A Look at ESAB (NYSE:ESAB) Valuation After New Automation-Focused Welding Tractors and Cobot Launch

ESAB (NYSE:ESAB) just rolled out its Tracfinder Rail and Wheel battery powered welding tractors alongside the ROBBI Mobile cobot welding system, a clear push deeper into automation that could gradually reshape its growth profile.

See our latest analysis for ESAB.

These launches land at an interesting moment, with ESAB’s share price at $113.71 and a solid 1 month share price return of 7.27% suggesting momentum is rebuilding. This is occurring even though the year to date share price return is slightly negative and the 3 year total shareholder return of 133.86% still frames it as a strong long term compounder.

If ESAB’s automation push has caught your attention, this could be a good time to explore aerospace and defense stocks, where industrial know how and longer cycle demand often meet compelling valuations.

With shares trading around a 20% implied discount to intrinsic value and over 24% below analyst targets, investors may be wondering whether ESAB’s automation momentum signals an overlooked entry point or if the market is already pricing in the next leg of growth.

Most Popular Narrative Narrative: 19.7% Undervalued

With ESAB last closing at $113.71 against a narrative fair value near $141.55, the story leans toward upside driven by improving earnings quality and mix.

The increasing adoption of automation in welding, driven by skilled labor shortages, is accelerating demand for higher-margin, technologically advanced solutions. ESAB's expanding equipment and automation portfolio, bolstered by acquisitions like EWM and recent AI/EBX initiatives, is expected to support a long-term shift toward improved net margins and recurring revenues.

Want to see how steady top line growth, rising margins, and a richer earnings mix all combine into that higher valuation target? The full narrative unpacks the revenue runway, the margin lift, and the punchy future earnings multiple that has to hold for this upside case to work. Curious which assumptions really move the fair value dial and how bold they are compared to today? Dive in to see the exact profit ambition behind that price.

Result: Fair Value of $141.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tariff uncertainty and cyclical industrial capex could still derail that upbeat margin story and crimp automation demand just as expectations move higher.

Find out about the key risks to this ESAB narrative.

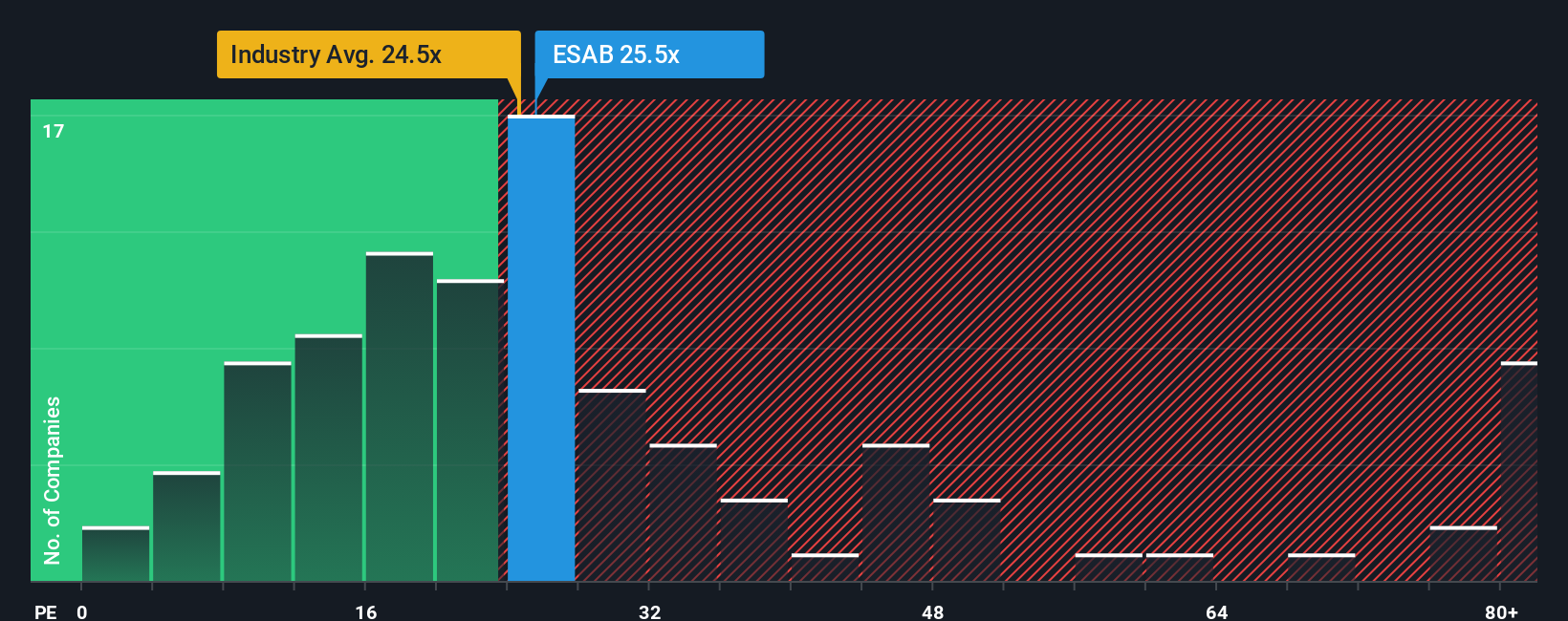

Another View Using Market Ratios

While the narrative fair value suggests nearly 20% upside, ESAB already trades on a price to earnings ratio of 25.2 times. This is very close to the US Machinery industry at 25.3 times and just under our 25.8 times fair ratio. That narrow gap hints the market may be pricing in much of the growth story already, leaving less room for error if margins or demand disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ESAB Narrative

If this outlook does not quite match your own view, or you prefer digging into the numbers yourself, you can build a custom narrative in minutes, Do it your way.

A great starting point for your ESAB research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall St Screener to move beyond ESAB, uncover fresh opportunities, and position your portfolio where growth, income, and innovation are actually happening.

- Capture high growth potential by targeting early stage opportunities through these 3633 penny stocks with strong financials before the wider market wakes up to them.

- Secure reliable cash flow by focusing on companies in these 12 dividend stocks with yields > 3% that reward shareholders with meaningful and sustainable payouts.

- Ride powerful technology shifts by zeroing in on leaders in these 24 AI penny stocks positioned to benefit from accelerating AI adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal