CarMax (KMX): Rethinking Valuation After Mixed Earnings, Margin Cuts, and Leadership Changes

CarMax (KMX) just delivered another mixed quarter, beating Wall Street on the headline numbers while still posting lower sales and profit, and that tension is exactly what has investors rethinking the stock.

See our latest analysis for CarMax.

The stock tells that story pretty clearly, with a 30 day share price return of almost 9 percent fading into a roughly 53 percent year to date share price slide and a similar 12 month total shareholder return. Investors are weighing margin cuts, leadership turnover, class action headlines, and a tougher used car backdrop against CarMax’s digital and cost saving plans.

If this kind of reset has you rethinking where to put fresh capital, it could be worth exploring auto manufacturers to compare how other vehicle names are balancing growth, pricing, and profitability right now.

With earnings under pressure, a management shake up, class action noise, and a stock trading below some valuation models despite modest analyst upside, is CarMax quietly turning into a contrarian opportunity, or is the market sensibly discounting future growth?

Most Popular Narrative: 0% Overvalued

CarMax last closed at $38.47, almost exactly in line with the most widely followed fair value estimate of about $38 per share, setting up a finely balanced valuation story.

Revenue Growth expectations have improved, moving from a steeper projected decline of about -2.1% to a milder decline of roughly -0.8%, suggesting less severe top line pressure than previously modeled. Net Profit Margin forecast has edged lower from roughly 3.1% to about 2.8%, pointing to slightly weaker anticipated profitability over the forecast period.

Curious how shrinking sales, rising earnings, and a lower future multiple can all coexist in one fair value math? The full narrative explains that tension step by step.

Result: Fair Value of $38.31 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent credit quality worries and competitive pressure from digital-first rivals could derail the margin recovery and multiple re-rating implied by today’s fair value.

Find out about the key risks to this CarMax narrative.

Another Angle on Value

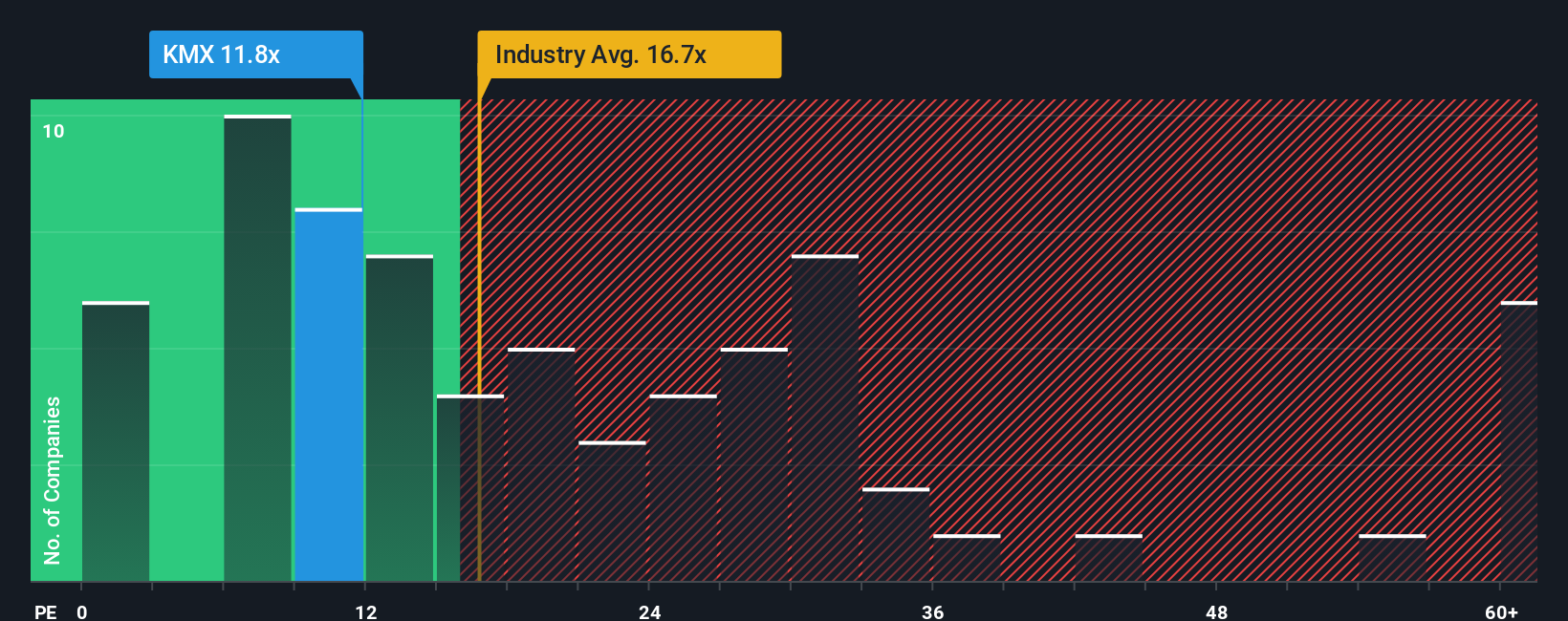

On earnings, CarMax looks cheap at about 12 times profit, versus roughly 20.3 times for the US Specialty Retail industry, peers at 12.3 times, and an 18.6 times fair ratio. That gap hints at upside if sentiment heals, but what if the discount reflects stubborn execution risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CarMax Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your CarMax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning hand picked opportunities across themes and sectors that many investors may overlook until later stages.

- Seek potential multi baggers early by targeting these 3633 penny stocks with strong financials that show robust balance sheets and healthier fundamentals than typical speculative names.

- Explore the next wave of automation and efficiency by focusing on these 29 healthcare AI stocks that are contributing to changes in diagnostics, treatment pathways, and hospital workflows.

- Identify growing cash returns by reviewing these 12 dividend stocks with yields > 3% that combine attractive yields with sustainable payout ratios and solid coverage.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal