Mastercard (MA): Reassessing Valuation After Dividend Hike, Buyback Plan and Growth-Focused Partnerships

Mastercard (MA) has moved into the spotlight after a 14% dividend hike, a new multi billion dollar buyback plan, and fresh partnerships spanning lending, wallets, and blockchain driven payment infrastructure.

See our latest analysis for Mastercard.

Those moves are landing against a solid backdrop, with the share price now at $572.23 and supported by steady gains, including a roughly 10 percent year to date share price return and a powerful multiyear total shareholder return that signals momentum is still firmly intact.

If Mastercard's mix of dividends, buybacks, and payments innovation appeals to you, this is a good moment to widen the lens and discover fast growing stocks with high insider ownership

With Mastercard trading near record highs yet still sitting at a double digit discount to analyst targets, the key question now is whether this payment powerhouse is mispriced value or if the market is already baking in tomorrow's growth.

Most Popular Narrative Narrative: 13% Undervalued

With Mastercard last closing at $572.23 against a narrative fair value near $657, the current setup hinges on how far growth and margins can stretch.

The company is capitalizing on the rise of e commerce and mobile commerce, with initiatives like widespread adoption of tokenization, Click to Pay, and partnerships with digital first players (e.g., PayPal, Uber, Mercado Libre, Alipay), driving higher transaction frequency, new customer acquisition, and increased fee based revenue.

Want to see what kind of revenue runway and margin lift would justify that premium style earnings multiple for a financial stock, and how buybacks amplify it all? The narrative breaks down the growth math, the profit mix shift, and the bold assumptions that turn today’s price into a projected upside story.

Result: Fair Value of $657.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising regulatory scrutiny and rapid adoption of local real time payment rails could compress margins and slow Mastercard's cross border driven growth story.

Find out about the key risks to this Mastercard narrative.

Another Lens On Value

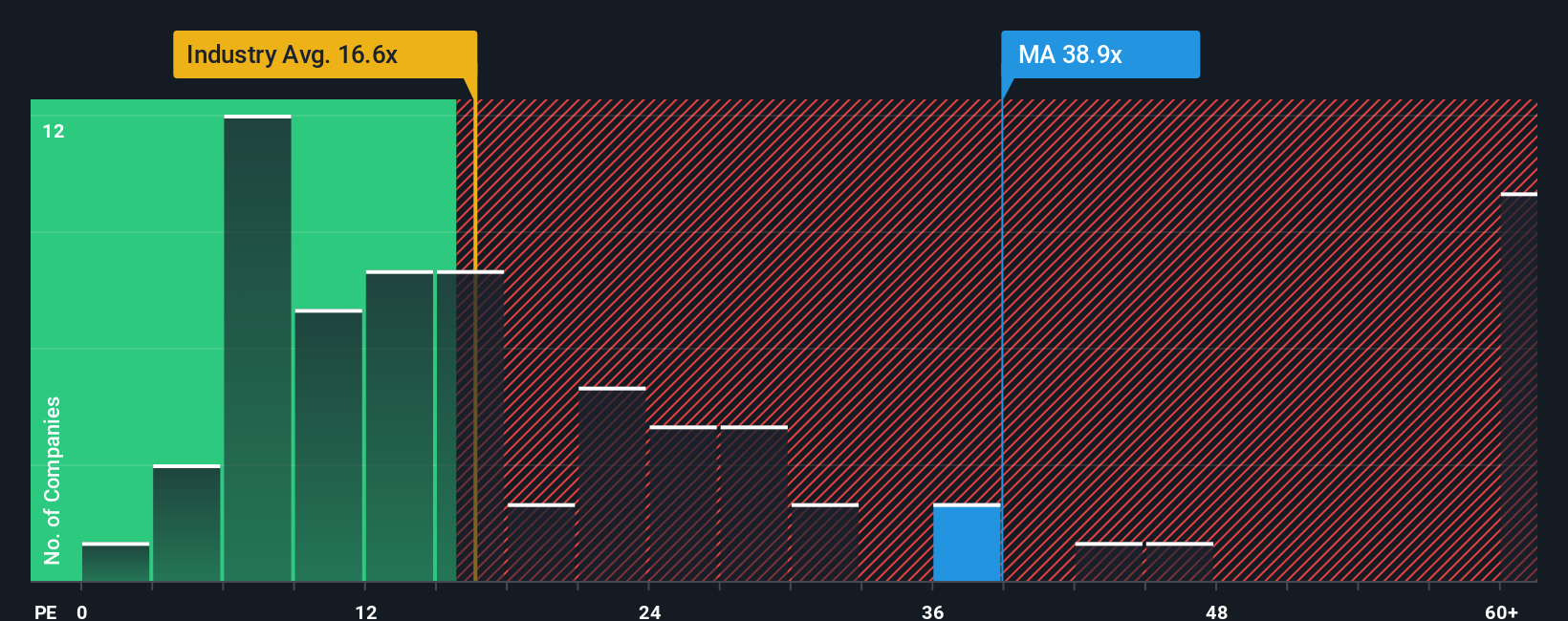

On earnings ratios, Mastercard looks anything but cheap. It trades on a 36.1x price to earnings ratio, versus 17x for peers and a 19.8x fair ratio that the market could drift toward. This raises the question: is today’s price a quality premium or a valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mastercard Narrative

If this perspective does not quite fit your view, or you prefer hands on research, you can quickly build a personalized Mastercard thesis in minutes: Do it your way

A great starting point for your Mastercard research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Mastercard; secure your next edge by using the Simply Wall Street Screener to uncover focused stock ideas tailored to your strategy and risk profile.

- Tap into potential multi baggers by targeting quality small caps through these 3632 penny stocks with strong financials that pair compelling stories with improving fundamentals.

- Ride the structural boom in automation and machine learning by zeroing in on companies at the heart of the trend with these 24 AI penny stocks.

- Lock in a growing income stream by filtering for reliable payers using these 12 dividend stocks with yields > 3% and avoid missing stocks quietly compounding with every distribution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal