Johnson Controls (JCI): Valuation Check After New AI-Powered Retail Sensors and Analytics Launch

Johnson Controls International (NYSE:JCI) just put its retail tech ambitions front and center, rolling out new AI powered Sensormatic sensors and analytics that promise sharper shopper insights, leaner staffing, and potentially stickier in store sales.

See our latest analysis for Johnson Controls International.

That launch lands at a strong moment for Johnson Controls International, with the share price at $119.53 and supported by a 51.40% year to date share price return and a 186.30% five year total shareholder return, suggesting momentum is firmly building around its smart building and retail tech strategy.

If this kind of AI driven transformation has your attention, it could be worth exploring other potential winners through high growth tech and AI stocks to see what else is reshaping the space.

Yet with shares already near record highs after a powerful multiyear run, the real question is whether Johnson Controls remains mispriced relative to its AI and smart building potential, or if the market has already baked in the growth.

Most Popular Narrative: 9.3% Undervalued

With Johnson Controls last closing at $119.53 against a narrative fair value near $132, the current price sits below the projected long term potential.

The raised upper bound of the price target range reflects increased conviction that management’s guidance is achievable, with upside potential if end market strength in data centers and critical infrastructure persists.

Curious what kind of revenue runway, margin lift, and future earnings multiple have to line up to support that valuation story? The most closely watched narrative blends steady top line growth, rising profitability, and a premium earnings multiple into a single forecast for where this building tech and HVAC powerhouse could trade next.

Result: Fair Value of $131.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on smooth execution, and operational complexity or restructuring missteps could easily derail the expected margin gains and growth trajectory.

Find out about the key risks to this Johnson Controls International narrative.

Another Lens on Valuation

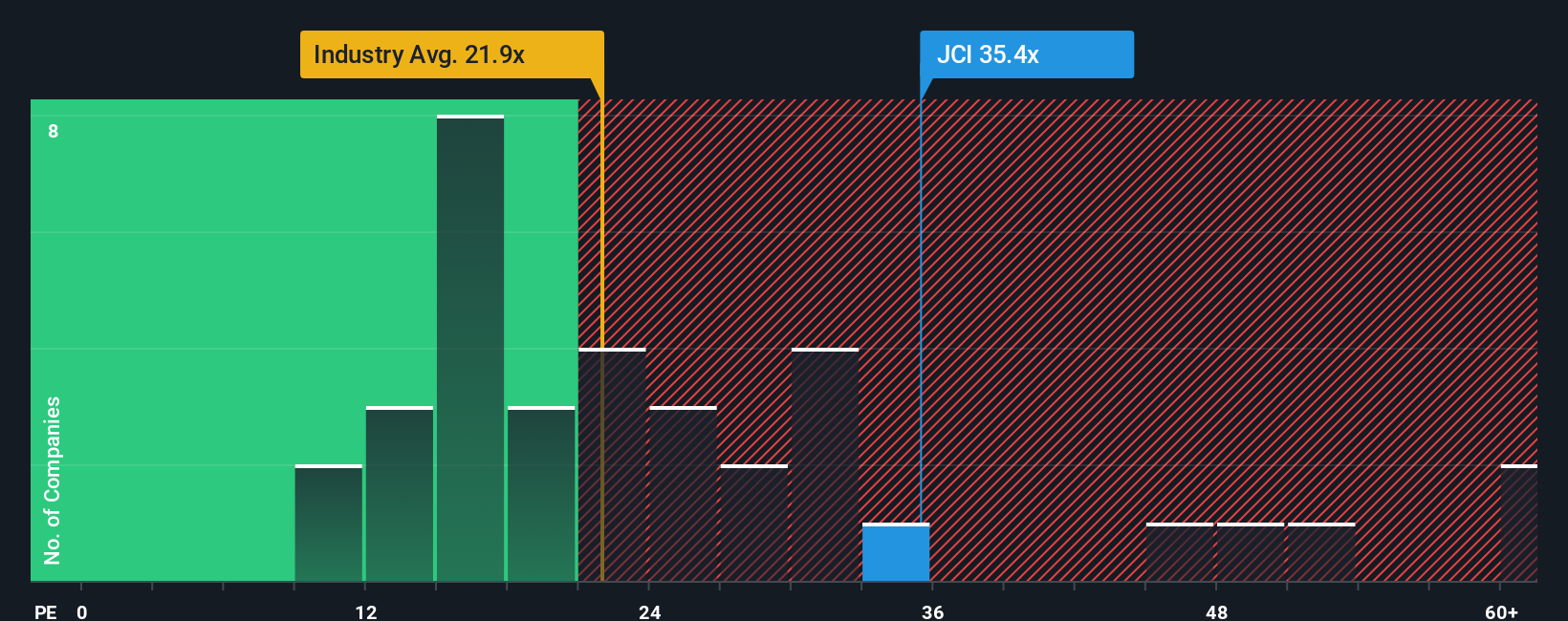

That upbeat narrative fair value contrasts sharply with how the market is actually pricing Johnson Controls today. On earnings, the shares trade at about 42.4 times profits versus 19.3 times for the US Building industry and a fair ratio closer to 37.1 times, pointing to a rich setup rather than a bargain.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Johnson Controls International Narrative

If you see the numbers differently or would rather test your own assumptions, you can quickly build a custom view in just minutes: Do it your way.

A great starting point for your Johnson Controls International research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for your next investing edge?

Set yourself up for smarter opportunities by using the Simply Wall St Screener to uncover focused, data driven ideas instead of waiting for the market to move first.

- Supercharge your hunt for quality by targeting these 903 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Tap into innovation by scanning these 24 AI penny stocks positioned to benefit from accelerating demand for intelligent software and automation.

- Strengthen your income strategy by zeroing in on these 12 dividend stocks with yields > 3% that can potentially boost returns while helping stabilize portfolio volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal