3 European Dividend Stocks To Watch With Up To 7.1% Yield

As European markets show signs of steady economic growth and benefit from looser monetary policy, the pan-European STOXX Europe 600 Index has risen by 1.60%, with major stock indexes also seeing gains. In this environment, dividend stocks can offer investors a potential source of income and stability, making them an attractive option to consider amid fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.13% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.62% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.02% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.85% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.28% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.86% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.12% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.33% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.29% | ★★★★★★ |

| Afry (OM:AFRY) | 4.13% | ★★★★★☆ |

Click here to see the full list of 205 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

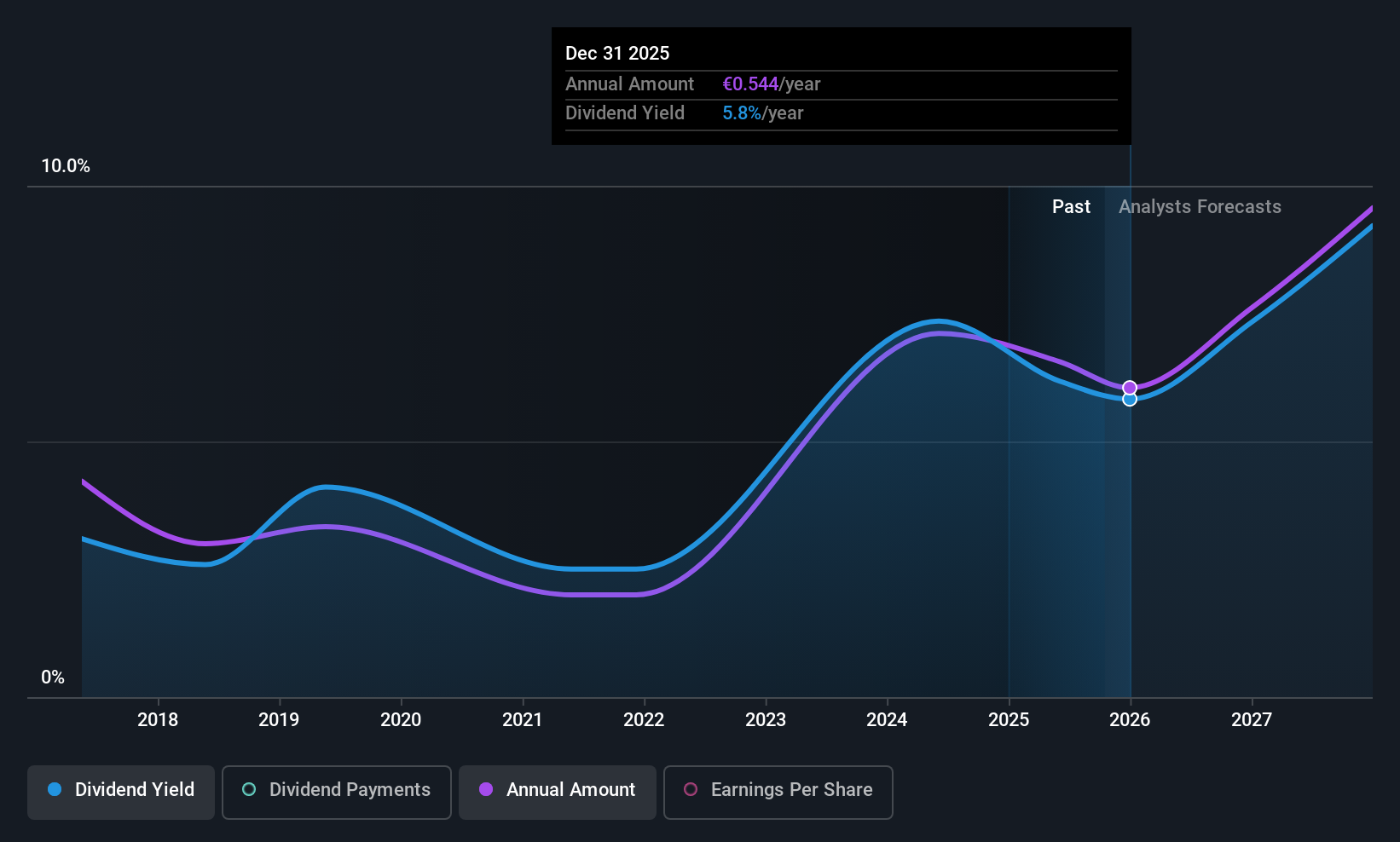

Clínica Baviera (BME:CBAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics across Spain and Europe, with a market cap of €760.57 million.

Operations: Clínica Baviera generates its revenue primarily from its ophthalmology segment, which accounts for €296.76 million.

Dividend Yield: 3.3%

Clínica Baviera offers a mixed dividend profile. Its dividends are well-covered by both earnings and cash flows, with payout ratios of 62.5% and 54.2%, respectively, suggesting sustainability. However, the dividend yield of 3.31% is below the top tier in Spain, and its track record has been unstable over the past decade despite recent growth in payments. Trading at 21.3% below estimated fair value could present potential value for investors seeking income amidst volatility concerns.

- Delve into the full analysis dividend report here for a deeper understanding of Clínica Baviera.

- The analysis detailed in our Clínica Baviera valuation report hints at an deflated share price compared to its estimated value.

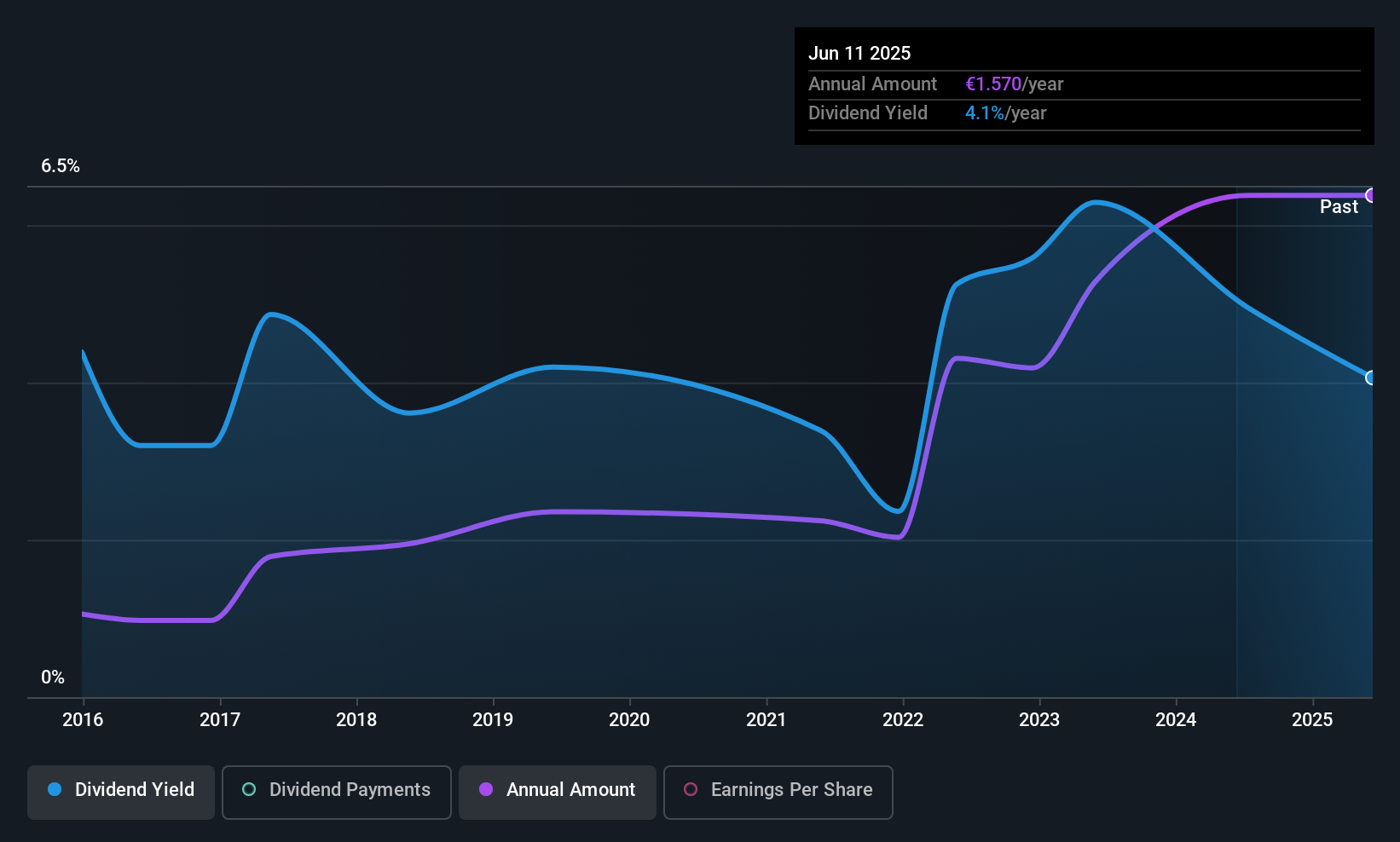

Ålandsbanken Abp (HLSE:ALBAV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ålandsbanken Abp operates as a commercial bank serving private individuals and companies in Finland and Sweden, with a market cap of €695.39 million.

Operations: Ålandsbanken Abp generates revenue through its segments, including IT (€54.43 million), Premium Banking (€66.20 million), Corporate and Other (€21.76 million), and Private Banking (Including Asset Management) (€96.10 million).

Dividend Yield: 6%

Ålandsbanken Abp offers a compelling dividend profile with stable and growing dividends over the past decade, supported by a reasonable payout ratio of 68.4%. Its current yield of 6% ranks in the top 25% among Finnish dividend payers. However, recent earnings reports show slight declines in net interest income and net income compared to last year. The bank's strategic fixed-income offerings could impact its financial flexibility moving forward.

- Navigate through the intricacies of Ålandsbanken Abp with our comprehensive dividend report here.

- Our expertly prepared valuation report Ålandsbanken Abp implies its share price may be lower than expected.

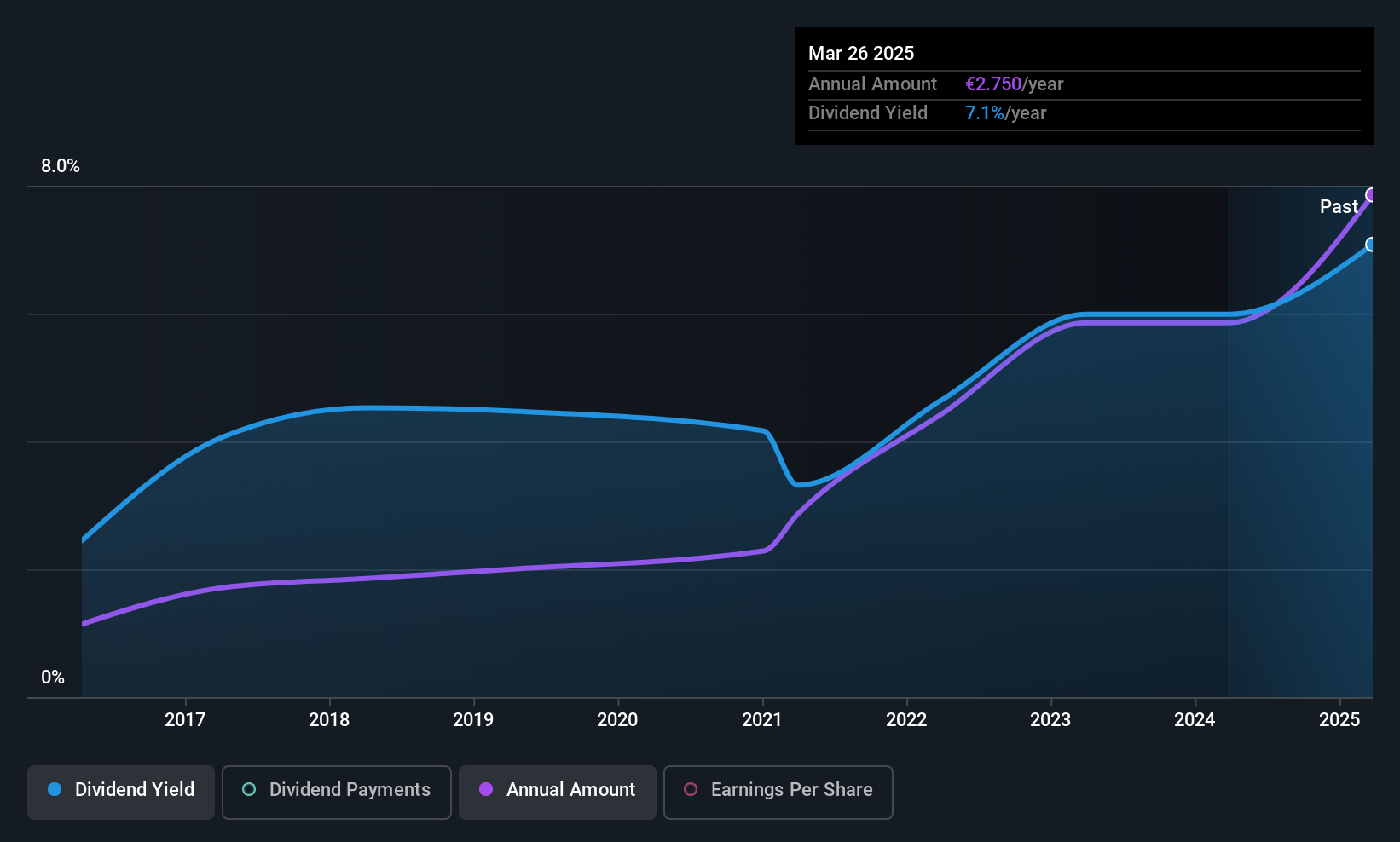

ProCredit Holding (XTRA:PCZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ProCredit Holding AG, with a market cap of €487.68 million, operates as a commercial bank offering products and services to small and medium enterprises and private customers across Europe, South America, and Germany.

Operations: ProCredit Holding AG generates its revenue primarily from its banking segment, which accounts for €431.38 million.

Dividend Yield: 7.1%

ProCredit Holding's dividend yield of 7.13% places it in the top 25% of German dividend payers. Despite its attractive yield, dividends have been volatile over the nine years they've been paid, with occasional declines exceeding 20%. The payout ratio is currently a manageable 44.7%, suggesting dividends are well covered by earnings and expected to remain so in three years (33.8%). Recent earnings reports indicate a decline in net income to €58.2 million from €84.78 million year-over-year, which may affect future dividend stability despite current coverage forecasts.

- Click here to discover the nuances of ProCredit Holding with our detailed analytical dividend report.

- According our valuation report, there's an indication that ProCredit Holding's share price might be on the cheaper side.

Next Steps

- Investigate our full lineup of 205 Top European Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal