Agree Realty (ADC): Assessing Valuation After a 3.6% Annualized Dividend Increase

Agree Realty (ADC) just gave income investors something new to consider, with its board approving a higher monthly common dividend that works out to a 3.6% annual increase compared with last year.

See our latest analysis for Agree Realty.

That higher payout comes as Agree Realty’s share price sits around $72.10, with a modest year to date share price return of 3.38% and a steadier 1 year total shareholder return of 6.97%. This suggests income focused investors are still backing the story even if momentum is only gradually building.

If this dividend move has you thinking about income and stability, it could be a good moment to scan beyond REITs and explore pharma stocks with solid dividends for other yield focused ideas.

But with Agree Realty trading below analyst targets and boasting steady double digit growth in revenue and earnings, is the market overlooking a defensive income grower, or is it already pricing in every dollar of future expansion?

Most Popular Narrative Narrative: 11.9% Undervalued

With Agree Realty last closing at $72.10 against a narrative fair value near $81.88, the gap hinges on ambitious growth and margin assumptions.

The durability of essential retail categories (grocery, pharmacy, home improvement, auto parts) is translating into high-quality, e commerce resistant tenant composition, supporting rent stability and protecting net margins against shifts in consumer behavior or economic cycles.

Want to see why steady rent checks might justify a richer multiple than most retail REITs enjoy? The narrative leans on accelerating revenue, rising margins, and a bold profit profile that looks more like a compounder than a slow moving landlord. Curious which earnings path and valuation bridge this gap? Read on to uncover the assumptions powering that fair value.

Result: Fair Value of $81.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, aggressive acquisition fueled by equity raises and concentration in large national retailers could pressure per share growth and test the market’s confidence.

Find out about the key risks to this Agree Realty narrative.

Another Lens on Valuation

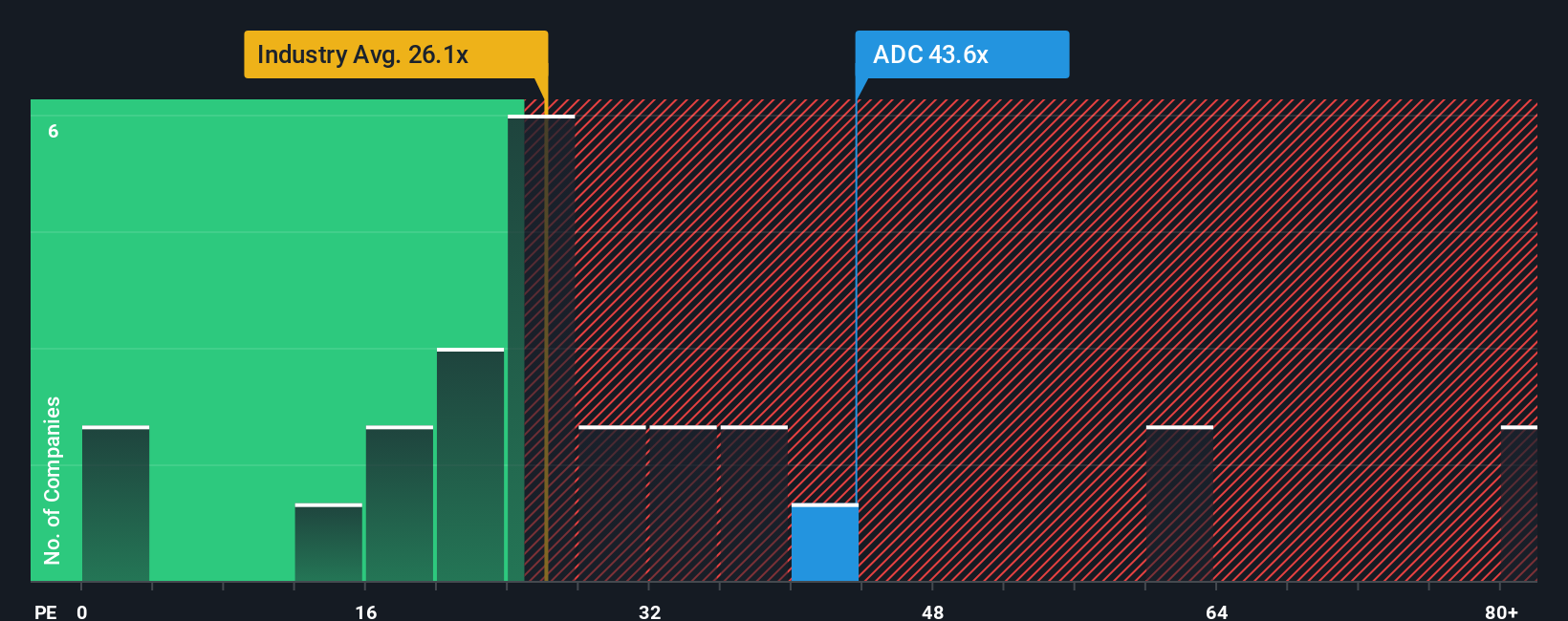

On simple earnings comparisons, Agree Realty looks stretched. Its P E ratio of 44.6x sits well above the US Retail REITs average of 27.2x, its peer average of 25.1x, and even our fair ratio estimate of 34.6x. This hints at limited margin for disappointment if growth slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Agree Realty Narrative

If you see the story differently or prefer digging into the numbers yourself, you can craft a complete view in minutes: Do it your way.

A great starting point for your Agree Realty research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single idea when a whole universe of opportunities is a click away. Use the Simply Wall Street Screener now before markets move.

- Capture potential bargains early by scanning these 903 undervalued stocks based on cash flows that may be trading below their intrinsic worth based on future cash flows.

- Capitalize on breakthrough innovation by targeting these 24 AI penny stocks positioned at the forefront of artificial intelligence adoption and monetization.

- Strengthen your income stream by focusing on these 12 dividend stocks with yields > 3% that combine healthy yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal