Symbotic (SYM) Valuation Check After Equity Raise, Q4 Margin Gains and Medline-Backed Backlog Growth

Symbotic (SYM) just wrapped up a $425 million equity raise and paired it with upbeat Q4 numbers, including better margins and a hefty $22.5 billion backlog anchored by new customer Medline.

See our latest analysis for Symbotic.

Despite some choppiness over the past week, Symbotic’s 1 month share price return of roughly 10 percent sits within a much stronger backdrop. Year to date share price gains are near 139 percent and the three year total shareholder return is above 435 percent, suggesting momentum is still firmly on the front foot as investors reprice its growth story and perceived execution risk.

If Symbotic’s run has you thinking about where else automation and digital infrastructure could create upside, this might be the moment to explore high growth tech and AI stocks for more ideas riding similar themes.

With the stock hovering just below Wall Street’s price target and trading at a premium to traditional value metrics, the central question now is whether Symbotic remains an attractive opportunity or whether its future growth is already fully reflected in the share price.

Most Popular Narrative: 4.4% Undervalued

With Symbotic’s fair value estimate sitting just above the recent 59 dollar close, the leading narrative sees only a modest upside still on the table.

Increasing software and service revenue software maintenance gross margins exceeding 70% and more than doubling year over year demonstrates significant operating leverage and margin expansion, positioning Symbotic for greater profitability as its installed base scales.

Want to see what kind of revenue ramp and margin lift could turn that operating leverage into outsized earnings power, and why the implied future earnings multiple still sits well above typical industrial names, even as profitability is expected to inflect sharply higher? The full narrative unpacks those assumptions line by line.

Result: Fair Value of $61.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting deployment timelines and heavy reliance on major customers like Walmart could quickly challenge these upside assumptions if execution or demand wobbles.

Find out about the key risks to this Symbotic narrative.

Another Angle on Valuation

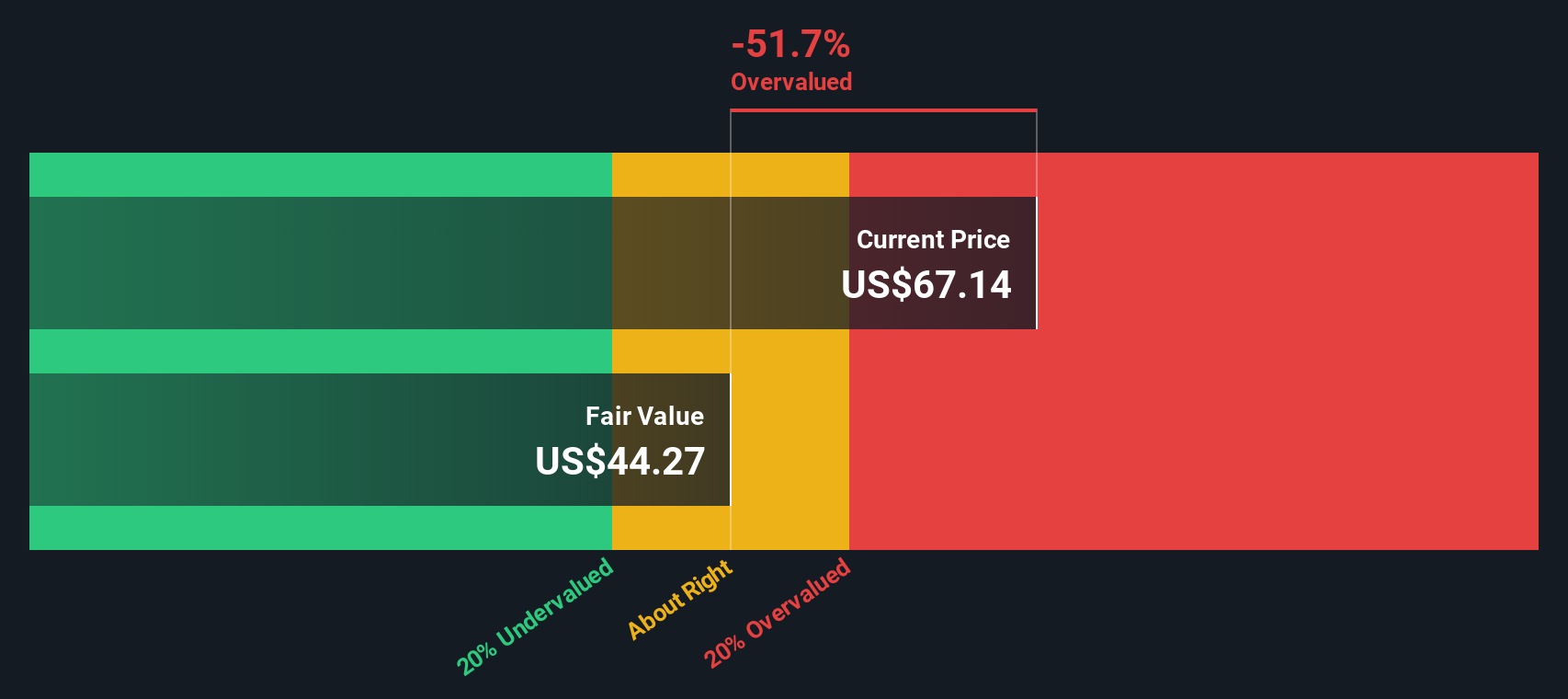

Our DCF model tells a different story, putting Symbotic’s fair value closer to 46.16 dollars. This would make the current 59 dollar price look stretched rather than cheap. If both models are using similar growth assumptions, is the real risk now skewed to the downside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Symbotic for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Symbotic Narrative

If you see the story unfolding differently or want to dig into the numbers yourself, you can craft a fresh narrative in just minutes: Do it your way.

A great starting point for your Symbotic research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next set of opportunities?

Before you move on, put Symbotic in context by lining it up against fresh ideas from the Simply Wall St screener, so you never miss your next potential opportunity.

- Explore potential multi-bagger upside by targeting quality small caps through these 3632 penny stocks with strong financials that already show stronger fundamentals than typical speculative names.

- Focus on companies involved in automation and machine learning with these 24 AI penny stocks that could benefit as AI adoption evolves.

- Seek a margin of safety by examining businesses trading below their assessed intrinsic value using these 910 undervalued stocks based on cash flows grounded in cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal