Post Holdings (POST): Valuation Check After New Debt Issue, Earnings Beat and $500m Buyback Plan

Post Holdings (POST) has given investors plenty to chew on lately, with fresh $1.3 billion senior notes, stronger than expected quarterly numbers, and a new $500 million buyback reshaping its capital playbook.

See our latest analysis for Post Holdings.

At around $100.83 per share, Post’s 1 month share price return has been modestly positive but its year to date share price return is still clearly negative. A 5 year total shareholder return in the mid 40 percent range shows the longer term story has rewarded patient holders, even as recent debt moves, stronger earnings, and fresh buybacks reset expectations.

If these capital allocation moves have your attention, it might also be a good time to explore fast growing stocks with high insider ownership for other ideas where management is heavily invested alongside shareholders.

With analysts largely bullish, earnings surprising to the upside, and shares still trading at a hefty discount to price targets, the real question is whether Post remains quietly undervalued or if the market already sees the next leg of growth.

Most Popular Narrative: 18.2% Undervalued

With Post Holdings last closing at $100.83 against a narrative fair value of about $123.22, the story hinges on steady growth and disciplined capital returns.

Strategic and aggressive M&A (such as the 8th Avenue acquisition) and a robust pipeline for further acquisitions provide catalysts for market share gains and potential cost synergies, supporting both revenue growth and long term EPS accretion. Post's expansion and targeted investments in omnichannel and e commerce distribution, along with product innovation aligned to health, wellness, and changing consumer preferences, position it to capture evolving retail channels and emerging growth categories, positively impacting future revenues and market positioning.

Curious how modest revenue growth, rising margins, and shrinking share count combine into that double digit upside case? The narrative’s math is surprisingly bold.

Result: Fair Value of $123.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained volume declines in core cereal and pet food, alongside Post’s elevated leverage, could limit its ability to deliver that upside.

Find out about the key risks to this Post Holdings narrative.

Another Angle on Value

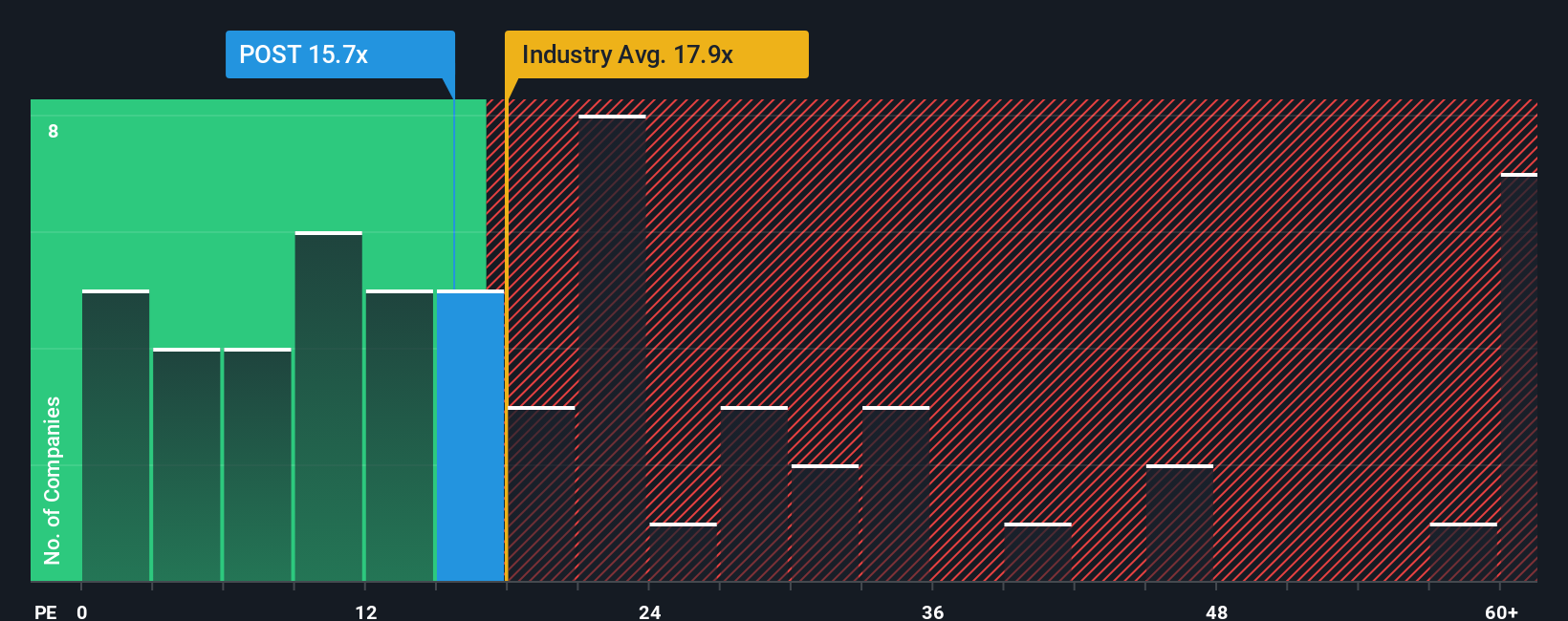

While the narrative points to upside versus fair value, the earnings multiple tells a tighter story. Post trades at about 15.7 times earnings, slightly richer than peer averages near 15.3 times but below the US Food industry at 19.9 times and a fair ratio of 17.1 times.

That mix of modest premium to peers but discount to both the industry and the fair ratio hints at limited downside with some re rating potential, but not a screaming bargain. It raises the question of whether this is a patient compounder at a reasonable price or a stock already priced for steady, not stellar, execution.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Post Holdings Narrative

If you are not fully on board with this view, or simply prefer to dig into the numbers yourself, you can build a complete narrative in just a few minutes, Do it your way

A great starting point for your Post Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop with just one opportunity; use the Simply Wall Street Screener to uncover high conviction stock ideas tailored to the themes and strategies that matter to you.

- Capture potential multi baggers early by scanning these 3635 penny stocks with strong financials that already show stronger business quality than typical speculative names.

- Ride structural growth in automation and machine learning by targeting these 24 AI penny stocks poised to benefit as AI spending accelerates across industries.

- Identify potentially attractive entry points by focusing on these 909 undervalued stocks based on cash flows where discounted cash flows suggest the market has not fully priced in future cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal