Top Dividend Stocks To Consider In December 2025

As the holiday-shortened week begins, major U.S. stock indexes are experiencing gains, buoyed by a continued advance in tech shares and record highs in gold and silver prices. In this dynamic market environment, dividend stocks can offer investors a measure of stability and potential income, making them an attractive option to consider amidst fluctuating indices and economic shifts.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.59% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.24% | ★★★★★★ |

| PCB Bancorp (PCB) | 3.50% | ★★★★★☆ |

| OTC Markets Group (OTCM) | 4.81% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.26% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.85% | ★★★★★★ |

| Ennis (EBF) | 5.53% | ★★★★★★ |

| Dillard's (DDS) | 4.70% | ★★★★★★ |

| Columbia Banking System (COLB) | 4.99% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.33% | ★★★★★★ |

Click here to see the full list of 112 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

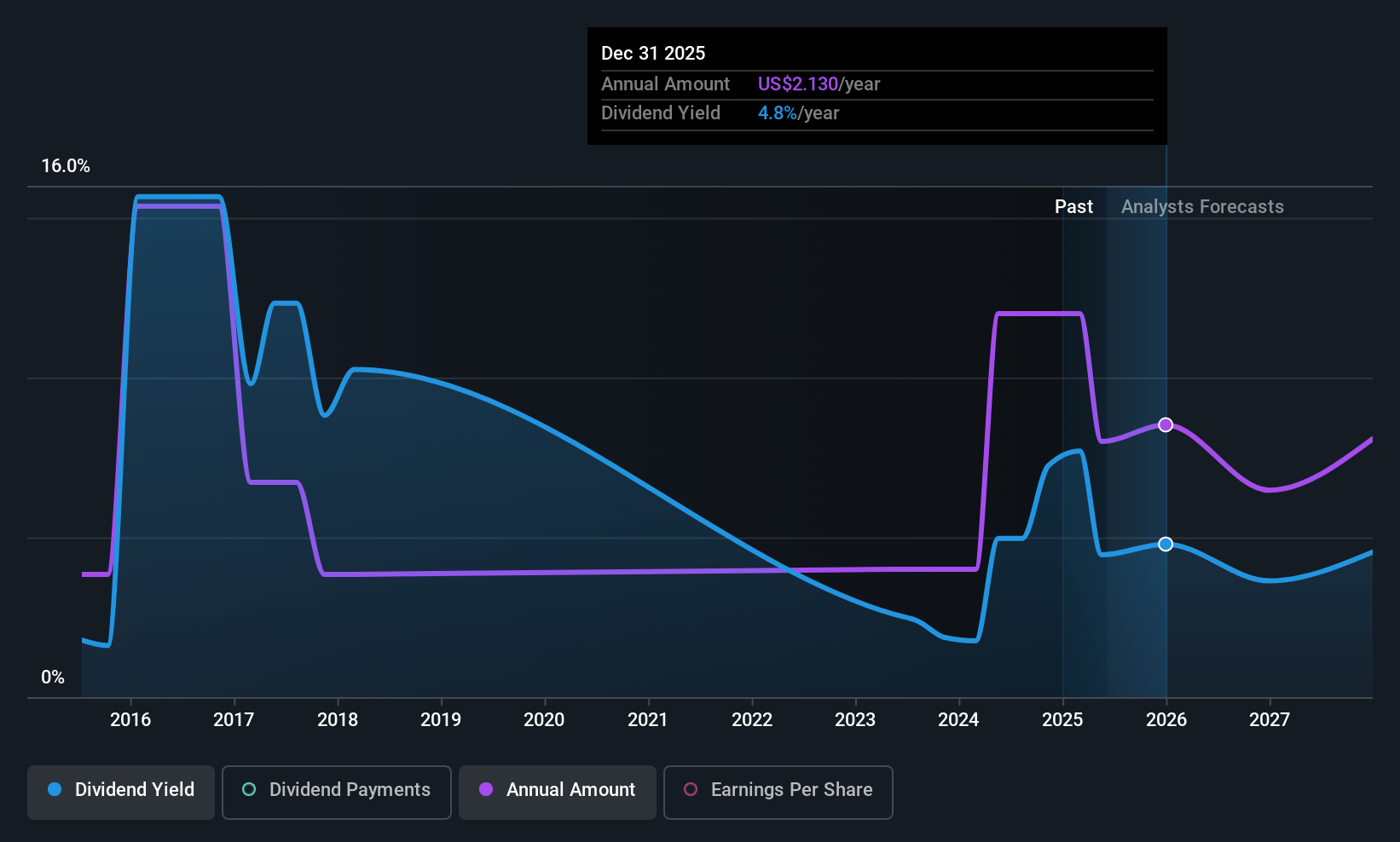

Teekay Tankers (TNK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teekay Tankers Ltd. offers marine transportation services to the oil industry both in Bermuda and globally, with a market cap of approximately $1.87 billion.

Operations: Teekay Tankers Ltd. generates revenue primarily from its Tankers segment, which accounts for $824.14 million, and its Marine Services and Other segment, contributing $127.74 million.

Dividend Yield: 3.7%

Teekay Tankers' dividend, though covered by both earnings and cash flows with a payout ratio of 33.1% and a cash payout ratio of 76.6%, is marked by volatility over the past decade. Despite recent affirmations of a US$0.25 per share quarterly dividend, its yield remains lower than the top tier in the U.S., and historical instability may concern some investors. The company reported strong Q3 net income growth to US$92.08 million, despite declining revenue year-over-year to US$229.02 million.

- Unlock comprehensive insights into our analysis of Teekay Tankers stock in this dividend report.

- The analysis detailed in our Teekay Tankers valuation report hints at an deflated share price compared to its estimated value.

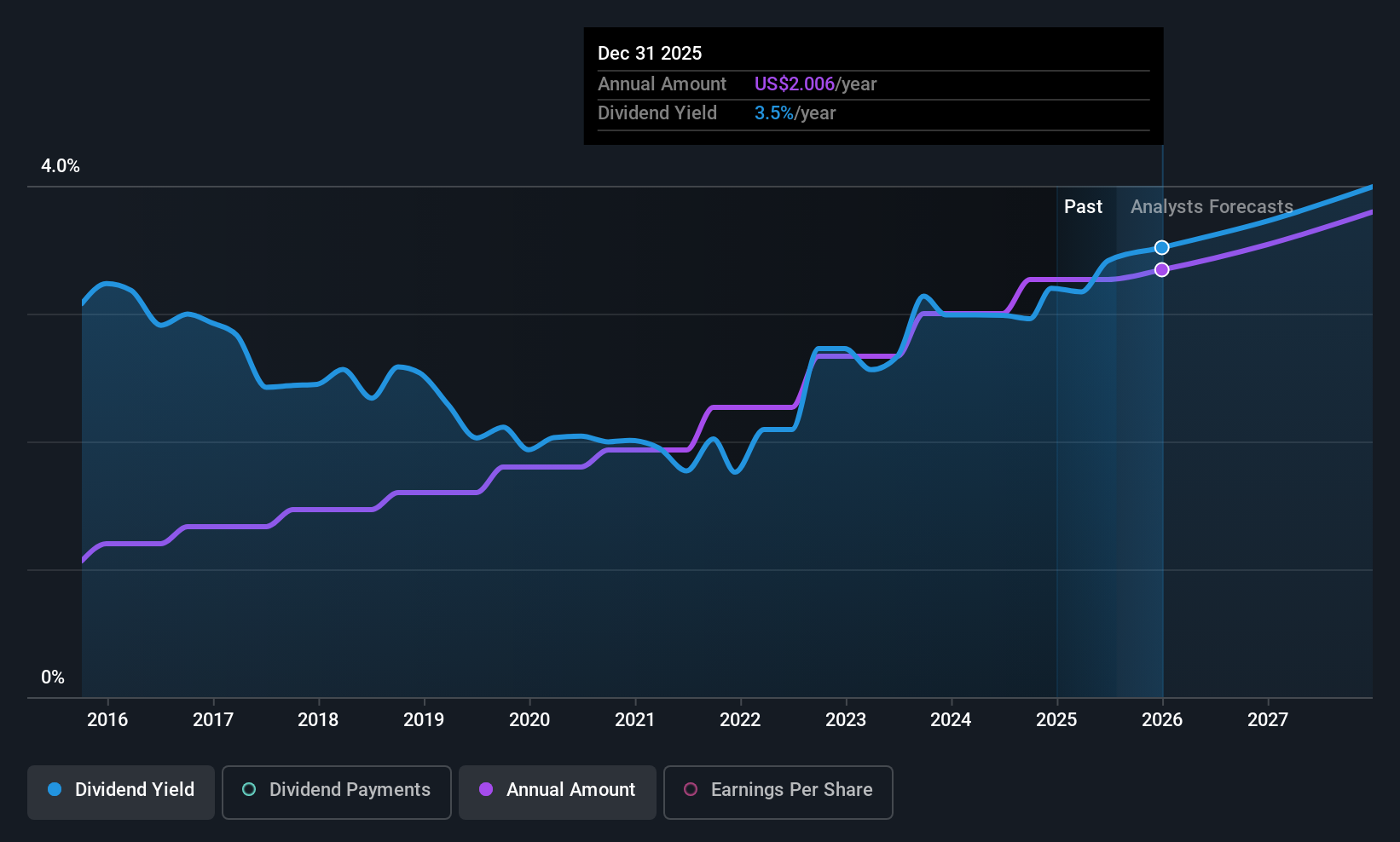

Terreno Realty (TRNO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Terreno Realty Corporation acquires, owns, and operates industrial real estate in six major coastal U.S. markets with a market cap of $6.27 billion.

Operations: Terreno Realty Corporation generates revenue primarily through its investments in industrial real estate, amounting to $442.61 million.

Dividend Yield: 3.4%

Terreno Realty's dividend is supported by earnings and cash flows, with a payout ratio of 76.5% and a cash payout ratio of 85%. The dividend has been stable over the past decade, although its yield of 3.43% is below the top U.S. tier. Recent strategic expansions include acquiring properties in Maryland and New York for US$50 million and US$4.7 million respectively, enhancing long-term revenue potential despite forecasted earnings decline by an average of 21.8% annually over three years.

- Dive into the specifics of Terreno Realty here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Terreno Realty is priced lower than what may be justified by its financials.

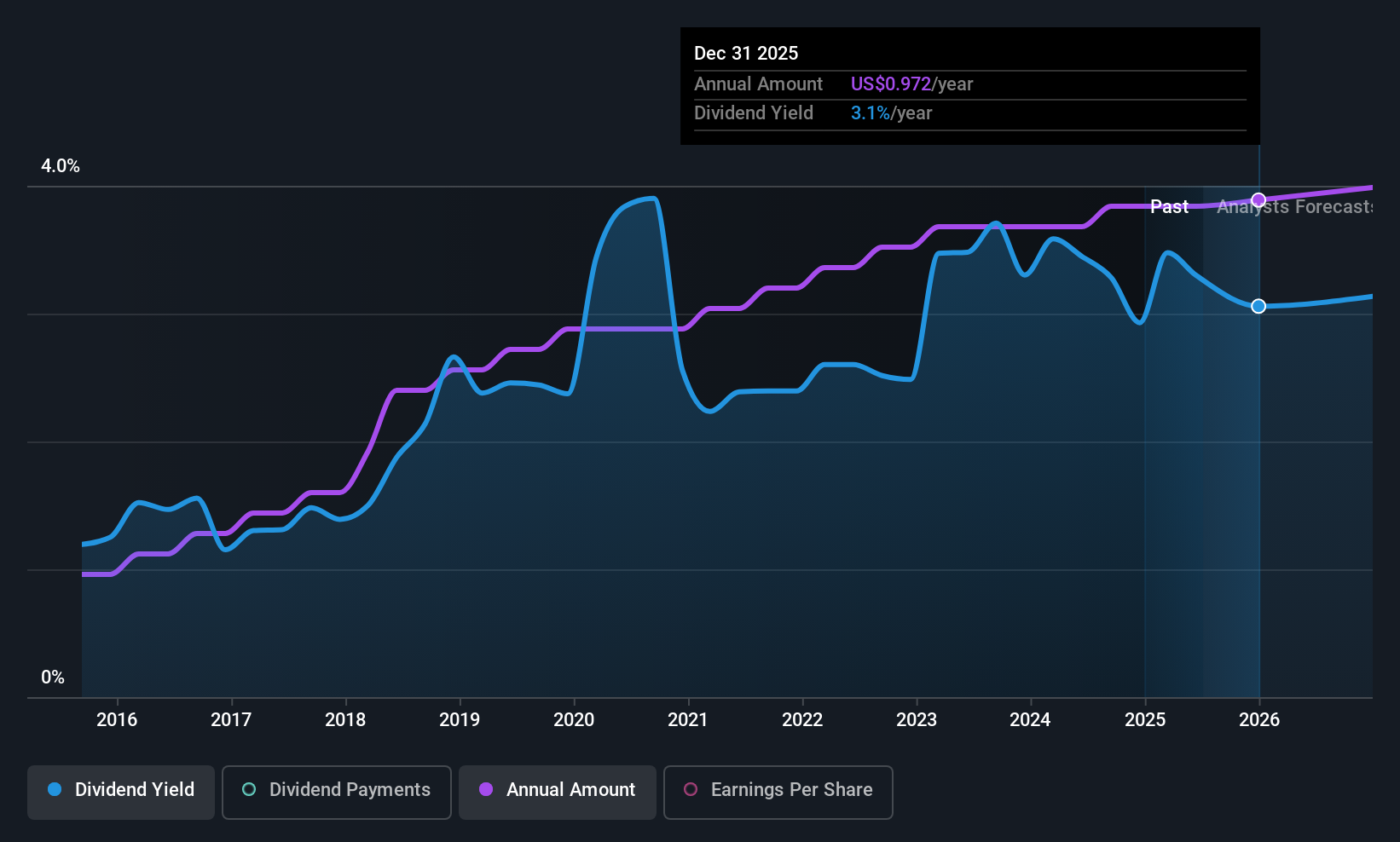

United Community Banks (UCB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: United Community Banks, Inc. is a bank holding company for United Community Bank, offering financial products and services across various sectors in the United States, with a market cap of approximately $3.92 billion.

Operations: United Community Banks, Inc. generates its revenue primarily from the Community Banking segment, which accounts for $989.09 million.

Dividend Yield: 3.1%

United Community Banks offers a reliable dividend with a payout ratio of 38.3%, indicating strong earnings coverage. The dividend yield is 3.1%, below the top U.S. tier, but it has consistently grown over the past decade. Recent strategic moves include a US$100 million share repurchase program and stable third-quarter earnings growth, with net income increasing to US$91.49 million from US$47.35 million year-over-year, supporting future dividend sustainability and shareholder value enhancement.

- Delve into the full analysis dividend report here for a deeper understanding of United Community Banks.

- According our valuation report, there's an indication that United Community Banks' share price might be on the cheaper side.

Where To Now?

- Embark on your investment journey to our 112 Top US Dividend Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal