CINOVIC Technology Innovation Board's IPO has been accepted for injectable imidazepam and is expected to be approved for domestic listing next year

The Zhitong Finance App learned that on December 22, Suzhou Sinovay Pharmaceutical Technology Co., Ltd. (abbreviation: Xinovi) was accepted for the Shanghai Stock Exchange Science and Technology Innovation Board IPO. Cathay Pacific Haitong Securities is its sponsor and plans to raise 2,940 billion yuan.

According to the prospectus, Xinovi is an innovative pharmaceutical company that focuses on major unmet clinical needs around the world, is disease-oriented, and is committed to transforming innovation into clinical value and providing patients with the best treatment drugs in the field of diseases. Xinovi has formed a “1 (NDA) +3 (Phase III) +N” innovative drug pipeline echelon, and has initially achieved research through global BD licensing or transfer.

At present, Xinnovi has developed 10 drug pipelines that are mainly being developed for major diseases with broad market space, such as anti-tumor and anti-infection. Among them, XNW5004 (EZH2 inhibitors), XNW27011 (Claudin 18.2 targeted ADC), and XNW28012 (TF targeted ADC) in the anti-tumor field are all in phase III or key clinical research stages. The above drugs have all shown excellent clinical efficacy. The above drugs have all been reviewed by the China Drug Administration. The center has been certified as a breakthrough therapeutic drug, XNW27011 and XNW28012 have obtained fast-track certification from the US Food and Drug Administration, and XNW28012 has been certified as an orphan drug by the US FDA.

In the anti-infective field, injectable imiziflu (a compound preparation composed of the novel beta-lactamase inhibitor fornovactam (XNW4107), imipenem, and cilastatin sodium) for the treatment of hospital-acquired bacterial pneumonia (HABP) and ventilator-associated bacterial pneumonia caused by gram-negative bacteria has been accepted. It is expected that it will be approved for marketing in 2026, which will help solve the problem of domestic gram-negative antibiotic resistance. Injectable amisifol has been approved for marketing in 2026. Infectious disease product certification and fast Channel certification. In addition to the above pipeline entering the NDA and post-clinical stages, the company still has a number of early pipelines with differentiation mechanisms and high clinical value that are progressing in a steady and orderly manner.

Supported by a global perspective and layout, Xinovi has initially achieved a “research through research” model through global BD. The company's first drug is expected to be launched in 2026, and the company will enter a stage of integrated growth driven by R&D, BD, and sales. Among them, the company has initially normalized BD transactions. While quickly realizing the value of the company's pipeline, it also shows that multinational pharmaceutical companies and well-known domestic listed pharmaceutical companies recognize the company's R&D capabilities and pipeline value.

Currently, Xinovi has 4 foreign authorized cooperation or transfer pipelines. Partners include well-known multinational pharmaceutical companies such as Astellas and well-known domestic listed pharmaceutical companies such as Genting Xinyao (01952) and China Antibody (03681). The total amount of agreed transactions (including down payment, milestone payment, etc.) has exceeded 2 billion US dollars, of which it has received an irrevocable down payment of 130 million US dollars (before tax) in 2025. It is expected that it will achieve company-level profits (after deducting non-recurring profits and losses), and has initially achieved a “research and development” model..

In addition, the company's first innovative drug, imidexifol for injection, is expected to be approved for domestic marketing in 2026. Three drugs, including XNW5004, XNW27011, and XNW28012, have been certified as CDE breakthrough therapeutics, and are expected to be launched domestically one after another between 2027 and 2028, which can continue to drive the rapid growth of the company's drug sales revenue.

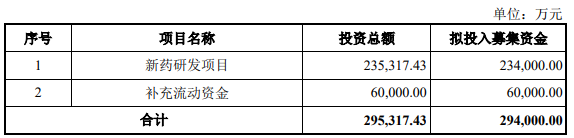

The net amount of the funds raised this time after deducting issuance fees is to be invested in the following projects:

Currently, there are no drugs approved for marketing by Xinovi, and drug sales revenue has not yet been realized. Although the company initially achieved R&D through the BD transaction to develop new drugs, due to the company's extensive research pipeline, 3 products in phase III clinical trials, and multiple pipelines in the early stages of clinical development or pre-clinical R&D, the company's R&D intensity and R&D expenses will continue to be at a high level.

The company continued to lose money during the reporting period. Net profit attributable to shareholders of the parent company was -463 million yuan, -427 million yuan, -386 million yuan and -374 million yuan in 2022, 2023, 2024, and January-June 2025, respectively. The company's continued losses are mainly due to the company's continued focus on the development of innovative drugs since its establishment. This type of project has a long R&D cycle, high uncertainty, and large capital investment.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal