US Stock Outlook | Futures on the three major stock indexes are rising. This week's focus: Can US stocks usher in a “Santa Claus Market”?

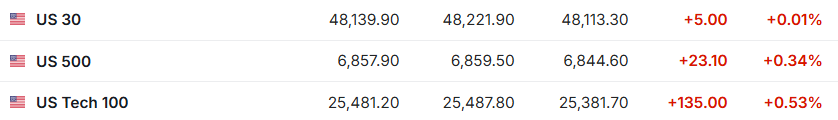

1. On December 22 (Monday), the futures of the three major US stock indexes rose sharply before the US stock market. As of press release, Dow futures were up 0.01%, S&P 500 futures were up 0.34%, and NASDAQ futures were up 0.53%.

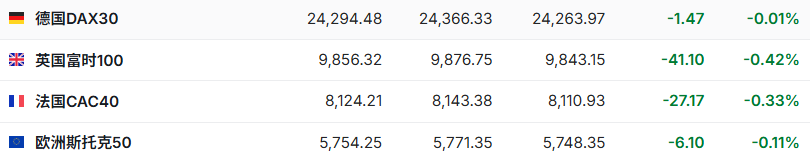

2. As of press release, the German DAX index fell 0.01%, the UK FTSE 100 index fell 0.42%, the French CAC40 index fell 0.33%, and the European Stoxx 50 index fell 0.11%.

3. As of press release, WTI crude oil rose 2.12% to $57.72 per barrel. Brent crude rose 2.10% to $61.74 per barrel.

Market news

Many favorable factors are gaining momentum. Can US stocks start a “Santa Claus market” this week? The week with mixed ups and downs for major stock indexes has come to an end, and this week was also the last full trading week of 2025. By the last seven trading days of 2025, the three major stock indexes will all be close to their all-time highs, with a gap of no more than 3%. This week, the US stock market will have a relatively quiet week. US stocks only opened for half a day on Wednesday and were closed on Christmas Day on Thursday. Many international markets will also continue to be closed on Friday. Over the next week, investors who remain active during the holidays will turn their attention to the “Santa Claus Market” outlook, while on Tuesday some lagging data delayed due to the US government shutdown will be released. The consumer confidence index released by the World Federation of Major Businesses on Tuesday morning should be the focus of attention, as one of the major trends in 2025 is the K-type economy emerging among American consumers.

Divergence within the Federal Reserve intensified: Hamak said the policy was “appropriate to suspend” and wait for inflation to become clear. Cleveland Federal Reserve Bank Governor Beth Hammark said that during the period of evaluating the impact of the cumulative 75 basis point interest rate cut in the first quarter on the economy, it is appropriate to suspend adjustments in the current monetary policy. “Our current position is a basic expectation — this level can be maintained for a while until we have more clear evidence that inflation is falling back to target levels, or that the job market is weakening more substantially,” Hamak said. The Federal Reserve's latest interest rate cut resolution on December 10 met with three negative votes, the most since 2019. Officials disagree on the path of interest rates. Some policymakers are more concerned about the cooling of the labor market, while others believe that the Federal Reserve should prioritize controlling inflation above target. Interest rate forecasts released after the meeting showed that six officials prefer to keep interest rates unchanged.

Both hit another record high! Expectations of interest rate cuts resonate with safe-haven demand, and gold and silver have risen sharply. Affected by heightened geopolitical tension and market expectations that the Federal Reserve will cut interest rates further next year, the price of silver continues to reach record highs, and the price of gold also rises. On Monday, as of press release, the spot price of silver rose 1.84% to $68.3995 per ounce. The price of spot gold rose to close to 4,383 US dollars/ounce, breaking through the historical high of more than 4,381 US dollars set in October. The price continued to rise in the previous two weeks. Silver prices continued to strengthen, boosted by speculative capital inflows and the continuing tight supply situation after the historic shortfall in October. Second, although the series of economic data released last week did not provide more clear information on the economic outlook, US President Trump has always advocated drastic interest rate cuts, and traders are betting that the Federal Reserve will cut interest rates twice in 2026.

$170 billion in place! Trump's “immigration crackdown” 2.0 is about to begin. US President Trump is preparing to use new funding to carry out more aggressive immigration crackdowns in 2026, including raids on more workplaces — although opposition is building up ahead of next year's midterm elections. Trump has previously deployed a large number of immigration enforcement agents to major US cities. They have swept through communities and clashed with local residents. Although federal agents have carried out some high-profile raids on businesses this year, they have largely avoided farms, factories, and other economically important businesses known to employ undocumented immigrants. After the Republican-controlled Congress passed a huge spending plan in July, the Immigration and Customs Enforcement (ICE) and Border Patrol will receive $170 billion in additional funding by September 2029 — a huge increase compared to their current annual budget of around $19 billion.

Goldman Sachs predicts that the global economy will grow steadily in 2026, but the job market is still sluggish. Goldman Sachs chief economist Jan Hatzius (Jan Hatzius) said in an outlook report that the global economy is expected to continue to expand steadily next year, but the labor market will remain relatively sluggish, while inflation will gradually fall back to the target level of major central banks. In the report entitled “Macro Outlook 2026: Steady Growth, Stagnant Employment, and Stable Prices”, released on December 18, Goldman Sachs expects the global GDP growth rate to be 2.8% in 2026, higher than the 2.5% generally expected by the market. Goldman Sachs believes that the US economy will continue to outperform other major developed economies. The GDP growth rate is expected to be 2.6% in 2026, mainly benefiting from weakening tariff drag, tax reduction policies, and a relaxed financial environment. The report warns that while overall output growth remains stable, improvements in the labor market may be difficult to keep up with economic expansion.

Individual stock news

Micron's strong guidance was compounded by many investment banks, and the semiconductor sector of US stocks rose in the pre-market. The semiconductor sector was generally higher before the market, supported by multiple benefits. The core driving force comes from strong earnings reports and optimistic guidelines released by Micron Technology (MU.US) last week. The growth in its HBM business has effectively allayed market concerns about a slowdown in AI hardware demand, driving the stock price to rise more than 3% before the market. Meanwhile, Wall Street investment banks have collectively raised the target prices of Broadcom (AVGO.US) and TSM.US (TSM.US), further confirming the long-term potential of AI infrastructure construction. Furthermore, as companies such as Atlas Cloud AI continue to increase their investment in Nvidia Blackwell chips, and the market's optimistic expectations for the “Santa Clause Market,” core chip stocks such as Nvidia and AMD followed suit, and the overall sector showed a strong recovery momentum.

Uber (UBER.US) teamed up with Baidu (BIDU.US) to launch driverless travel services in London. Uber rose 1.12% to $80.2 in the premarket. According to the news, Uber announced today that it will cooperate with Baidu's Radish Run to test run driverless taxis in the UK and closely follow the US autonomous driving company Waymo. Uber said it plans to launch a pilot project using the Baidu Apollo Go RT6 model in London in the first half of 2026, and is expected to be officially put into operation by the end of 2026. Previously, Waymo had taken the lead in launching relevant tests in London in early December, and the deployment of driverless ride-hailing around the world accelerated markedly. Earlier, after a large-scale power outage caused several autonomous vehicles to be paralyzed, Waymo, an autonomous driving division under Google (GOOGL.US), temporarily suspended its autonomous taxi service in San Francisco, causing traffic chaos in parts of the city.

Italian regulators have fined Apple (AAPL.US) nearly 100 million euros. The Italian Competition and Market Authority announced on December 22 that it will fine Apple, Apple Distribution International, and Apple Italy with 98.635 million euros for abusing their dominant position in the market. The statement said that the agency's investigation results determined that from the perspective of competition law, Apple's “application tracking transparency” policy has the nature of restricting competition.

Rocket Lab's (RKLB.US) 2025 launch mission ended successfully: 21 launches throughout the year, with a 100% success rate. American commercial space company Rocket Lab announced last Sunday that its “Electron” launch vehicle's 21st mission during the year was a complete success, and its customer, the Japanese Earth Imaging Company Institute for Q-Shu Pioneers of Space (iQPS), has launched a new satellite into the scheduled orbit. Boosted by this positive news, Rocket Lab's stock price rose about 4% before Monday's market. The company said that the satellite launched this time will join the iQPS synthetic aperture radar constellation to provide customers around the world with near-real-time imaging services through 12 different orbits.

Private equity giants Permira and Huaping Investment led the acquisition of Clearwater (CWAN.US), with a valuation of US$8.4 billion. A group of private equity firms led by Permira and Warburg Pincus (Warburg Pincus) have agreed to acquire investment and accounting software manufacturer Clearwater Analytics Holdings Inc., valuing the deal, including debt, at $8.4 billion. According to a statement, Clearwater shareholders will receive cash at a price of $24.55 per share, with an equity value of approximately $7 billion. The company said the price was about 10% higher than the previous closing price of the stock, and the premium was 47% compared to previous reports that the two acquisition companies were in negotiations on the acquisition.

Key economic data and event forecasts

21:30 Beijing time: The US Chicago Federal Reserve National Activity Index for November was released.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal