3 Dividend Stocks Offering Yields From 4% To 5.1%

As the U.S. stock market experiences a resurgence with major indexes like the S&P 500 and Nasdaq posting weekly gains, investors are increasingly eyeing dividend stocks as a way to capture steady income amid fluctuating tech sector performances. In this environment, selecting dividend stocks that offer yields between 4% and 5.1% can provide both reliable returns and potential for capital appreciation, making them attractive options in today's dynamic market landscape.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.59% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.24% | ★★★★★★ |

| PCB Bancorp (PCB) | 3.50% | ★★★★★☆ |

| OTC Markets Group (OTCM) | 4.81% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.26% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.85% | ★★★★★★ |

| Ennis (EBF) | 5.53% | ★★★★★★ |

| Dillard's (DDS) | 4.70% | ★★★★★★ |

| Columbia Banking System (COLB) | 4.99% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.33% | ★★★★★★ |

Click here to see the full list of 112 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Copa Holdings (CPA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Copa Holdings, S.A. operates through its subsidiaries to offer airline passenger and cargo transport services, with a market cap of approximately $5.12 billion.

Operations: Copa Holdings generates revenue primarily from its airline passenger and cargo transport services.

Dividend Yield: 5.2%

Copa Holdings offers a dividend yield of 5.19%, placing it in the top 25% of US dividend payers, but its dividends are not well covered by cash flows, with a high cash payout ratio of 123.3%. While earnings have grown significantly at 56.9% annually over the past five years, dividends have been volatile and unreliable. Recent results show revenue growth to US$913.15 million for Q3 2025, supporting future earnings potential despite current dividend sustainability concerns.

- Click here to discover the nuances of Copa Holdings with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Copa Holdings shares in the market.

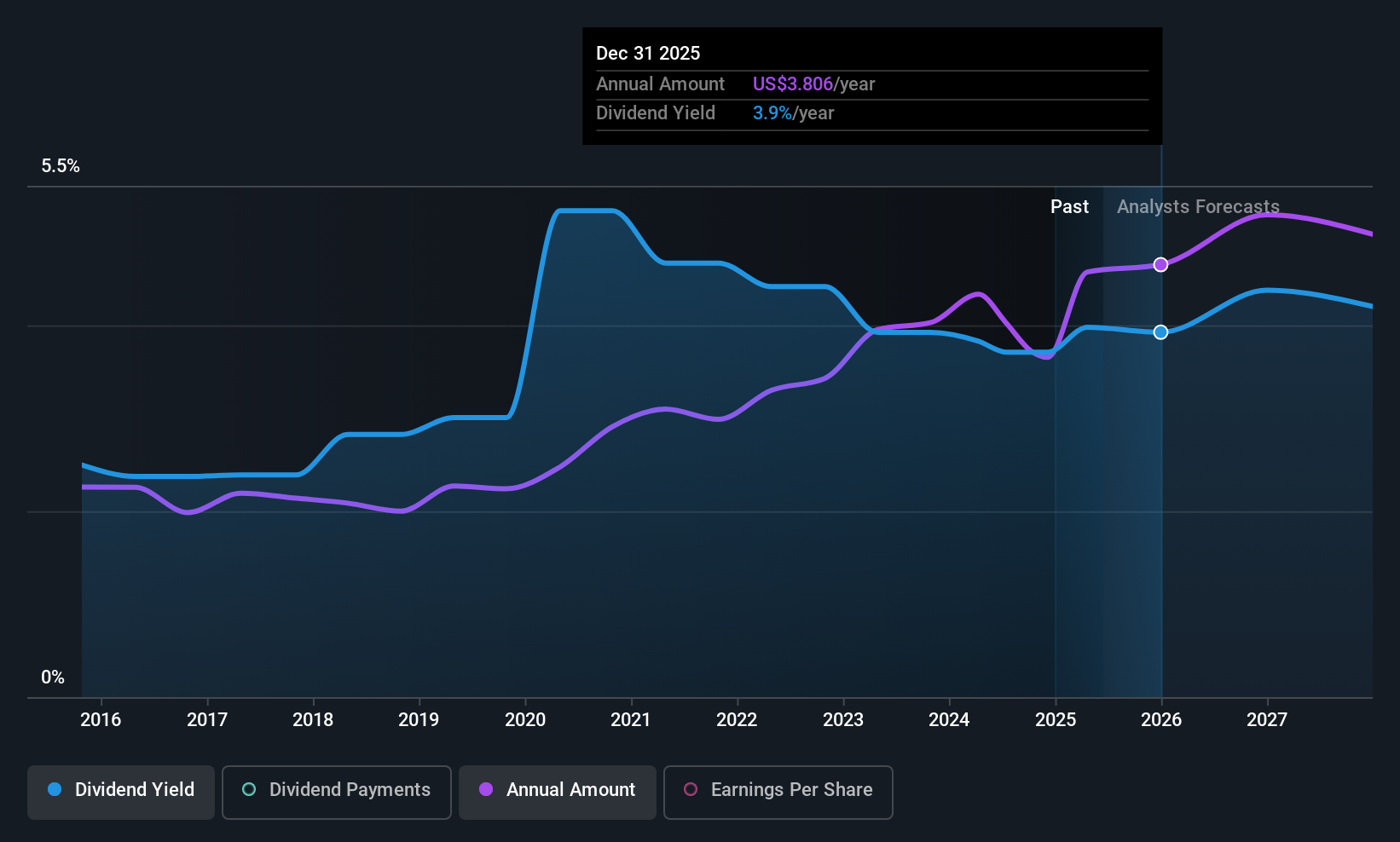

Coca-Cola FEMSA. de (KOF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Coca-Cola FEMSA, S.A.B. de C.V., a franchise bottler, operates in the production, marketing, sale, and distribution of Coca-Cola trademark beverages across several Latin American countries including Mexico and Brazil, with a market cap of approximately $19.95 billion.

Operations: Coca-Cola FEMSA generates its revenue primarily from non-alcoholic beverages, amounting to MX$289.90 billion.

Dividend Yield: 4.3%

Coca-Cola FEMSA's recent dividend of US$0.9234 per share reflects stable and growing payouts over the past decade, though its cash payout ratio of 232.1% indicates dividends are not well covered by cash flows, raising sustainability concerns. Despite a dividend yield of 4.3%, slightly below top-tier US payers, it trades at good value relative to peers. Recent earnings showed modest growth with Q3 sales reaching MXN 71.88 billion and net income at MXN 5.90 billion, maintaining reliable dividends despite coverage challenges.

- Click to explore a detailed breakdown of our findings in Coca-Cola FEMSA. de's dividend report.

- Our valuation report here indicates Coca-Cola FEMSA. de may be undervalued.

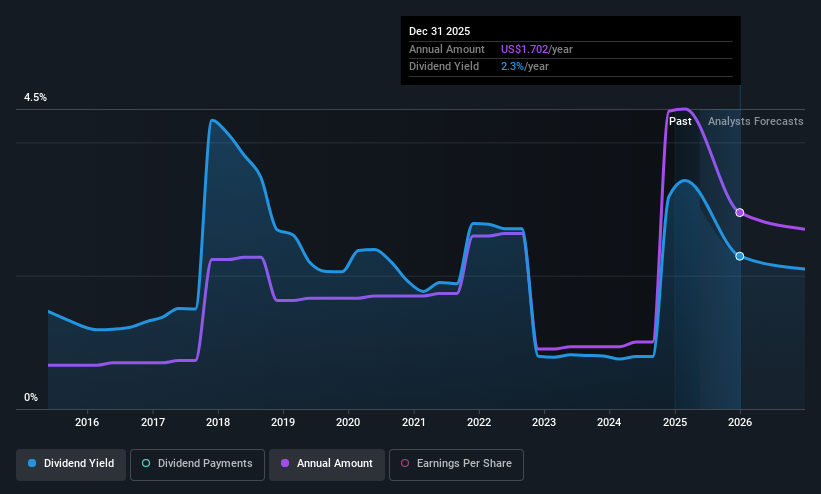

RLI (RLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: RLI Corp. is an insurance holding company that offers property, casualty, and surety insurance products, with a market cap of $6.03 billion.

Operations: RLI Corp.'s revenue is derived from three main segments: Surety ($147.60 million), Casualty ($933.02 million), and Property ($524.51 million).

Dividend Yield: 4%

RLI's dividend yield of 4.02% is below the top tier in the US, and its dividends have been volatile over the past decade. Despite this, RLI maintains a low payout ratio of 16%, indicating dividends are well-covered by earnings and cash flows. Recent announcements include a regular dividend of $0.16 per share and a special $2.00 per share dividend totaling approximately $184 million, signaling shareholder returns amidst executive transitions and stable earnings growth.

- Click here and access our complete dividend analysis report to understand the dynamics of RLI.

- The valuation report we've compiled suggests that RLI's current price could be inflated.

Make It Happen

- Click through to start exploring the rest of the 109 Top US Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal