Southern (SO): Valuation Check After Georgia Power Wins Approval to Expand Data Center Capacity

Southern (SO) just secured a major green light in Georgia, where regulators unanimously approved Georgia Power’s plan to boost capacity to meet the AI-driven data center surge across the state.

See our latest analysis for Southern.

Despite the regulatory win, Southern’s recent share price return has cooled, with a roughly 9 percent 3 month pullback and softer 1 month performance, even as its 5 year total shareholder return of about 72 percent signals durable, long term compounding.

If this AI driven demand story has you thinking beyond a single utility, it could be a good moment to explore high growth tech and AI stocks for other potential beneficiaries of the trend.

With shares lagging recently but still trading below the average analyst target, is Southern a steady utility temporarily out of favor, or has the AI driven growth story already been fully priced in by the market?

Most Popular Narrative: 14.1% Undervalued

At a last close of $85.28 versus a narrative fair value near $99, Southern is framed as modestly mispriced, with future earnings power doing the heavy lifting.

The expansion of large scale electrification projects including hyperscaler data centers and industrial developments across Alabama, Georgia, and Mississippi is materially increasing Southern's load outlook, resulting in regulatory approvals and filings for up to 10 GW of new generation and $13 billion of incremental capital investment, driving long term earnings and rate base growth.

Want to see the math behind that upside gap? The narrative leans on steady revenue growth, rising margins, and a premium future earnings multiple. Curious which assumptions really move the needle.

Result: Fair Value of $99.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated capital needs, potential equity dilution, and any cooling in data center demand could quickly challenge today’s earnings assumptions and valuation upside.

Find out about the key risks to this Southern narrative.

Another View: Multiples Paint a Richer Picture

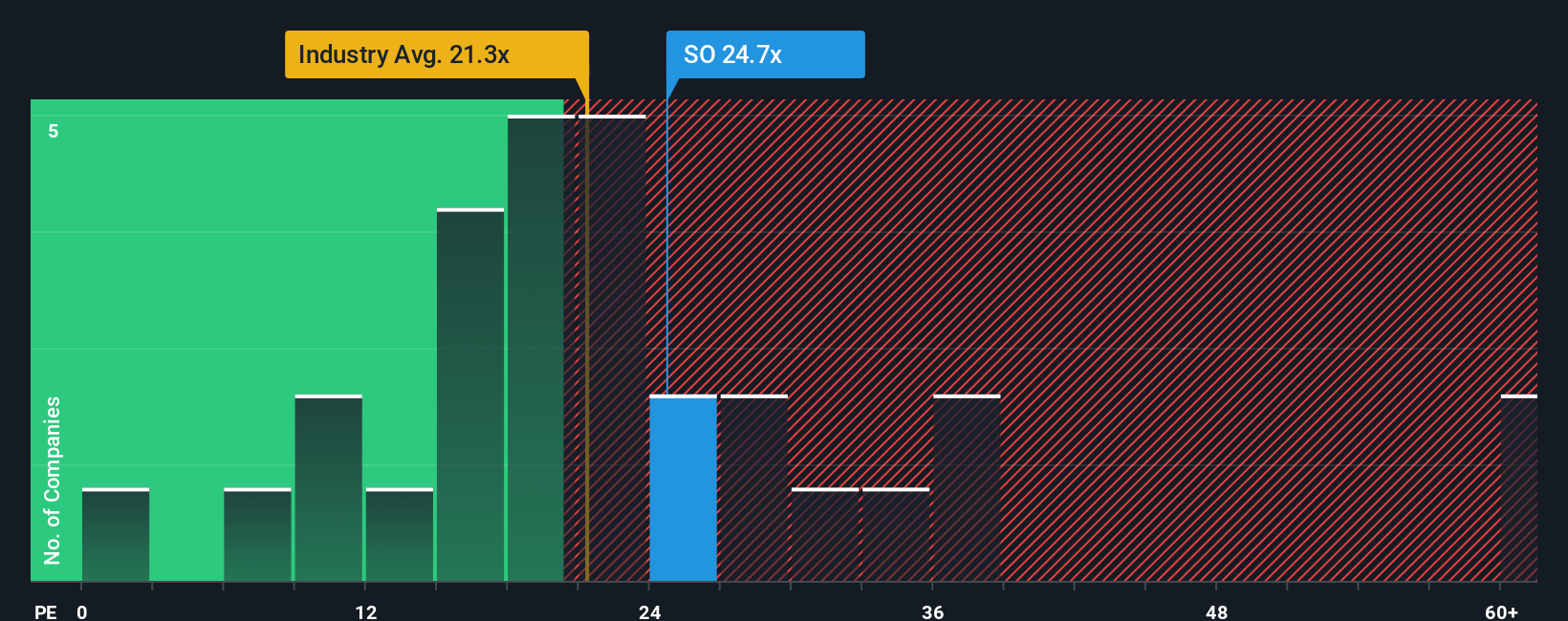

Our fair value narrative suggests upside, but the earnings multiple tells a more demanding story. Southern trades on a 21.1x P/E versus 19.4x for US electric utilities, even as its fair ratio points closer to 25.2x. Is this a bargain in progress or optimism already reflected?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Southern Narrative

If you are skeptical of this take or simply want to dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Southern research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with Southern when you can scan the market for focused opportunities that match your strategy and spot tomorrow’s winners before they become obvious.

- Capture fast moving opportunities in smaller names by running through these 3636 penny stocks with strong financials that already show stronger fundamentals than most investors expect.

- Position yourself at the heart of the AI build out by targeting infrastructure and enablers via these 24 AI penny stocks before the story becomes crowded.

- Lock in potential mispricings by filtering for quality businesses trading below their estimated cash flow value using these 907 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal