ASX Penny Stocks To Watch In December 2025

The Australian sharemarket has experienced a positive start to the last trading week of 2025, with notable gains in the materials and energy sectors contributing to an overall increase. Despite being considered an outdated term, penny stocks remain a relevant investment area, often representing smaller or newer companies that offer growth potential at lower price points. In this article, we explore three penny stocks that stand out for their strong financial fundamentals and potential for significant returns.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$116.07M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$67.93M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.775 | A$48.26M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.87 | A$456.46M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.85 | A$3.5B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.22 | A$1.39B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.84 | A$120.18M | ✅ 4 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.48 | A$230.53M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.21 | A$124.98M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.45 | A$645.2M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 427 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Invictus Energy (ASX:IVZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Invictus Energy Limited is an independent upstream oil and gas company focused on exploring and appraising oil and gas properties in northern Zimbabwe, Africa, with a market cap of A$216.47 million.

Operations: The company generates revenue of A$0.09 million from its oil and gas operations.

Market Cap: A$216.47M

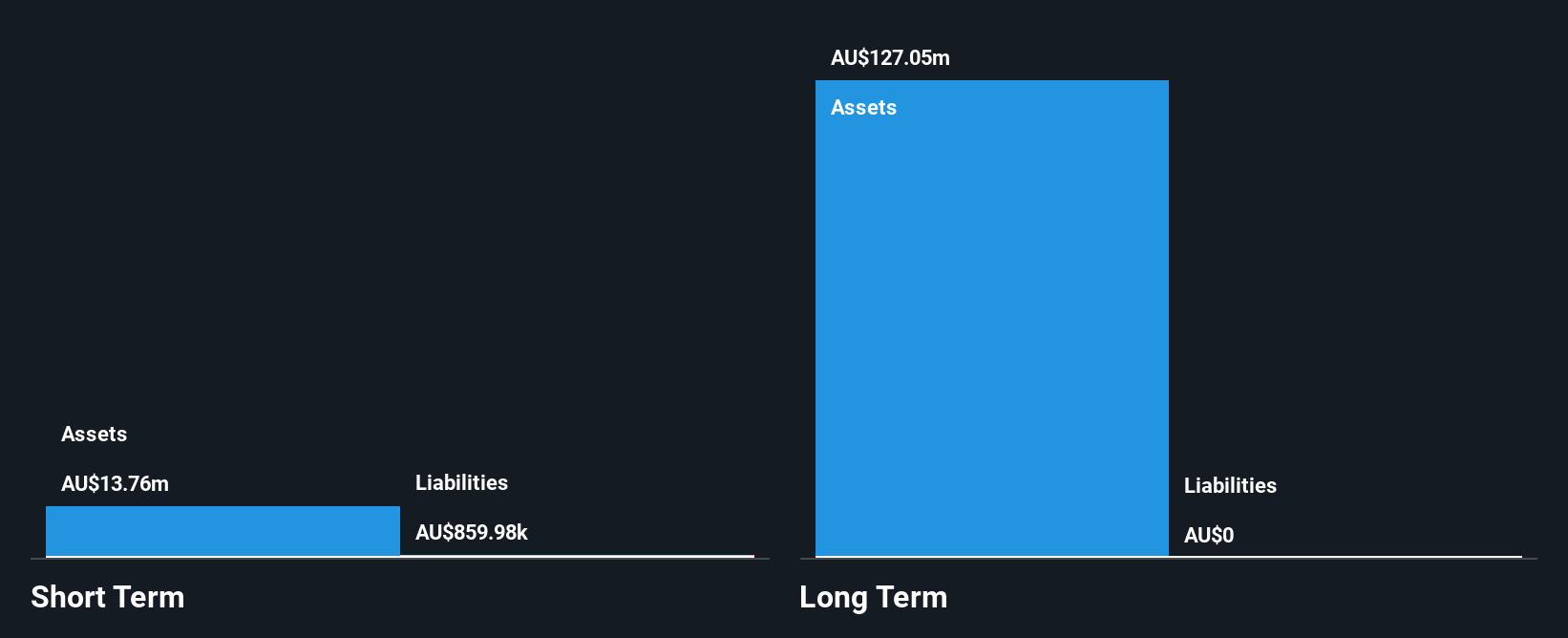

Invictus Energy is a pre-revenue company with a market cap of A$216.47 million, focused on oil and gas exploration in Zimbabwe. Despite its unprofitability and high share price volatility, the company benefits from being debt-free with short-term assets exceeding liabilities. The experienced management team has an average tenure of 7.5 years, suggesting stability in leadership. Recent capital raising efforts have bolstered its cash runway beyond the initial nine months based on past free cash flow reports. Shareholders have not faced significant dilution over the past year, indicating careful capital management amidst ongoing strategic developments.

- Get an in-depth perspective on Invictus Energy's performance by reading our balance sheet health report here.

- Understand Invictus Energy's track record by examining our performance history report.

Kinatico (ASX:KYP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kinatico Ltd offers screening, verification, and SaaS-based workforce management and compliance technology systems in Australia and New Zealand, with a market cap of A$138.27 million.

Operations: The company generates A$32.56 million in revenue from providing screening and verification checks.

Market Cap: A$138.27M

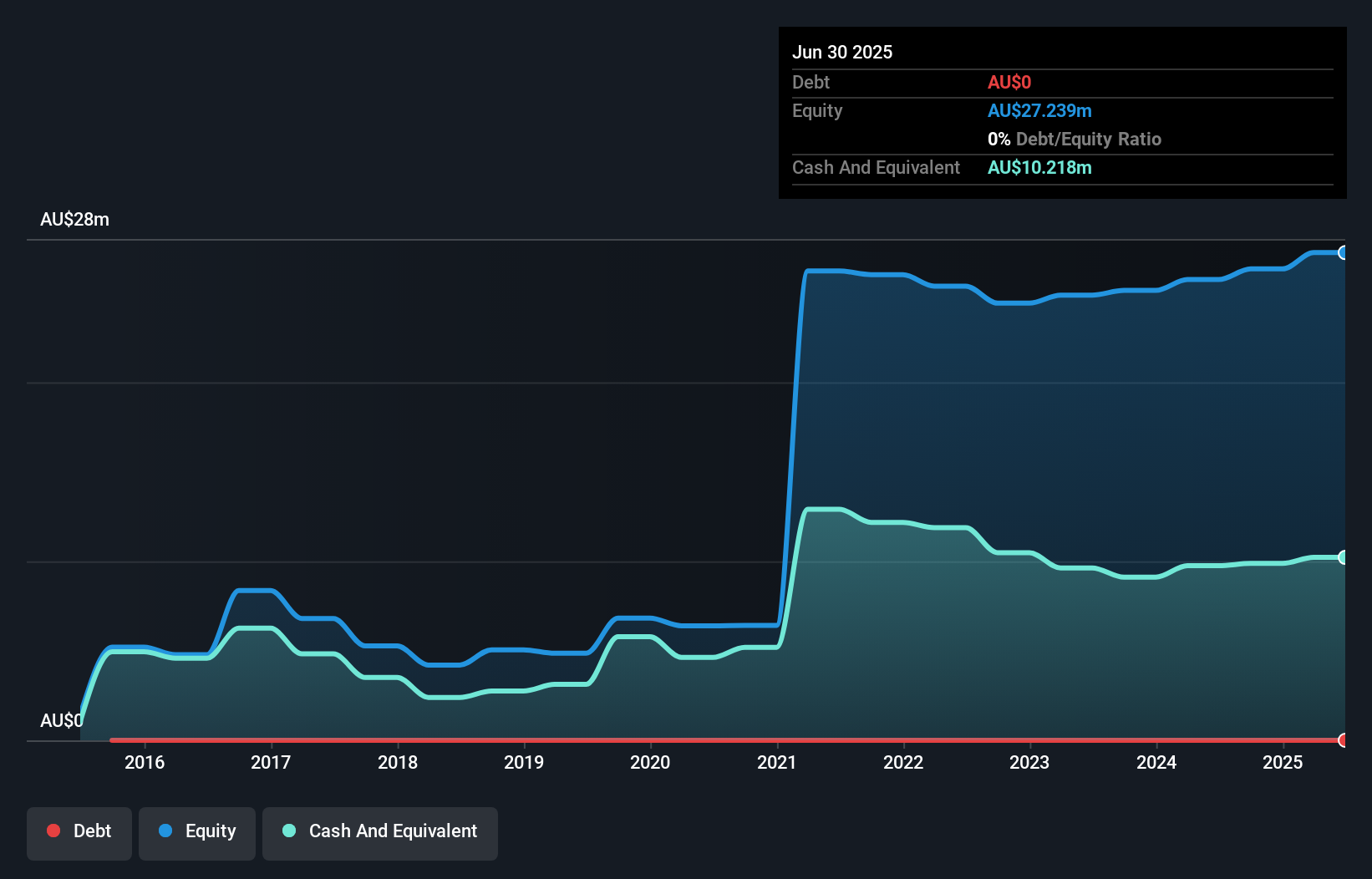

Kinatico Ltd, with a market cap of A$138.27 million, is trading at 32.5% below its estimated fair value, suggesting potential upside. The company has demonstrated strong financial health with no debt and short-term assets exceeding both short- and long-term liabilities. Over the past five years, Kinatico has achieved profitability with earnings growing by 51.4% annually on average and maintaining high-quality earnings despite a low return on equity of 4.1%. Earnings are forecasted to grow by 42.29% per year, supported by an experienced management team averaging 4.4 years in tenure and stable weekly volatility at 10%.

- Dive into the specifics of Kinatico here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Kinatico's future.

Marmota (ASX:MEU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Marmota Limited is involved in the exploration of mineral properties in Australia, with a market cap of A$147.54 million.

Operations: Marmota Limited does not report any specific revenue segments.

Market Cap: A$147.54M

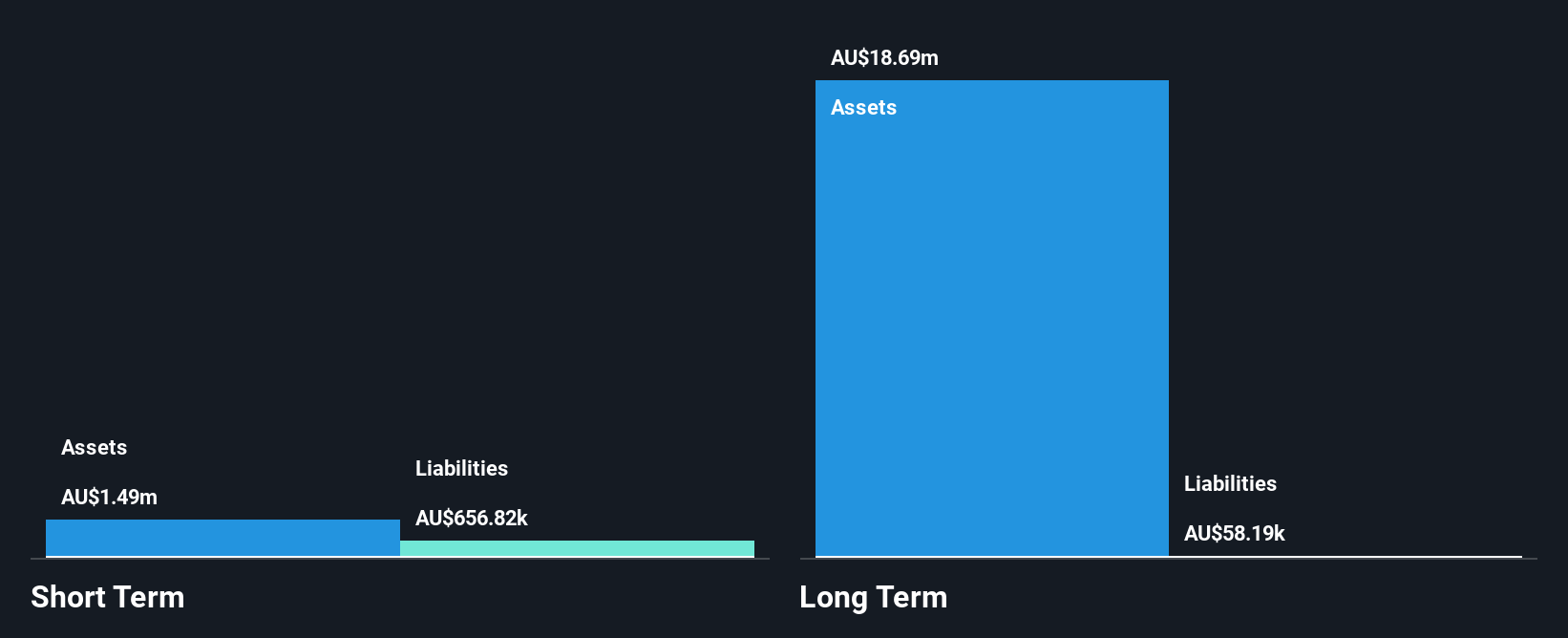

Marmota Limited, with a market cap of A$147.54 million, is pre-revenue and unprofitable but has managed to reduce losses over the past five years at 3% annually. The company maintains strong financial health with no debt and short-term assets of A$5.0 million exceeding both its short- and long-term liabilities. Despite high weekly volatility increasing from 16% to 28%, shareholders have not faced significant dilution recently. The management team is seasoned, averaging 6.3 years in tenure, providing stability amidst the company's challenges in achieving profitability and navigating a volatile share price environment over the last three months.

- Take a closer look at Marmota's potential here in our financial health report.

- Gain insights into Marmota's past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 424 more companies for you to explore.Click here to unveil our expertly curated list of 427 ASX Penny Stocks.

- Ready For A Different Approach? Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal