a quietly undervalued utility, or is the market already pricing in its future growth?

Most Popular Narrative: 9.9% Undervalued

With OGE Energy last closing at 42.50 dollars versus a narrative fair value of about 47.15 dollars, the latest storyline leans toward modest upside grounded in steady fundamentals rather than dramatic growth.

Federal and state policies focused on grid modernization and reliability, as well as incentives for infrastructure investment, underpin OGE's ability to secure cost recovery on capital projects, enhancing long-term profitability and margin stability. The company's strong balance sheet and relatively low refinancing risk (next modest refi in 2027) allow for cost-effective capital funding, further boosting net margins in a continued low interest rate environment.

Want to see what is really powering that upside gap? The narrative leans on deliberate revenue expansion, stronger margins, and a future earnings multiple that might surprise utility investors. Curious how those moving parts combine into a higher fair value, even with only moderate growth forecasts? Dive in to unpack the full playbook behind this valuation call.

Result: Fair Value of $47.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent industrial demand softness or rising regulatory pressure on gas heavy assets could quickly challenge the steady growth and valuation assumptions that underpin this outlook.

Find out about the key risks to this OGE Energy narrative.

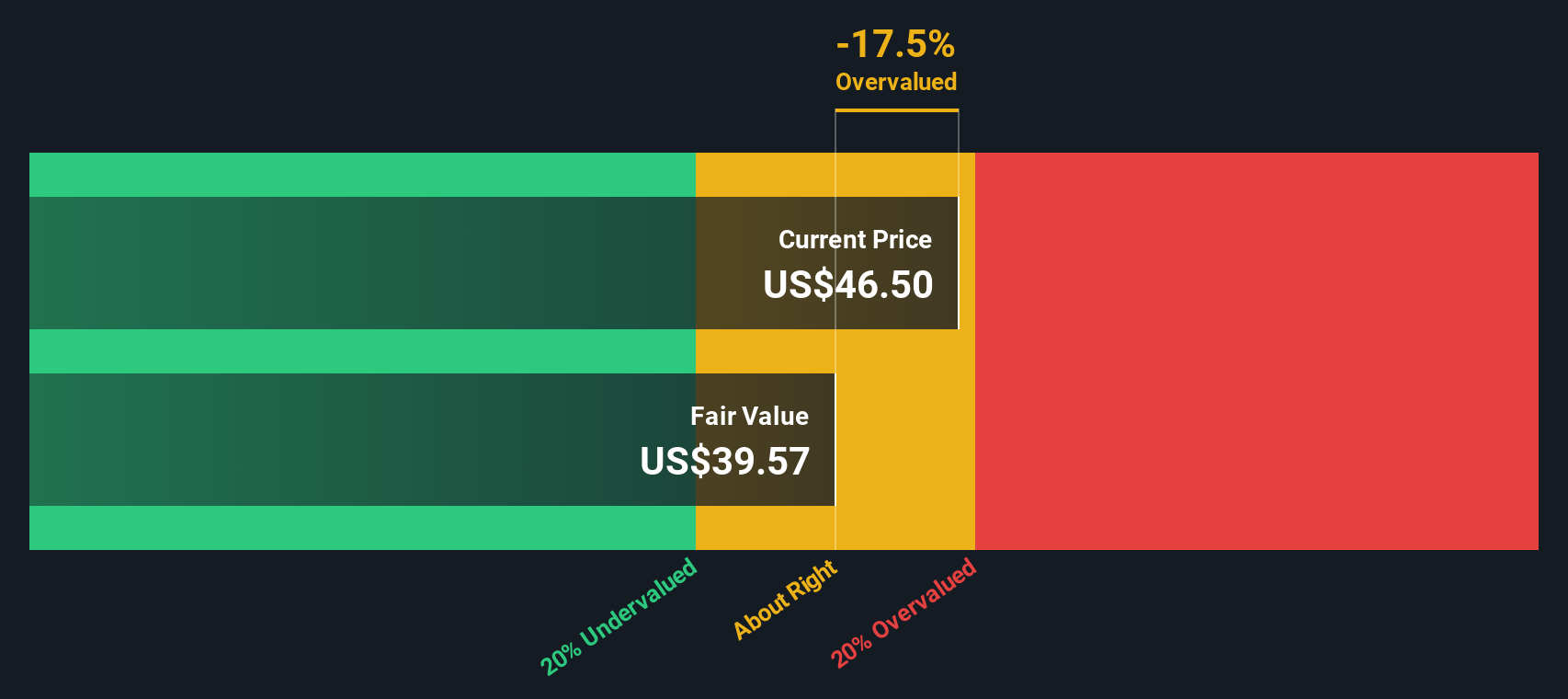

Another View: DCF Flags Mild Overvaluation

While the narrative fair value sits near 47.15 dollars, our DCF model paints a cooler picture, with fair value closer to 37.70 dollars. On that basis, today’s 42.50 dollar price screens as overvalued, not undervalued. Is the market overestimating growth, or is the model too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OGE Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OGE Energy Narrative

If you see the story differently, or want to pressure test your own assumptions against the numbers, you can build a custom view in minutes: Do it your way

A great starting point for your OGE Energy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put the Simply Wall St Screener to work so you do not miss compelling opportunities beyond a single utility stock.

- Capture potential multibaggers early by scanning these 3629 penny stocks with strong financials with improving fundamentals and room to grow into their valuations.

- Position your portfolio for structural tech change by targeting these 24 AI penny stocks riding powerful data and automation tailwinds.

- Identify potential upside and manage downside risk by focusing on these 899 undervalued stocks based on cash flows where current cash flows suggest the market price may not fully reflect underlying value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal