3 Asian Growth Companies With High Insider Ownership Seeing Up To 69% Revenue Growth

As the Asian markets navigate a landscape marked by economic shifts and monetary policy adjustments, investors are increasingly drawn to growth companies with substantial insider ownership, which can signal confidence in a company's long-term prospects. In this context, high insider ownership is often seen as a positive indicator, suggesting that those closest to the company believe in its potential to thrive amidst evolving market conditions.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| M31 Technology (TPEX:6643) | 26.3% | 117.3% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Here's a peek at a few of the choices from the screener.

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Doushen (Beijing) Education & Technology Inc. operates in the education and technology sector with a market capitalization of CN¥14.86 billion.

Operations: The company's revenue is primarily derived from its Information Technology Service segment, which generated CN¥976.05 million.

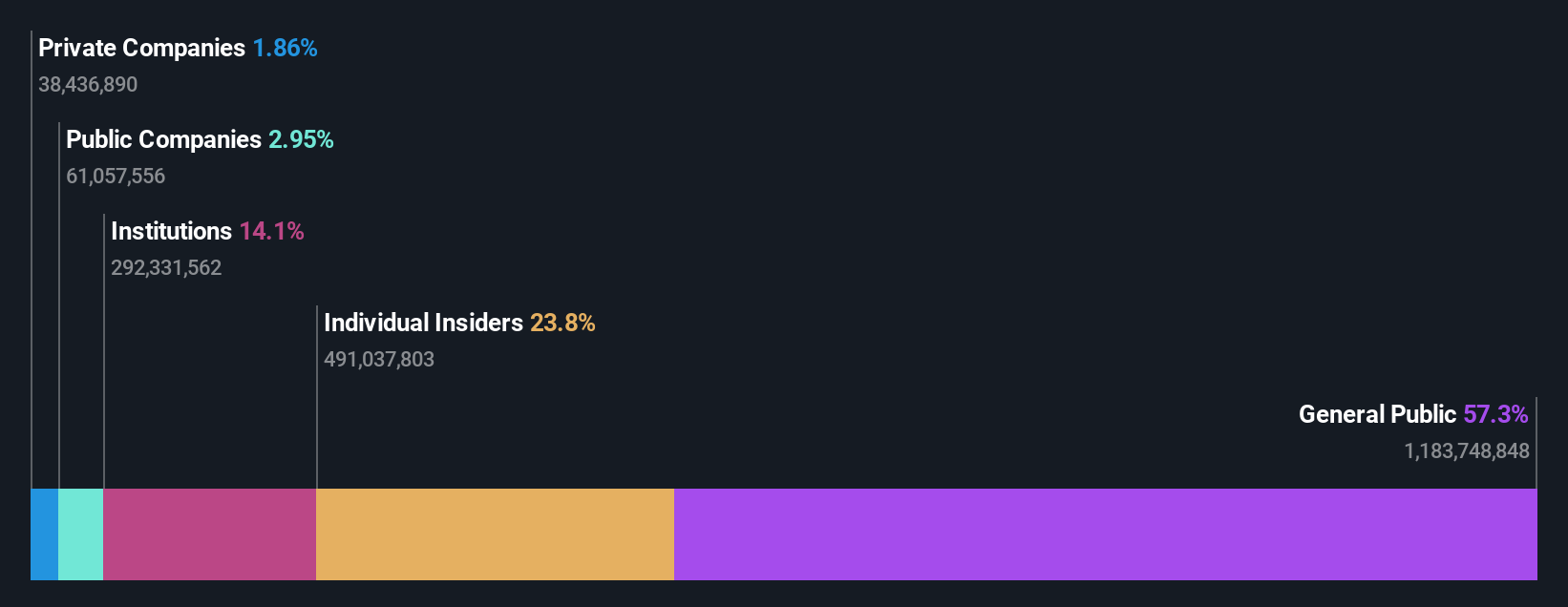

Insider Ownership: 23.8%

Revenue Growth Forecast: 39.4% p.a.

Doushen (Beijing) Education & Technology has shown significant revenue growth, reporting CNY 776.24 million for the first nine months of 2025, up from CNY 557.02 million a year ago. Despite this, net income decreased to CNY 91.77 million from CNY 110.87 million last year, reflecting lower profit margins and high non-cash earnings. The company recently amended its articles of association, potentially impacting governance structures as it navigates expected annual earnings growth exceeding market averages over the next three years.

- Click to explore a detailed breakdown of our findings in Doushen (Beijing) Education & Technology's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Doushen (Beijing) Education & Technology shares in the market.

Cre8 Direct (NingBo) (SZSE:300703)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cre8 Direct (NingBo) Co., Ltd. designs, produces, processes, and sells paper products in North America and has a market capitalization of approximately CN¥5.09 billion.

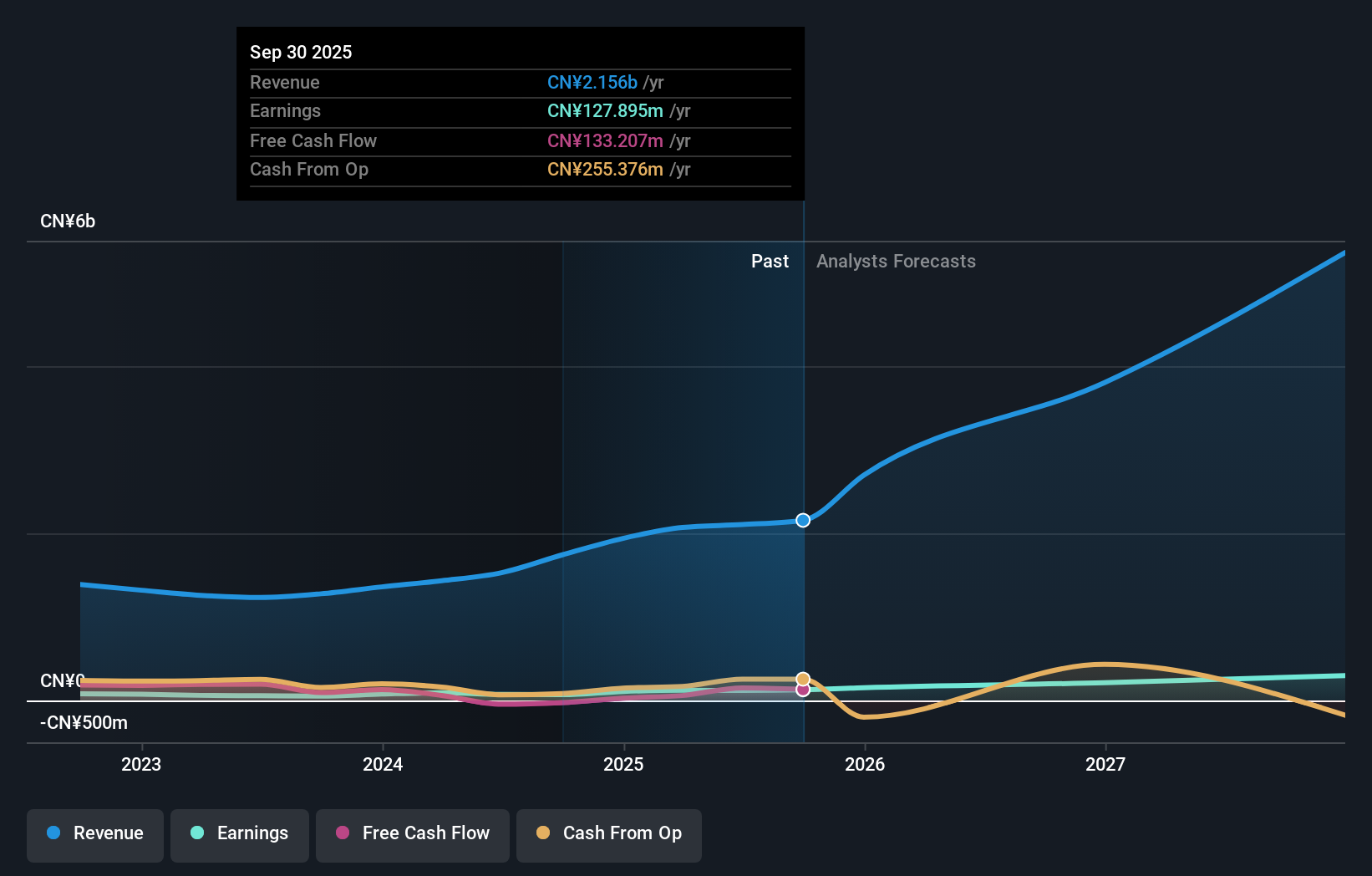

Operations: The company generates revenue of approximately CN¥2.16 billion from its paper and paper products segment.

Insider Ownership: 13.8%

Revenue Growth Forecast: 39.1% p.a.

Cre8 Direct (NingBo) demonstrates robust growth potential, with earnings and revenue forecasted to outpace the broader Chinese market significantly. The company reported substantial earnings growth of 83.3% over the past year, alongside a share repurchase program valued at CNY 153.55 million, which could enhance shareholder value. However, its volatile share price and unstable dividend history might concern some investors despite a favorable price-to-earnings ratio compared to market averages. Recent amendments to its articles of association may influence future governance dynamics.

- Click here and access our complete growth analysis report to understand the dynamics of Cre8 Direct (NingBo).

- Our valuation report unveils the possibility Cre8 Direct (NingBo)'s shares may be trading at a premium.

Qingdao Huicheng Environmental Technology Group (SZSE:300779)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Qingdao Huicheng Environmental Technology Group Co., Ltd. (SZSE:300779) operates in the environmental technology sector and has a market cap of CN¥30.57 billion.

Operations: Qingdao Huicheng Environmental Technology Group's revenue segments are not specified in the provided text.

Insider Ownership: 31.5%

Revenue Growth Forecast: 69.2% p.a.

Qingdao Huicheng Environmental Technology Group is poised for substantial growth, with revenue expected to rise significantly faster than the Chinese market. Despite a decline in profit margins from last year, earnings are projected to grow at a very high rate. However, the company faces challenges with volatile share prices and interest payments not well covered by earnings. Recent financials show modest sales growth but a decrease in net income, highlighting potential profitability concerns amidst its rapid expansion trajectory.

- Get an in-depth perspective on Qingdao Huicheng Environmental Technology Group's performance by reading our analyst estimates report here.

- The analysis detailed in our Qingdao Huicheng Environmental Technology Group valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Gain an insight into the universe of 635 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Looking For Alternative Opportunities? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal