European Penny Stocks To Watch In December 2025

As the European markets continue to show signs of steady economic growth, with the pan-European STOXX Europe 600 Index ending 1.60% higher, investors are increasingly looking for opportunities in various sectors. Penny stocks, often associated with smaller or newer companies, remain an intriguing area for those seeking growth potential at a lower entry cost. Despite being considered a niche investment category today, penny stocks can still offer compelling opportunities when backed by strong financial health and resilience.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.548 | €1.57B | ✅ 4 ⚠️ 3 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.68 | €83.11M | ✅ 4 ⚠️ 1 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €222.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.02 | €64.06M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.00 | SEK182.52M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.29 | €379.17M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.26 | €312.38M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.074 | €7.96M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 296 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Vidhance (DB:8W50)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vidhance AB (publ) develops video enhancement software solutions for both the Swedish and international markets, with a market cap of €36.72 million.

Operations: The company's revenue is derived entirely from its Software & Programming segment, amounting to SEK 22.67 million.

Market Cap: €36.72M

Vidhance AB, with a market cap of €36.72 million, reported a decline in revenue to SEK 3.86 million for Q3 2025 from SEK 6.89 million the previous year, reflecting challenges in its financial performance as it remains unprofitable with a net loss of SEK 5.13 million for the quarter. The company is debt-free and has sufficient cash runway for over a year despite increasing losses over the past five years at an annual rate of 56.9%. Its share price has been highly volatile recently, and its board lacks extensive experience with an average tenure below three years.

- Jump into the full analysis health report here for a deeper understanding of Vidhance.

- Evaluate Vidhance's historical performance by accessing our past performance report.

Arbona (NGM:ARBO A)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Arbona AB (publ) is an investment company focusing on small and medium-sized listed and unlisted companies in Sweden, with a market cap of SEK1.73 billion.

Operations: The company's revenue is primarily generated from its operations in Sweden, amounting to SEK937.71 million.

Market Cap: SEK1.73B

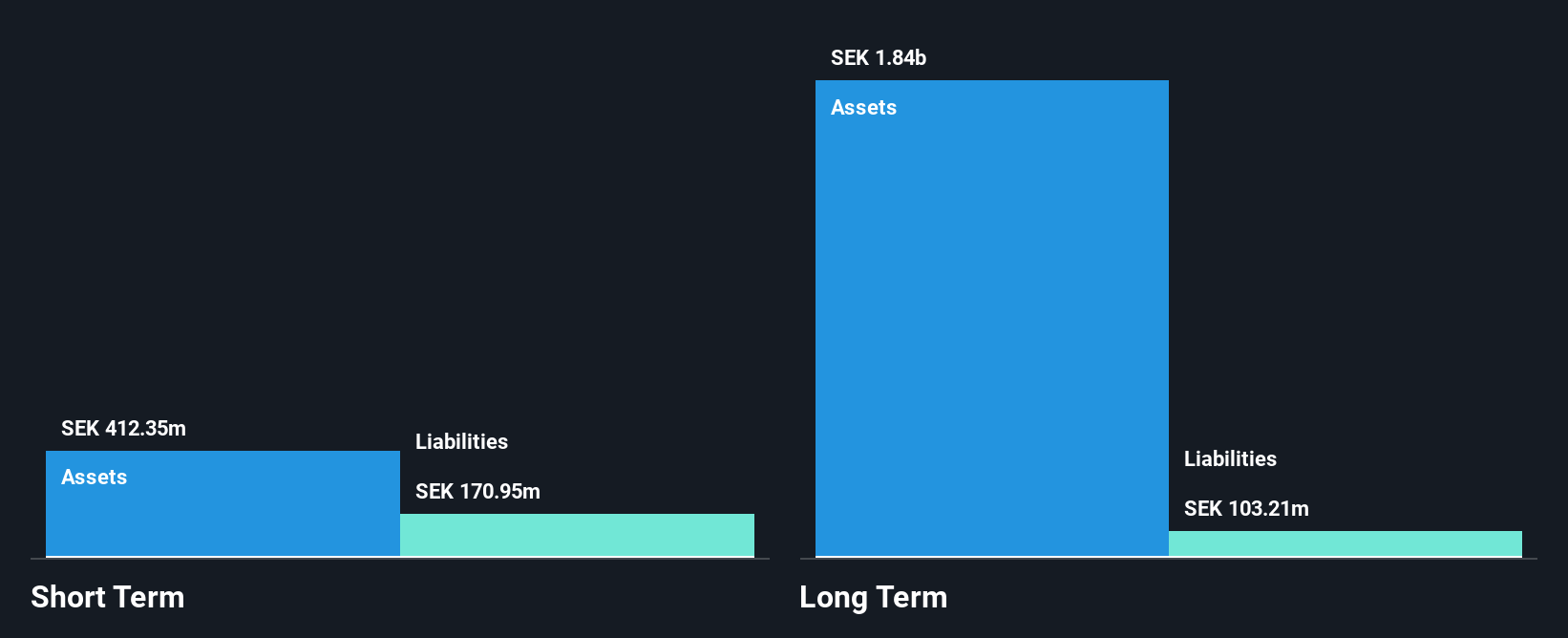

Arbona AB, with a market cap of SEK1.73 billion, has shown profitability growth over the past five years, achieving an annual earnings increase of 27.4%. Despite this progress, recent performance highlights challenges as earnings declined by 72.6% last year compared to industry averages. The company's financial health is supported by short-term assets exceeding both short and long-term liabilities and having more cash than total debt. However, its return on equity remains low at 5.7%. A significant one-off gain of SEK122.6 million affected recent results, while trading at a substantial discount to estimated fair value offers potential appeal for investors seeking undervalued opportunities in the penny stock segment.

- Click here and access our complete financial health analysis report to understand the dynamics of Arbona.

- Review our historical performance report to gain insights into Arbona's track record.

Kudelski (SWX:KUD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kudelski SA, with a market cap of CHF72.42 million, offers digital access and security solutions for digital television and interactive applications across Switzerland, the United States, France, Germany, Austria, and other international markets.

Operations: The company's revenue is derived from its Cybersecurity segment, generating $106.04 million, and its Internet of Things segment, contributing $45.13 million.

Market Cap: CHF72.42M

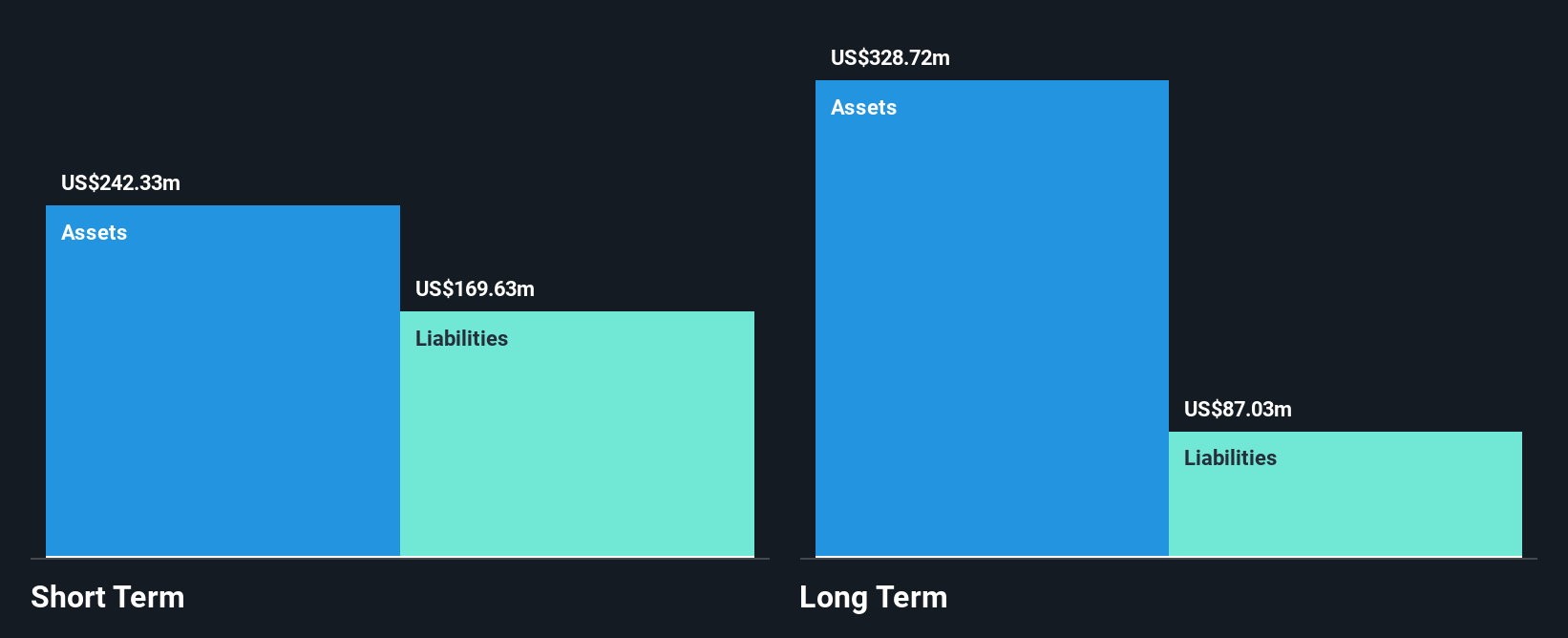

Kudelski SA, with a market cap of CHF72.42 million, operates in digital security solutions across multiple regions. Despite being unprofitable, its financial health shows resilience as short-term assets ($196.3M) cover both short and long-term liabilities, and the company holds more cash than debt. While trading at 98.9% below estimated fair value presents potential for undervaluation appeal, challenges persist with increasing losses over five years at 49% annually and less than a year of cash runway based on current free cash flow. Management's experience is notable with an average tenure of 10.2 years amidst these operational hurdles.

- Get an in-depth perspective on Kudelski's performance by reading our balance sheet health report here.

- Assess Kudelski's future earnings estimates with our detailed growth reports.

Next Steps

- Reveal the 296 hidden gems among our European Penny Stocks screener with a single click here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal