Discovering 3 Undiscovered Gems in the US Market

As the U.S. stock market navigates a holiday-shortened week, major indices like the S&P 500 and Nasdaq have shown modest gains, buoyed by a continued rally in tech shares. Amidst this backdrop of rising gold and silver prices and fluctuating economic indicators, investors are increasingly on the lookout for potential opportunities within lesser-known small-cap stocks that could offer unique growth prospects. In such an environment, identifying promising stocks involves looking beyond mainstream giants to uncover hidden gems that may be poised to benefit from current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

eGain (EGAN)

Simply Wall St Value Rating: ★★★★★★

Overview: eGain Corporation develops, licenses, implements, and supports customer service infrastructure software solutions across various regions including North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of $285.93 million.

Operations: eGain generates revenue primarily from its software and programming segment, amounting to $90.14 million. The company's financial performance is characterized by a focus on this core revenue stream, which plays a significant role in its overall business model.

eGain stands out for its robust earnings growth of 490% over the past year, significantly surpassing the software industry's 25%. This company is debt-free and trades at nearly 18% below its estimated fair value. Despite a volatile share price recently, eGain's strategic partnerships, like with Achmea and OCCU, reflect its commitment to expanding AI-driven customer service solutions. However, projected earnings are expected to drop by an average of 98% annually over the next three years. With recent revenue at US$23.51 million and net income rising to US$2.82 million from US$0.65 million a year ago, eGain's future remains cautiously optimistic amidst these challenges.

AdvanSix (ASIX)

Simply Wall St Value Rating: ★★★★★☆

Overview: AdvanSix Inc. is a company involved in the production and distribution of polymer resins both domestically and globally, with a market capitalization of approximately $444.87 million.

Operations: AdvanSix generates revenue primarily through its chemical manufacturing segment, which reported $1.49 billion in sales. The company's market capitalization is approximately $444.87 million.

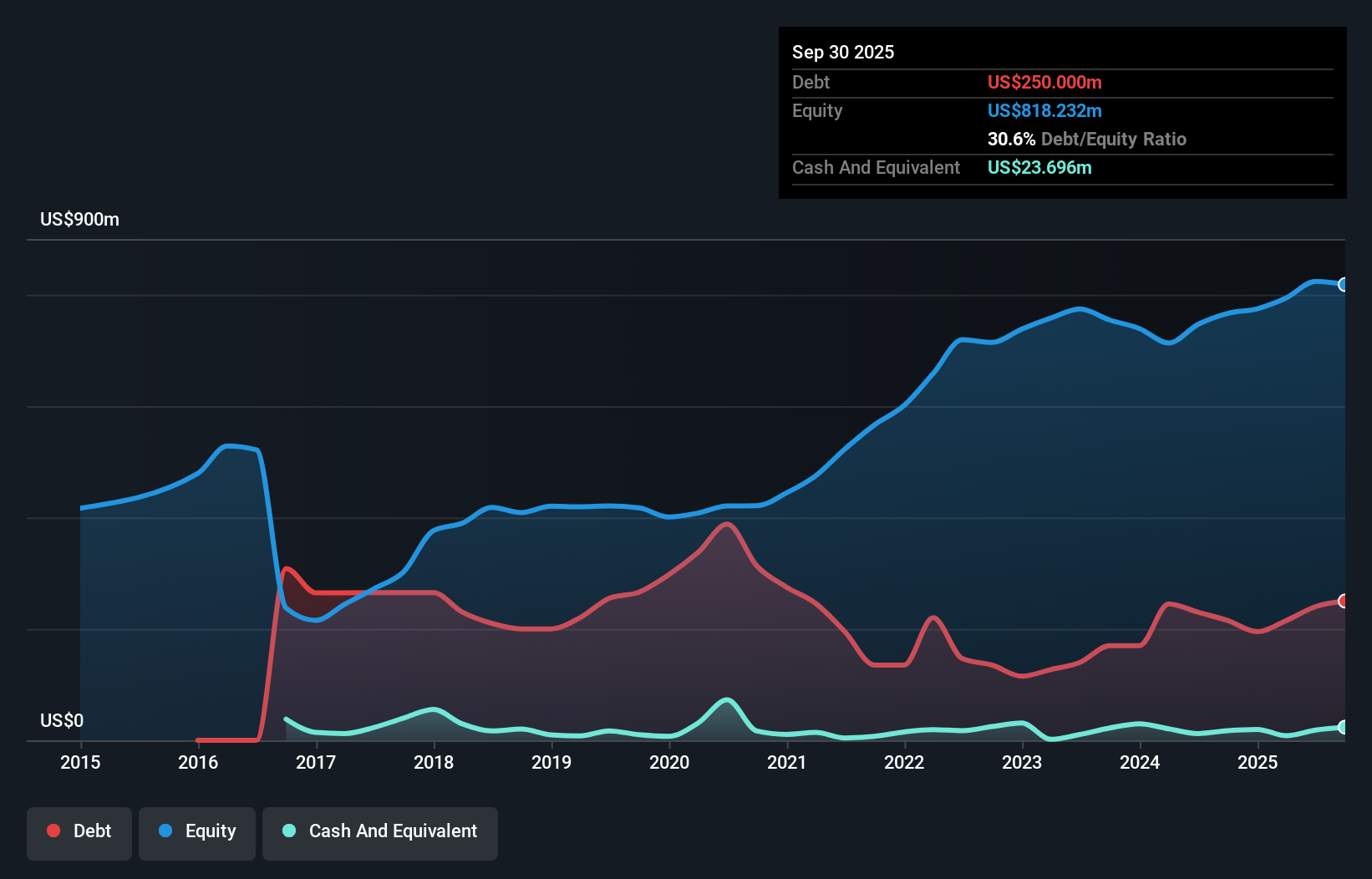

AdvanSix, a smaller player in the chemicals sector, has demonstrated resilience with a 35% earnings growth over the past year, outpacing the industry's -5.6%. Despite this growth, its stock trades at 89% below estimated fair value. Over five years, it reduced its debt-to-equity ratio from 74% to 31%, improving financial stability. Recent challenges include being dropped from several S&P indices and reporting a Q3 net loss of US$2.64 million compared to a US$22.27 million profit last year. However, for the nine months ended September 2025, net income rose to US$52.08 million from US$43.8 million previously.

Park Aerospace (PKE)

Simply Wall St Value Rating: ★★★★★★

Overview: Park Aerospace Corp. is an aerospace company that develops and manufactures advanced composite materials for the aerospace market across North America, Asia, and Europe, with a market cap of $427.38 million.

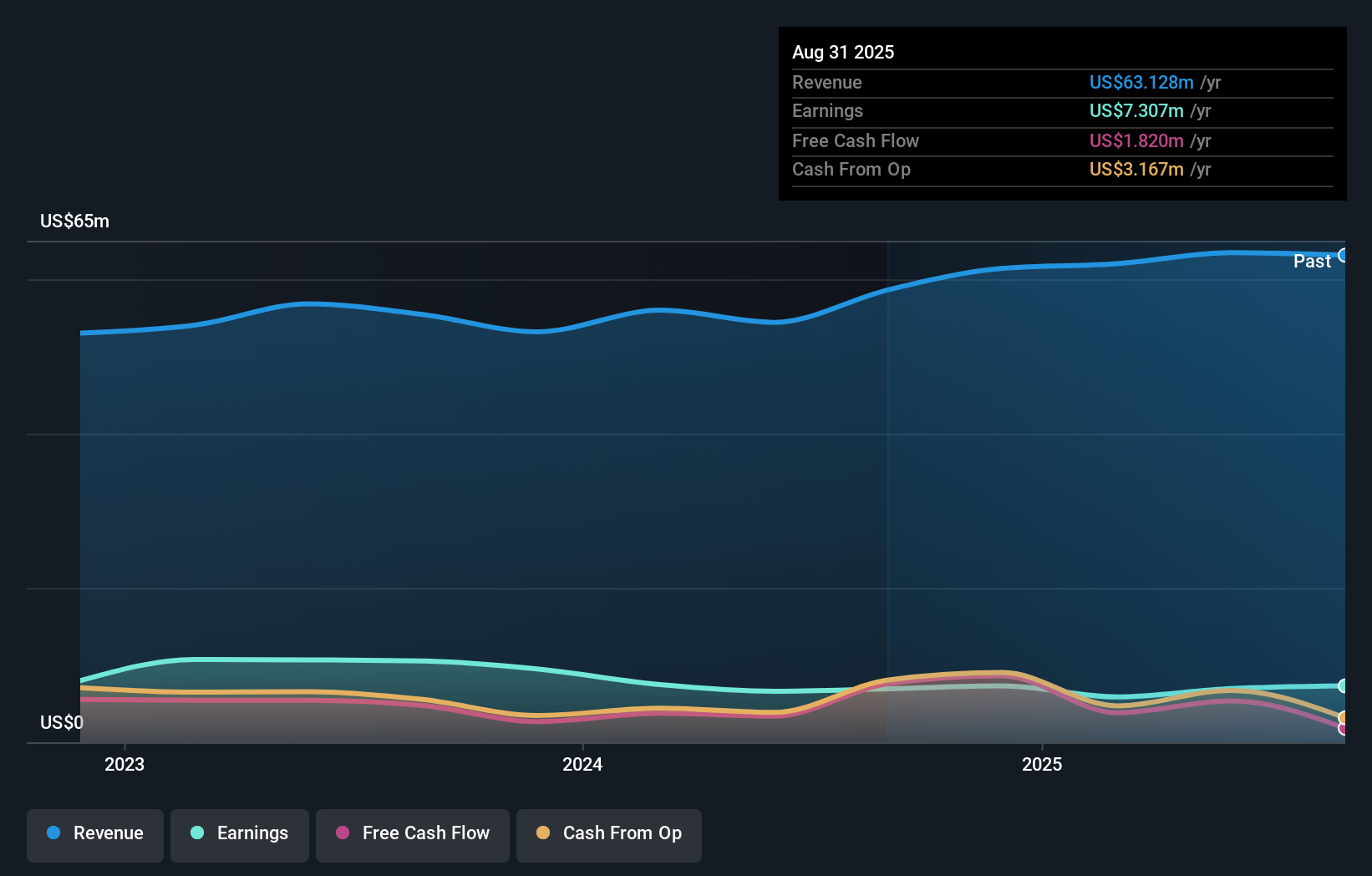

Operations: Park Aerospace generates revenue primarily from its Aerospace & Defense segment, which contributed $63.13 million. The company's financial performance is reflected in its gross profit margin, providing insight into cost efficiency and pricing strategy.

Park Aerospace, a nimble player in the aerospace sector, has showcased steady financial health with earnings growing 0.7% annually over five years. Despite not outpacing the industry's growth last year, it reported US$16.38 million in second-quarter sales and a net income of US$2.4 million, up from US$2.07 million previously. The company remains debt-free and boasts high-quality earnings with free cash flow positivity evident through its recent figures like a levered free cash flow of US$8.62 million in December 2024. A dividend of $0.125 per share underscores its commitment to returning value to shareholders amidst stable operations.

- Get an in-depth perspective on Park Aerospace's performance by reading our health report here.

Gain insights into Park Aerospace's historical performance by reviewing our past performance report.

Next Steps

- Get an in-depth perspective on all 298 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal