Did KT-621 Fast Track Status Just Shift Kymera Therapeutics' (KYMR) Investment Narrative?

- Earlier in December 2025, Kymera Therapeutics announced positive Phase 1b results for KT-621 in moderate to severe atopic dermatitis, followed by the FDA granting Fast Track designation to the oral STAT6 degrader for this chronic, debilitating condition.

- These KT-621 data, which showed biologics-like effects across multiple biomarkers and clinical endpoints in an oral, once-daily format, could meaningfully reshape expectations for Kymera’s protein degradation platform in Type 2 inflammatory diseases.

- We’ll now examine how Fast Track status for KT-621, with its once-daily oral profile, may influence Kymera’s broader investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Kymera Therapeutics Investment Narrative Recap

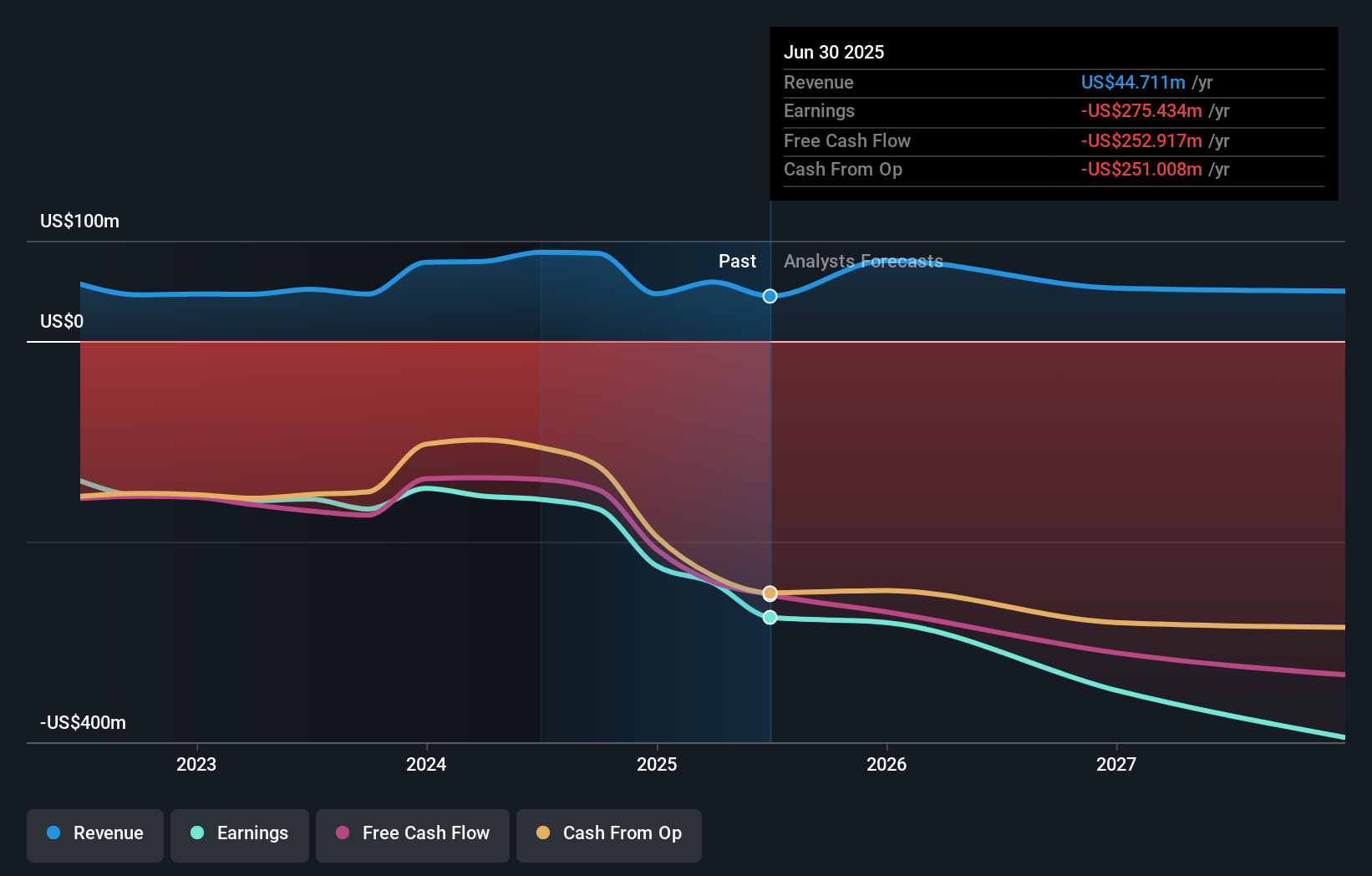

To own Kymera, you need to believe its targeted protein degradation platform can translate into meaningful, multi-indication drugs, with KT-621 as the flagship in Type 2 inflammation. The Fast Track designation and strong Phase 1b data appear to sharpen the focus on KT-621 as the key near term clinical catalyst, while the biggest risk remains Kymera’s high cash burn and reliance on future trial success to justify that spending.

Among recent announcements, the US$602,000,000 follow on equity offering stands out, because it adds financial flexibility just as Kymera moves KT-621 into parallel Phase 2b and planned Phase 3 programs. This extra capital may help support the expanded clinical agenda around KT-621 and other degraders, but it also increases dilution, which investors must weigh against the potential payoff from these upcoming milestones.

Yet before getting too comfortable with the KT-621 story, investors should also be aware of the risk that sustained high R&D spend...

Read the full narrative on Kymera Therapeutics (it's free!)

Kymera Therapeutics’ narrative projects $82.2 million revenue and $13.0 million earnings by 2028.

Uncover how Kymera Therapeutics' forecasts yield a $114.00 fair value, a 36% upside to its current price.

Exploring Other Perspectives

One member of the Simply Wall St Community currently values Kymera at US$114 per share. You can compare that single viewpoint with the KT-621 driven catalyst story and Kymera’s ongoing R&D spending risk to see how different assumptions can shape expectations for the business.

Explore another fair value estimate on Kymera Therapeutics - why the stock might be worth just $114.00!

Build Your Own Kymera Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kymera Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Kymera Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kymera Therapeutics' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal