Assessing Flywire (FLYW) Valuation After Its Recent Share Price Rebound

Flywire (FLYW) has quietly bounced, with shares up about 3% over the past week and 11% over the past month, even though the stock remains down sharply year to date.

See our latest analysis for Flywire.

That recent rebound has only chipped away at a tough year, with the share price still showing a steep year to date share price loss and a three year total shareholder return that points to fading long term momentum, even as some investors are tentatively re rating the growth story.

If Flywire has you thinking about where the next payment or fintech winner might come from, it could be worth scanning fast growing stocks with high insider ownership for other under the radar growth ideas.

With Flywire still lossmaking but growing revenue and trading only modestly below analyst targets, the real question is whether today’s valuation reflects temporary pessimism, or if the market has already priced in its next leg of growth.

Most Popular Narrative Narrative: 10.8% Undervalued

With Flywire last closing at $14.8 against a narrative fair value of $16.59, the story leans toward upside, hinging on aggressive growth assumptions.

Ongoing investment in proprietary technology, AI driven automation, and integration capabilities is yielding significant platform efficiencies (e.g., 25% operational cost improvements, 90% automated payment matching, and 40% automated customer service). These efficiencies underpin Flywire's ability to maintain or increase net margins and deliver stronger earnings leverage as scale increases.

Curious how modest revenue growth, surging earnings power, and a rich future earnings multiple can still justify this higher fair value? The full narrative unpacks the bold growth runway and profitability leap underpinning that target, plus the valuation gear change it assumes for Flywire’s shares.

Result: Fair Value of $16.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside hinges on policy and execution, with tougher visa rules and intensifying competition both capable of knocking Flywire’s growth story off course.

Find out about the key risks to this Flywire narrative.

Another View: Price Tag Tells a Different Story

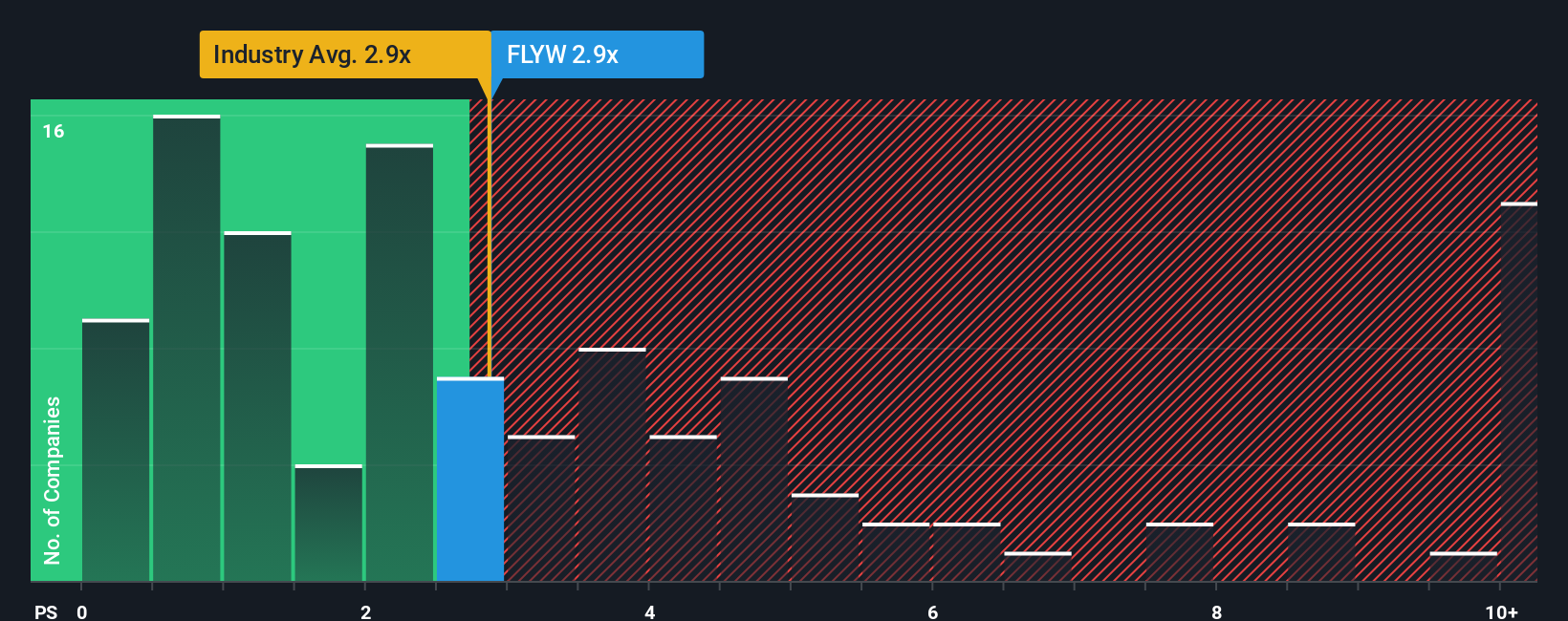

Those upbeat growth assumptions meet a harsher reality when you look at valuation. On a price to sales basis, Flywire trades at 3.1 times, well above both peers at 1.7 times and its own fair ratio of 2.3 times. This suggests investors are still paying up for execution risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Flywire Narrative

If you see this differently, or simply prefer to dive into the numbers yourself, you can build a complete narrative in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Flywire.

Looking for more investment ideas?

If you want a real edge, move now and let the Simply Wall St Screener surface quality, data driven opportunities before everyone else spots them.

- Capture early stage upside by reviewing these 3633 penny stocks with strong financials that pair tiny share prices with solid fundamentals and the potential to scale fast.

- Ride structural tailwinds by targeting these 29 healthcare AI stocks at the intersection of medicine, data, and automation, where adoption can unlock powerful compounding growth.

- Strengthen your portfolio’s income engine by focusing on these 12 dividend stocks with yields > 3% that can help sustain returns even when markets turn volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal