Is it dangerous when all of Wall Street is bullish on US stocks?

The Zhitong Finance App learned that Wall Street stock analysts have always been known for their bullish stance, but their current optimistic expectations for 2026 are causing concern among some market observers.

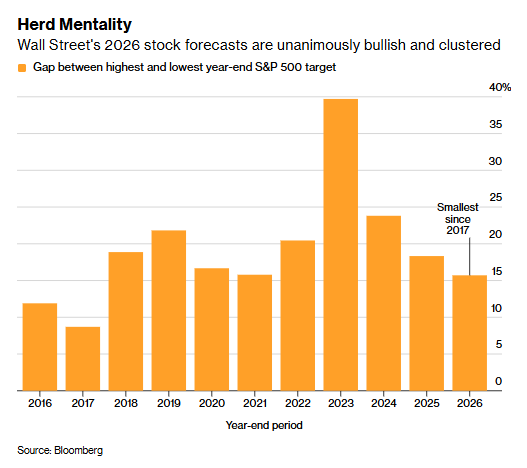

According to compiled data, the concentration of year-end target points given by sell-side strategists of major institutions for the S&P 500 index reached the highest level in nearly ten years. Oppenheimer gave the highest prediction of 8,100 points, while Stifel Nicolaus & Co. gave the lowest 7,000 points, but the expected gap between the two was only 16%.

This highly consistent view is often viewed as an inverse indicator in the market — when all market participants are betting in the same direction, this state of imbalance often corrects itself. Moreover, the current risks in the market are already obvious: the inflation rate is still higher than the Federal Reserve's target level, and the market's expectations of monetary policy easing may fall short at any time; the unemployment rate has continued to rise in recent months; and huge investment in artificial intelligence (AI) has yet to bring real profits.

Even so, against the backdrop of three consecutive years of double-digit gains in US stocks, strategists still expect an average increase of about 11% for US stocks in 2026.

Steve Sosnick, chief strategist at Yingtou Securities, said: “This high degree of consistency and concentration of predictions worries me. If everyone's expectations are the same, then those expectations must already be reflected in current stock prices — especially when most of the logic behind the consensus is based on similar logic such as interest rate cuts, tax cuts, and the continued dominance of AI.”

Oppenheimer and Deutsche Bank predict that by the end of December 2026, the S&P 500 index will break the 8,000 mark. Even the most pessimistic targets given by Stifel and Bank of America — 7,000 points and 7100 points — mean there is still some room for growth compared to last Friday's closing price.

Optimists believe that the core of this bullish logic is that economic growth will drive corporate profits upward. They pointed out that tax cuts and deregulation policies will boost economic vitality. Coupled with the expectation that the Federal Reserve is expected to cut interest rates by 25 basis points twice, the market has upward support. Pessimists, on the other hand, interpret this general optimism as a reflection of market complacency.

Dave Mazza, CEO of Roundhill Financial Inc., said, “When the target points of the S&P 500 index are so highly concentrated, it means that market expectations are fully reflected in stock prices, and these predictions themselves are vulnerable — the market will therefore be more sensitive to any subtle negative factors. When all market participants are on the 'same side of the ship', even if the economy does not fall into recession, as long as corporate profits fall short of expectations, unexpected policy changes, or there is no room for fault tolerance, it is enough to cause sharp fluctuations.”

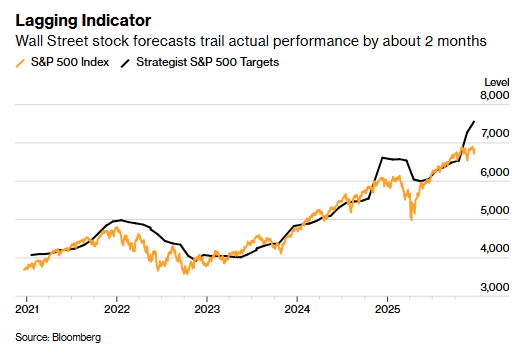

Publishing S&P 500 point predictions is a Wall Street tradition that has continued for many years. Every year at the end of the year, analysts from all walks of life, from large investment banks to niche investment institutions, reveal their predictions. However, these predictions have always been famous for being “tested and mistaken.” Piper Sandler & Co. According to the data, the target point of the S&P 500 index often lags behind the actual performance of the index by about two months, and the prediction of individual stock target prices also has the same lag problem.

Michael Kantrowitz, chief investment strategist at Piper Sandler, said, “Market consensus targets are not so much a leading indicator of market trends as market trends are leading indicators of consensus target adjustments. In my opinion, the target points given by strategists are just a simple way for them to express their bullish or bearish positions.”

Although the market has long been concerned that the concentration of the technology sector is too high and that the AI commercialization process falls short of expectations, the recent implementation of interest rate cuts and the promotion of the White House tax relief bill have injected confidence into economic growth and are continuously boosting investor sentiment.

Greg Boutle, head of US stock and derivatives strategy at BNP Paribas, said, “The risk that the current market is generally optimistic is that this sentiment is based on the inertia of the index continuing to rise. In my opinion, the market movement is the most likely outcome, but it is also because of this, once an external shock occurs, its impact will be further amplified.”

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal