How New Long-Term CARVYKTI Safety Data At Legend Biotech (LEGN) Has Changed Its Investment Story

- Earlier this month, Legend Biotech reported new long-term clinical and translational data for its CARVYKTI CAR-T therapy in relapsed or refractory multiple myeloma, including updated efficacy and safety findings from the CARTITUDE-1 and CARTITUDE-4 trials.

- The disclosure that over half of treated patients received the immune-modulating drug tocilizumab, alongside reports of neurologic toxicity with parkinsonism, adds important context to CARVYKTI's real-world risk–benefit profile and Legend's broader cell-therapy ambitions.

- Next, we'll examine how these long-term CARVYKTI data, particularly the neurologic toxicity findings, may influence Legend Biotech's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Legend Biotech Investment Narrative Recap

To own Legend Biotech, you need to believe CARVYKTI can sustain meaningful commercial traction while the broader cell therapy pipeline matures. The new long term data, including neurologic toxicity with parkinsonism and heavy tocilizumab use, sharpens the safety picture but does not obviously change the near term focus on execution with CARVYKTI and progress in additional indications. The biggest immediate risk remains concentration in a single commercial product and any adverse regulatory or label action that could restrict its use.

Among recent announcements, the October 2025 update adding overall survival data from CARTITUDE 4 and new REMS safety warnings for CARVYKTI feels most connected to these latest findings. Together, the accumulating efficacy and safety data, label refinements, and risk management updates frame how regulators and clinicians may view CARVYKTI’s benefit risk balance, which sits at the center of Legend’s key commercial catalyst and its most important product level uncertainty.

Yet alongside CARVYKTI’s promise, the evolving neurologic and immune related safety profile is information investors should be aware of as they consider whether...

Read the full narrative on Legend Biotech (it's free!)

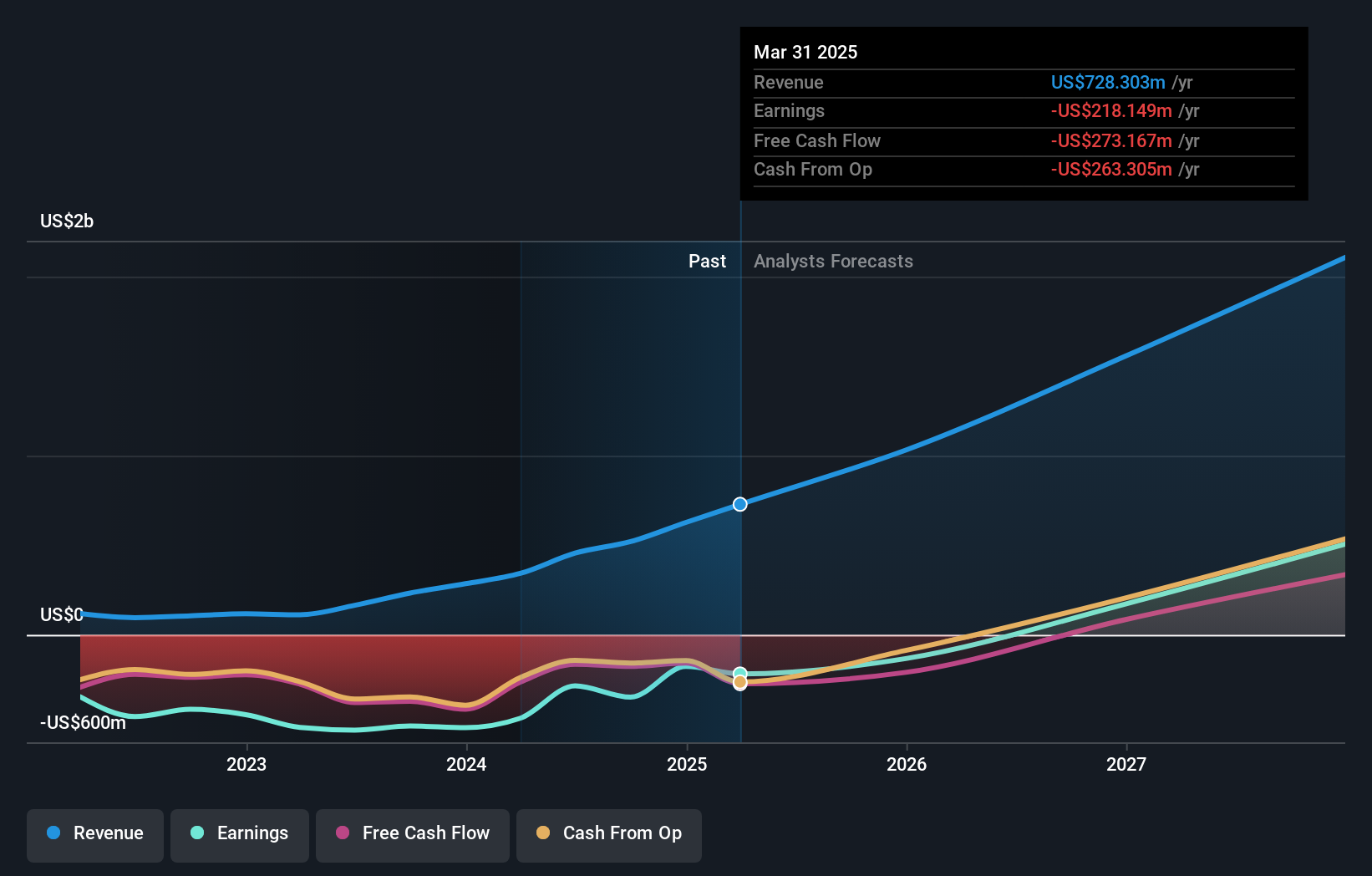

Legend Biotech's narrative projects $2.3 billion revenue and $632.7 million earnings by 2028. This requires 42.3% yearly revenue growth and about a $958 million earnings increase from $-325.3 million today.

Uncover how Legend Biotech's forecasts yield a $74.51 fair value, a 240% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly US$40 to US$182 per share, showing how far apart individual views can be. Against that backdrop, CARVYKTI’s concentrated product risk and ongoing safety updates may weigh heavily on how you think about Legend’s future earnings power and the resilience of its current valuation.

Explore 6 other fair value estimates on Legend Biotech - why the stock might be worth just $40.82!

Build Your Own Legend Biotech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Legend Biotech research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Legend Biotech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Legend Biotech's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal