Evaluating TravelSky Technology (SEHK:696)’s Valuation After Jiang Bo’s Election as Chairman and Executive Director

TravelSky Technology (SEHK:696) just handed Jiang Bo the keys, elevating him to executive director, board chairman, and head of key committees after shareholders approved resolutions at an Extraordinary General Meeting.

See our latest analysis for TravelSky Technology.

The leadership reshuffle lands at a time when momentum is quietly improving, with a year to date share price return of 8.73% and a 1 year total shareholder return of 6.00%, even though longer term total shareholder returns remain deeply negative. This hints that investors are reassessing TravelSky’s growth and governance story from a low base.

If Jiang Bo’s appointment has you thinking about where leadership and growth might meet next, it could be worth exploring fast growing stocks with high insider ownership for other under the radar opportunities.

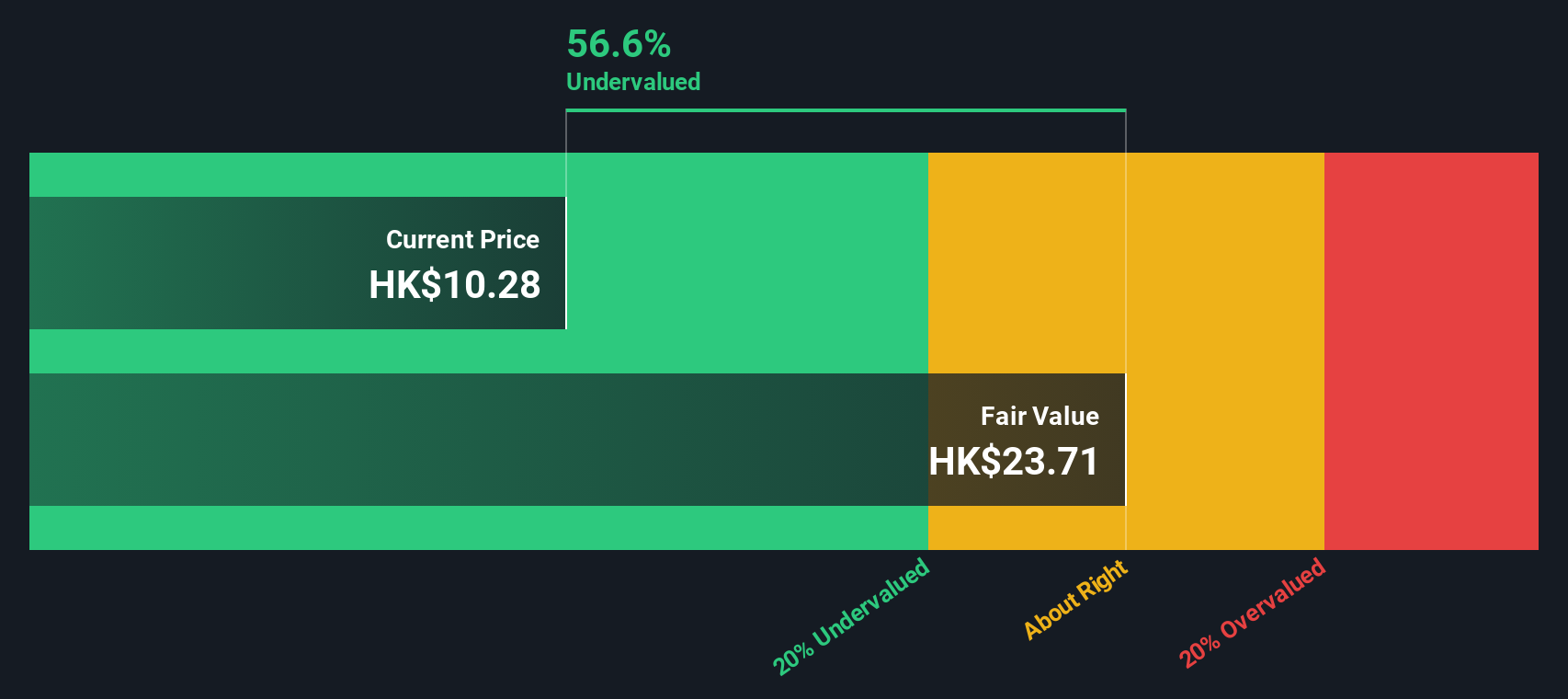

With the shares trading below analyst targets and our model suggesting a steep intrinsic discount, the question now is whether TravelSky is quietly undervalued or if the market is already baking in a new growth chapter.

Price-to-Earnings of 13.3x: Is it justified?

On a price-to-earnings ratio of 13.3x at the last close of HK$10.84, TravelSky screens as undervalued versus both peers and our internal fair ratio.

The price-to-earnings multiple compares the current share price with the company’s earnings per share, offering a shorthand view of how much investors are paying for current profits. For a business like TravelSky, with established profitability and positive earnings growth, this is a central yardstick for how the market is valuing its income stream.

Here, the market is applying a 13.3x multiple, even though our fair price-to-earnings estimate sits higher at 15.2x, and peer and industry averages are also above the current level. That gap suggests investors may still be applying a discount to TravelSky’s earnings power, leaving room for the valuation multiple to drift closer to those higher benchmarks if recent growth and margin improvements prove sustainable.

Compared with the Hong Kong Hospitality industry average of 17.1x and a peer average of 15.7x, TravelSky’s 13.3x multiple looks materially cheaper, implying the stock trades on a noticeable earnings discount rather than a premium narrative.

Explore the SWS fair ratio for TravelSky Technology

Result: Price-to-Earnings of 13.3x (UNDERVALUED)

However, continued weak longer term returns and dependence on China’s aviation cycle mean any traffic slowdown or regulatory shift could quickly challenge this renewed optimism.

Find out about the key risks to this TravelSky Technology narrative.

Another View: DCF Points to Deeper Upside

Our DCF model presents a far stronger upside case, putting fair value closer to HK$23.51 versus the current HK$10.84, which implies the shares trade at roughly a 54% discount. If the cash flows are realistic, is the market simply too cautious on TravelSky’s future?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TravelSky Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TravelSky Technology Narrative

If you see the numbers differently or want to dig into the data yourself, you can build a personalised view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding TravelSky Technology.

Ready for your next investing move?

Do not stop at one opportunity; use the Simply Wall Street Screener to quickly surface fresh ideas before the market fully prices in their potential.

- Capture momentum early by scanning these 3632 penny stocks with strong financials that pair tiny market caps with surprisingly resilient fundamentals and room for re rating.

- Harness structural growth by filtering for these 24 AI penny stocks that are turning artificial intelligence into real revenue and durable competitive edges.

- Lock in potential mispricings with these 912 undervalued stocks based on cash flows that trade below their estimated cash flow value while their underlying businesses keep improving.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal