Aldeyra Therapeutics And 2 Other Promising Penny Stocks For Your Watchlist

As of December 19, 2025, major stock indexes in the United States have shown a notable upswing, with the tech-heavy Nasdaq and benchmark S&P 500 posting weekly gains amid a continued rally in technology shares. This positive momentum in broader markets can create an intriguing backdrop for exploring investment opportunities across various sectors. Penny stocks, while often considered speculative due to their lower price points and smaller company profiles, remain relevant as they can offer unique growth potential when supported by robust financials. In this article, we explore three penny stocks that stand out for their potential to capitalize on current market conditions.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.54 | $544.33M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.95 | $705.24M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.931 | $159.22M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.30 | $555.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.27 | $1.37B | ✅ 4 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $4.96 | $56.24M | ✅ 3 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.43 | $357.61M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.89015 | $6.47M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.71 | $84.05M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 343 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Aldeyra Therapeutics (ALDX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aldeyra Therapeutics, Inc. is a biotechnology company focused on discovering and developing therapies for immune-mediated and metabolic diseases, with a market cap of approximately $298.41 million.

Operations: No revenue segments are reported for this biotechnology company focused on therapies for immune-mediated and metabolic diseases.

Market Cap: $298.41M

Aldeyra Therapeutics, with a market cap of US$298.41 million, remains pre-revenue, focusing on developing therapies for immune-mediated diseases. Despite being unprofitable, the company has reduced its losses over five years and maintains a sufficient cash runway for 1.6 years based on historical free cash flow growth rates. Recent developments include an FDA extension of the PDUFA target action date for reproxalap's New Drug Application to March 2026 due to additional data submissions. The company's management and board are experienced, and short-term assets significantly cover liabilities, though share price volatility remains high.

- Take a closer look at Aldeyra Therapeutics' potential here in our financial health report.

- Gain insights into Aldeyra Therapeutics' outlook and expected performance with our report on the company's earnings estimates.

Cytek Biosciences (CTKB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cytek Biosciences, Inc. is a cell analysis solutions company that offers tools to advance biomedical research and clinical applications, with a market cap of approximately $632.93 million.

Operations: The company's revenue comes from its Scientific & Technical Instruments segment, totaling $196.83 million.

Market Cap: $632.93M

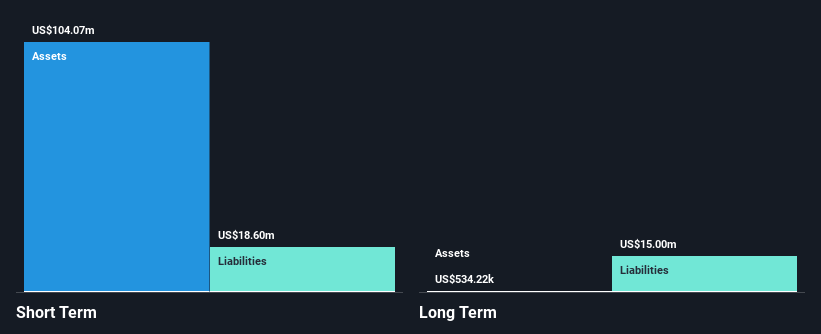

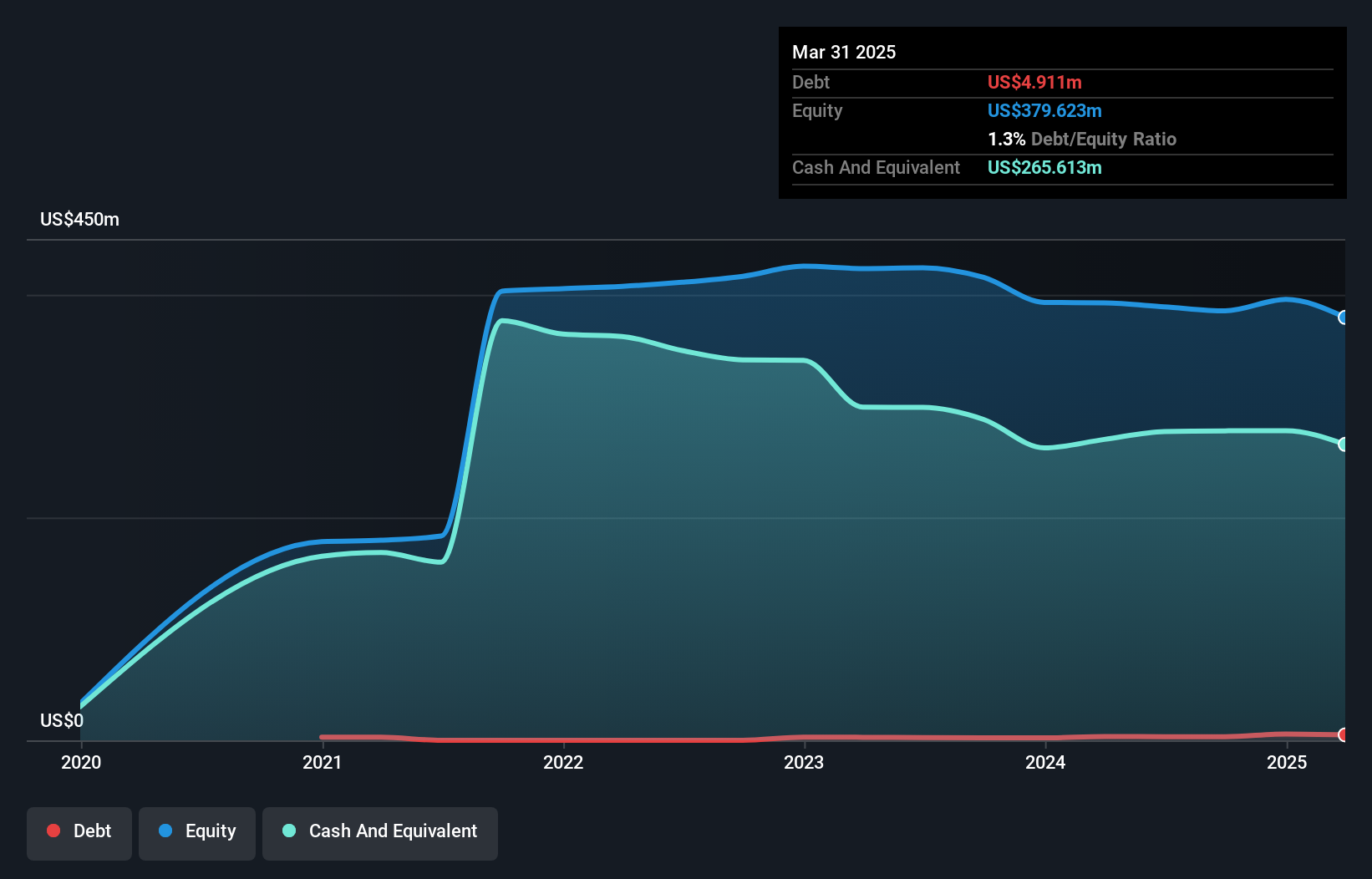

Cytek Biosciences, with a market cap of US$632.93 million, is navigating the challenges typical of its sector. Despite being unprofitable and experiencing increased losses over the past five years, it maintains a strong financial position with short-term assets significantly exceeding liabilities and sufficient cash runway for over three years. Recent earnings showed slight revenue growth but also reported a net loss for Q3 2025. The company reaffirmed its full-year revenue guidance, reflecting stability amidst expansion efforts like relocating its European headquarters to Amsterdam to enhance service delivery and operational efficiency in the EMEA region.

- Navigate through the intricacies of Cytek Biosciences with our comprehensive balance sheet health report here.

- Gain insights into Cytek Biosciences' future direction by reviewing our growth report.

Dingdong (Cayman) (DDL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dingdong (Cayman) Limited operates as an e-commerce company in China with a market capitalization of approximately $544.33 million.

Operations: The company's revenue is primarily generated from its online retail operations, amounting to CN¥24.02 billion.

Market Cap: $544.33M

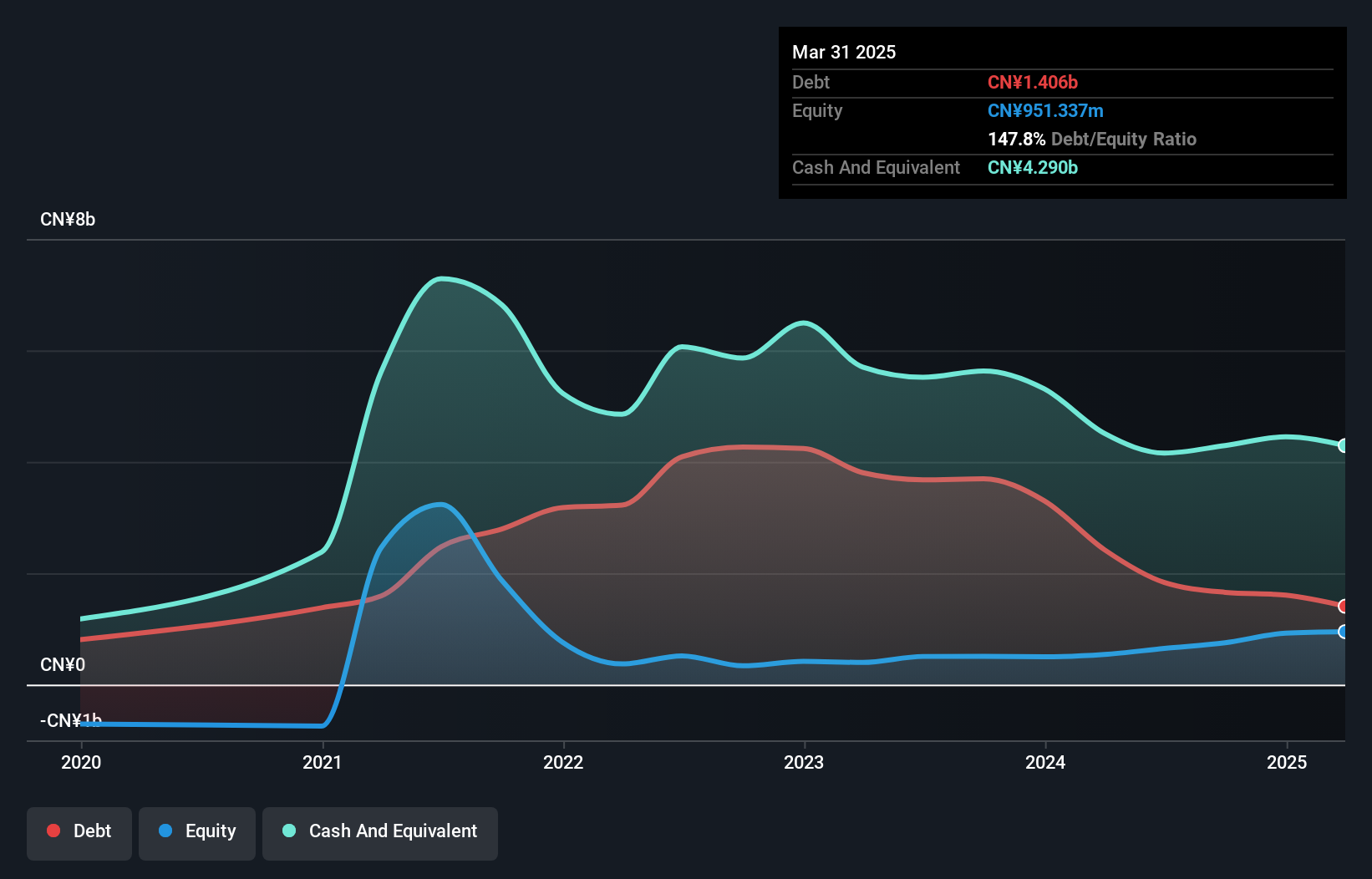

Dingdong (Cayman) Limited, with a market cap of approximately US$544.33 million, has shown resilience in the competitive e-commerce sector. The company reported third-quarter revenue of CN¥6.66 billion, reflecting steady growth compared to the previous year. Despite a decline in net income to CN¥82.89 million from CN¥133.41 million, Dingdong's financial health is robust; it covers debt well with operating cash flow and maintains more cash than total debt. Its short-term assets exceed both short- and long-term liabilities, and it trades at a significant discount to estimated fair value while boasting high-quality earnings and strong return on equity at 25%.

- Click here and access our complete financial health analysis report to understand the dynamics of Dingdong (Cayman).

- Understand Dingdong (Cayman)'s earnings outlook by examining our growth report.

Summing It All Up

- Investigate our full lineup of 343 US Penny Stocks right here.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal