Mitsubishi Chemical Group (TSE:4188): Valuation Check After New Boston Materials Thermal Management Partnership

Mitsubishi Chemical Group (TSE:4188) just deepened its push into advanced materials, teaming up with Boston Materials to co develop next generation thermal interface products for semiconductor and AI data center cooling.

See our latest analysis for Mitsubishi Chemical Group.

The collaboration lands at a time when Mitsubishi Chemical Group’s 1 year total shareholder return of 21.67 percent and 3 year total shareholder return of 46.03 percent signal steadily improving sentiment, even as the 1 month share price return of 6.92 percent suggests momentum is now picking up again.

If this AI oriented materials story has your attention, it could be a good moment to explore other high growth tech and AI names using high growth tech and AI stocks.

Yet with the stock now hovering just below analyst targets while trading at a steep discount to some estimates of intrinsic value, are investors looking at an overlooked entry point, or has the market already priced in the growth story?

Most Popular Narrative: 10% Undervalued

With Mitsubishi Chemical Group last closing at ¥905, the most followed narrative points to a slightly higher fair value of ¥905.45, built on detailed long term cash flow assumptions.

The analysts have a consensus price target of ¥923.0 for Mitsubishi Chemical Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥1300.0, and the most bearish reporting a price target of just ¥700.0.

Want to see what kind of earnings surge and margin reset could justify that spread in expectations? The narrative leans on bold profitability and valuation math that might surprise you.

Result: Fair Value of ¥905.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent MMA oversupply and slower than planned shifts into higher margin composites could delay the earnings and margin reset that this narrative depends on.

Find out about the key risks to this Mitsubishi Chemical Group narrative.

Another View: Rich Multiples, Different Story

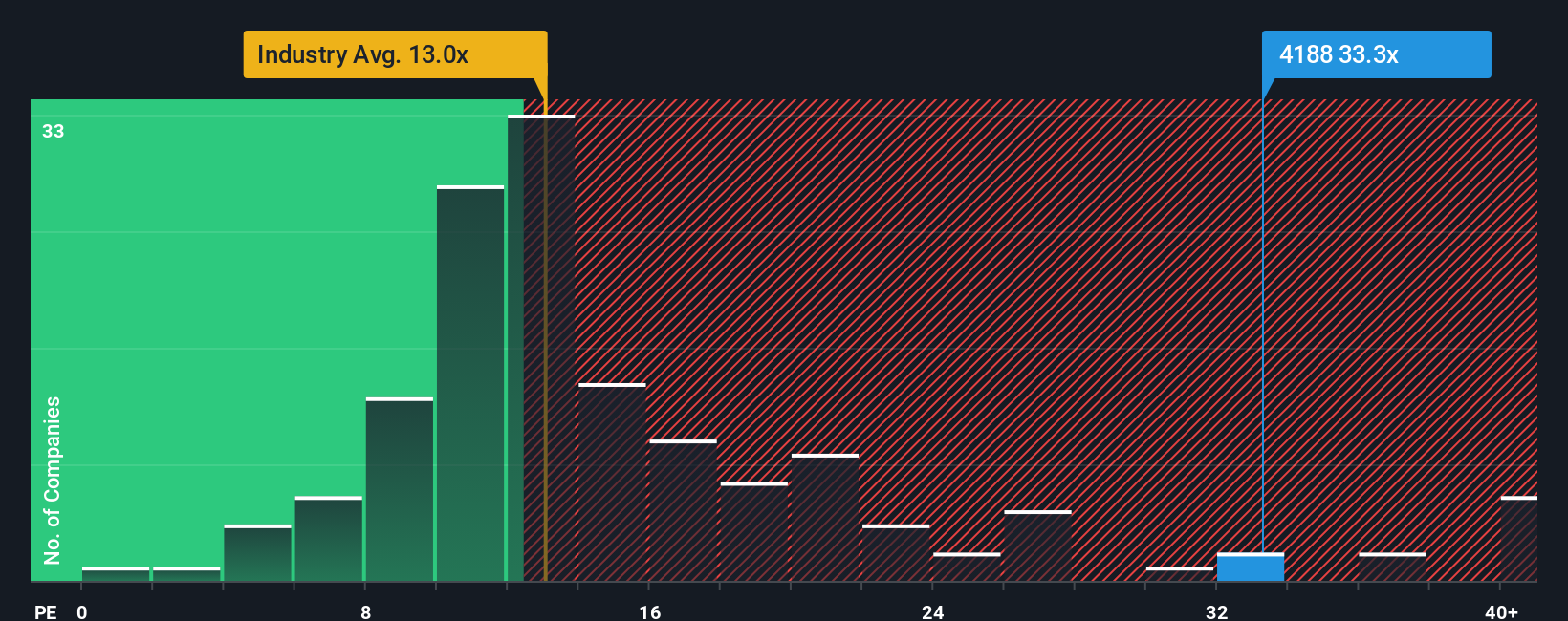

Step away from narratives built on cash flows and the picture looks less comfortable. On a price to earnings basis, Mitsubishi Chemical Group trades at 63.6 times versus 13.9 times for peers and a 22.2 times fair ratio, implying the market already bakes in a lot of future good news. Could that optimism unwind if margins or growth underdeliver?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsubishi Chemical Group Narrative

If you see things differently or simply want to dig into the numbers yourself, you can build a personalised view in minutes: Do it your way.

A great starting point for your Mitsubishi Chemical Group research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop with one opportunity, use the Simply Wall Street Screener to uncover focused stock ideas tailored to different strategies and stay ahead of slower investors.

- Capture potential mispricings early by scanning these 909 undervalued stocks based on cash flows that may offer strong upside based on solid underlying cash flows.

- Capitalize on innovation trends by targeting these 24 AI penny stocks positioned to benefit from accelerating breakthroughs in artificial intelligence.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3% that combine attractive yields with resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal