Assessing SITC International Holdings (SEHK:1308) Valuation After Its Confidence-Boosting Special Dividend Announcement

SITC International Holdings (SEHK:1308) has just declared a special cash dividend of HKD 0.70 per share, which is a clear signal that management is comfortable returning extra cash to shareholders on top of regular payouts.

See our latest analysis for SITC International Holdings.

The special dividend announcement comes after a strong run, with the share price at HK$27.74 and a robust year to date share price return. The one year total shareholder return of 58.02 percent suggests momentum is still very much on SITC International Holdings side despite some recent consolidation.

If this payout has you thinking about where else capital and confidence are lining up, now is a good moment to explore fast growing stocks with high insider ownership.

Yet with earnings coming off their peak and the share price sitting close to analyst targets, the key question is whether SITC still trades at a meaningful discount or if markets are already pricing in its future growth.

Price-to-Earnings of 7.4x: Is it justified?

Based on the latest data, SITC International Holdings trades on a price-to-earnings ratio of 7.4x at the last close of HK$27.74, placing it slightly more expensive than close peers but still below the wider Asian shipping sector.

The price-to-earnings multiple compares what investors are paying today for each unit of current earnings, making it a core gauge for a mature, profit generating logistics and shipping business like SITC. With earnings having grown sharply over the past year and profitability now running at elevated levels, this lens helps show whether the market is overpaying for what could be cyclical strength or sensibly pricing durable earnings power.

Relative to its direct peer group, SITC screens as somewhat expensive on 7.4x versus a peer average of 6.9x, which suggests investors are willing to ascribe a modest premium to its earnings profile. However, against the broader Asian Shipping industry average multiple of 10.4x, the same 7.4x looks notably cheaper, implying the market is not assigning SITC a full sector level valuation despite its outstanding 50.8 percent return on equity and strong recent profit growth. This sits close to our estimated fair price-to-earnings ratio of 7.5x, which indicates that the current multiple is broadly aligned with where the market could reasonably gravitate over time.

Explore the SWS fair ratio for SITC International Holdings

Result: Price-to-Earnings of 7.4x (ABOUT RIGHT)

However, slowing revenue and earnings growth, combined with shares already near analyst targets, could quickly challenge sentiment if industry conditions weaken further.

Find out about the key risks to this SITC International Holdings narrative.

Another View on Value

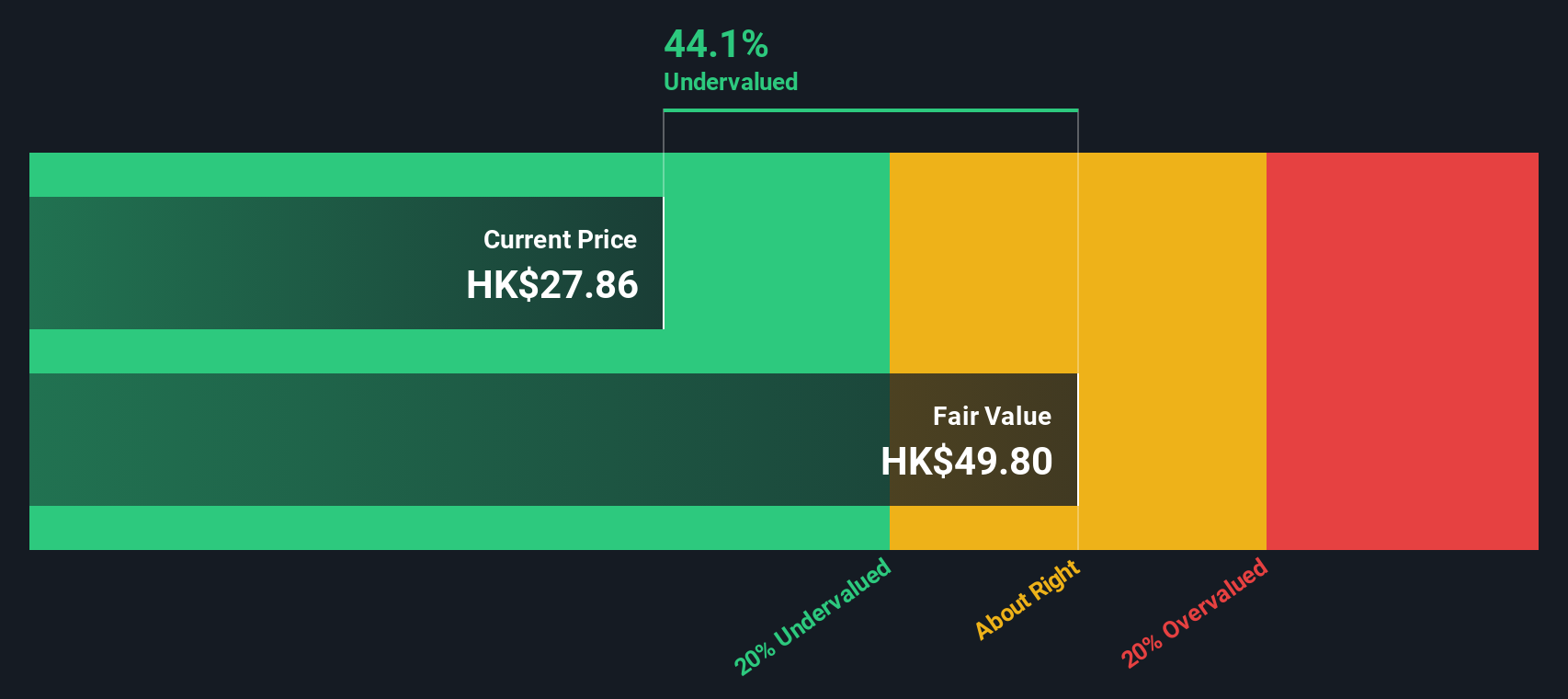

While the 7.4x earnings multiple suggests SITC International Holdings is fairly priced, our DCF model points to a very different story. It indicates the shares trade around 44 percent below an estimated fair value of roughly HK$49.91. Is the market underestimating future cash flows, or is the model too generous?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SITC International Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SITC International Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a tailored view in just minutes: Do it your way.

A great starting point for your SITC International Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investment moves?

Do not stop at a single opportunity; use the Simply Wall St Screener to uncover focused stock ideas tailored to different strategies and risk appetites.

- Capture potential mispricings by running through these 903 undervalued stocks based on cash flows, which flags companies where current prices lag underlying cash flow strength.

- Position ahead of emerging tech shifts by scanning these 24 AI penny stocks, featuring businesses harnessing artificial intelligence for scalable growth.

- Strengthen your income strategy by reviewing these 12 dividend stocks with yields > 3%, built around companies offering yields above 3 percent with room for stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal