South Korea's economy highlights “chip addiction”: export growth slowed in the first 20 days of December, and a sharp rise in semiconductor demand conceals structural weakness in the economy

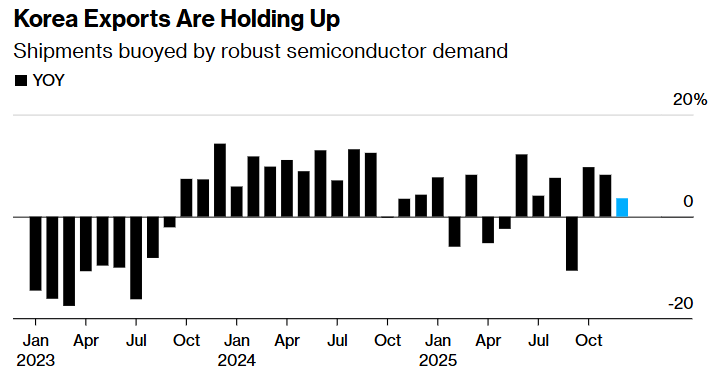

The Zhitong Finance App learned that South Korea's strong semiconductor exports continued to mask weakness in other industries and helped maintain overall shipment growth in the first few weeks of December. South Korea is currently coping with the impact of US tariffs. According to data released by Korea Customs on Monday, after adjusting for differences in working days, exports increased 3.6% year-on-year in the first 20 days of December, compared with 8.2% for the same period last month. In contrast, the revised increase in exports for the month of November was 13%. Unadjusted exports also increased 6.8%, while overall imports increased 0.7%, contributing to a trade surplus of $3.8 billion.

Semiconductor exports grew by nearly 42%, continuing the recovery driven by artificial intelligence and data center demand. Shipments of wireless communication equipment also increased by nearly 18%. These increases offset the decline in other industries. Automobile exports fell 13%, while petrochemical products weakened due to rising input costs and US protectionist measures. By destination, exports to China increased 6.5%, while exports to the US fell 1.7%.

Barclays Bank economist Bumki Son said, “After excluding the semiconductor industry, economic data is still weak, which further highlights the strong performance of the semiconductor industry. I think we still need to be wary of the risk that monetary policy positions may not be neutral to most sectors of the economy other than the semiconductor industry.”

In late November, the Bank of Korea changed its previously clear “interest rate cut position” and instead adopted a more neutral policy approach, keeping the benchmark interest rate unchanged at 2.5% and raising the 2026 economic growth forecast to 1.8%, citing strong exports and a steady recovery in private consumption. However, Bank of Korea Governor Lee Chang-yong pointed out that the improvement in economic growth expectations is mainly due to the growth of the chip and information technology industry.

Barclays Bank expects South Korea's exports to grow by 2.1% next year, but if semiconductor-related exports, imports, and investments are excluded, the growth rate is only about 1.1%. This continuing polarization has made it more difficult for the Bank of Korea to formulate policies, and the weak Korean won and the bubble of real estate prices in the South Korean capital Seoul have worsened its situation.

After three months of negotiations, Seoul and Washington reached a landmark tariff agreement in late October, setting the upper limit of US tariffs on South Korean goods at 15%. Earlier this month, the US issued an official notice in the Federal Register, and since November 1, tariffs on South Korean cars and auto parts have also been reduced retroactively to 15%. Although the deal lowered the level of tariffs announced by Trump in spring, the tax rate is still far above the level the country enjoyed under the previous free trade agreement.

At the time of the release of this trade report, the exchange rate of the won against the US dollar had already fallen by more than 8% in the second half of 2025, raising concerns about rising inflation. Currently, Korea's core consumer price index and overall consumer price index have both exceeded the Bank of Korea's target level of 2%. The central bank warned that the continued weakness of the won could further drive up import costs.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal