Demystifying the twin engines behind the Thai baht, the “strongest currency in Southeast Asia” in 2025: the “unexpected aid” of tariffs and the tide of gold

The Zhitong Finance App learned that the Thai baht, one of the core sovereign currencies of Southeast Asia, is moving towards the biggest annual increase against the US dollar in eight years. Since 2025, the Thai baht has risen by as much as 10% against the US dollar. The rise during the same period is rare, while also surpassing the Singapore dollar, the Malaysian ringgit, and the Indonesian rupiah, making it the strongest currency in Southeast Asia. At first glance, there is little to explain its outstanding performance compared to the Southeast Asian region's sovereign currency. Thailand's economy is far from growing strongly, and is heavily hampered by continued weak tourism, high household debt, and the imposition of a 19% tariff on US exports.

According to Wall Street analysts, the rare currency trend of the Thai baht is mainly driven by the rise in gold prices and the “unexpected boost effect” of Trump's tariff policy, and the rise in the Thai baht exchange rate is reducing the competitiveness of the export manufacturer that Southeast Asian countries rely on, and exacerbating the challenges faced by the new Prime Minister Anutin Charnvilacourt — the Thai government headed by him will face an early election in February.

Why is the Thai baht so strong?

The Thai currency began to strengthen against the US dollar in mid-2024, almost at the same time as the government introduced an economic stimulus plan to boost exports and traders began selling the dollar before the latest round of the Federal Reserve's interest rate cut cycle. Since this year, foreign exchange traders' doubts about the US dollar's status as a reserve currency have also provided strong support for this round of gains.

Much of the recent rise in the Thai baht is driven by spillover effects brought about by a sharp rise in the price of gold (gold against the US dollar) and the weakening of the US labor market — weak US employment has greatly deepened market expectations for further interest rate cuts by the Federal Reserve in 2026, and driven by seasonal peaks in the Thai tourism industry.

Import tariffs led by the Trump administration recently unexpectedly boosted Thailand's economy, which has continued to weaken since the pandemic, in two ways: before the tariffs came into effect, exporters from China and other Asian countries switched more locally manufactured industrial goods (such as automobiles) to the US. In addition, the 19% tariff imposed by the US on Thailand's exports to the US is lower than the 30% tariff imposed on many Chinese industrial products. This is encouraging large manufacturers from China to set up factories in Thailand to produce the products American consumers need. This also drove Thailand's foreign and domestic investment proposals to reach a record high of US$42.2 billion in the first seven months of 2025.

The Thai baht was also strongly boosted by the spillover effects of the gold price increase of more than 60% this year, because as Trump imposed tariffs on the world and threatened the independence of the Federal Reserve's monetary policy, investors began to question the “American exception theory” and then chose to sell off US assets and invest in alternative commodities, including this safe-haven precious metal. Gold is an important export product of Thailand, and it is the preferred wealth storage method for most wealthy families in Thailand. Thai commodity traders or investors play an unusually important role in gold bar trading, making the country one of the top ten gold markets in the world.

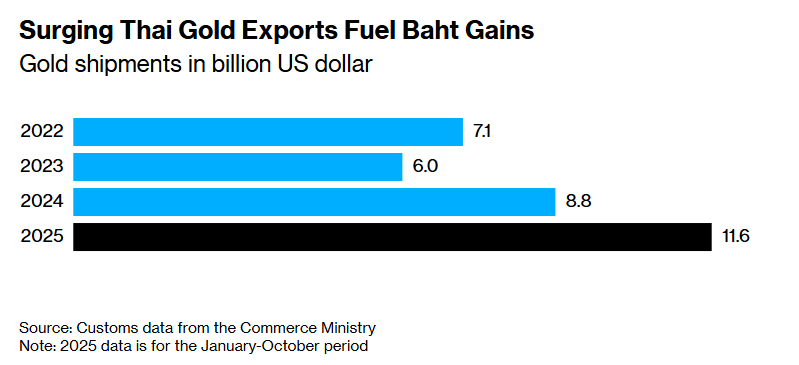

Higher gold prices and continued strong demand from wealthy families will encourage Thai traders to sell more gold, and they often exchange their income in dollars for local currency. Statistics show that Thailand's gold exports jumped 52% to 11.6 billion US dollars from January to October, leading to large-scale inflows of US dollars into the country.

Surge in Thai gold exports boosts the strength of the Thai baht - gold shipments surged (billion US dollars)

Will there be any problems with the strong Thai baht?

First, there is no doubt that the overly strong Thai baht makes products made in Thailand more expensive in overseas markets. According to statistics from Thailand's Ministry of Commerce, the country's exports grew at the slowest rate in more than a year in October.

As a strong currency weakens Thailand's appeal as a low-cost holiday destination, the tourism industry is also under pressure. Thailand's Ministry of Finance previously lowered the forecast for foreign visitors in 2025 to 33.5 million in October from the previous forecast of 34.5 million visitors. Chinese tourists, in particular, are choosing to avoid Thailand in favor of relatively cheaper alternative destinations such as Vietnam and Malaysia — a trend also fueled by China's security concerns over Thailand caused by a high-profile kidnapping incident earlier this year. Furthermore, severe flooding in the country's southernmost province hit the number of arrivals from Malaysia, which has long contributed the largest share of international visitors.

However, for Thai households, a stronger baht can make imported goods such as fuel and consumer electronics cheaper and help ease inflation in Thailand. But for an economy that is highly dependent on commodity exports and tourism, the disadvantages outweigh the benefits.

What can the Thai government do about a strong sovereign currency?

After meeting with industry leaders in early September, Anutin said his government would urgently address export-oriented companies' concerns about the rise in the Thai baht. However, due to political turmoil and the fact that geopolitical issues on the Thai-Cambodia border are unlikely to subside in the short term, there is great uncertainty about the direction of the Thai government's fiscal policy.

Anutin is the country's third leader in two years. He dissolved the House of Representatives in mid-December to completely thwart a no-confidence motion initiated by his party's main rival, the BJP. Thailand's latest general election round will be held on February 8.

Regardless of who is in charge next year, the Thai economy will face a delicate balance: further appreciation of the Thai baht could derail the fragile economy. Any decisive move to depress the exchange rate could cause the US Treasury to identify Thailand as an exchange-rate manipulator — a label often accompanied by the threat of trade sanctions, and would be another blow to the country's exporters.

Currently, Thai finance officials have intervened in the foreign exchange market to mitigate what they call excessive fluctuations. The Bank of Thailand, on the other hand, said it favors the Thai baht to be driven by fundamentals — such as current account balances, interest rate differences, and the global economic growth pattern — while retaining the option to act when fluctuations are excessive.

They didn't just stand idly by. The Bank of Thailand's measures to withstand the sharp rise in the Thai baht were enough to push foreign exchange reserves to a record high of US$278 billion on December 12, equivalent to about half of the gross domestic product. In response to the recent strength of the sovereign currency, the Bank of Thailand has even proposed raising the upper limit of foreign exchange earnings that companies can keep in the offshore market, so that enterprises can be more flexible in how they manage overseas income. Further measures may also be introduced.

The central bank is also in discussions with gold traders to explore ways to curb the metal's excessive appreciation of the Thai baht. One option is to promote more gold transactions settled in US dollars through online platforms, which may in turn significantly weaken the long-standing direct link between the liquidity of gold bars and Thailand's sovereign currency. The Bank of Thailand has also requested financial institutions to step up scrutiny of gold-related transactions to reduce capital flows brought about by precious metals flowing through informal channels.

Another measure under consideration is taxing physical gold transactions. However, central bank officials warned that such measures would take time to weigh and require thorough research and in-depth consultations with industry stakeholders.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal