Intercontinental Exchange (ICE): Reassessing Valuation After Potential $5 Billion MoonPay Investment Talks

Intercontinental Exchange (ICE) is back on investors radar after reports that it is in talks to invest in crypto payments firm MoonPay at a funding round valuing the startup near $5 billion.

See our latest analysis for Intercontinental Exchange.

The potential MoonPay deal comes on top of record trading in ICE’s energy contracts, new climate risk data partnerships and leadership changes in mortgage tech. The share price is up 7.34% year to date, while the three year total shareholder return of 62.10% signals longer term momentum is still very much intact.

If this kind of strategic deal making has your attention, it could be worth scanning other high growth tech and market infrastructure names using our curated high growth tech and AI stocks.

With earnings still growing faster than revenue and shares trading at a roughly 19% discount to analyst targets, is ICE quietly undervalued, or is the market already baking in years of digital and energy growth?

Most Popular Narrative Narrative: 16% Undervalued

Compared with Intercontinental Exchange’s last close of $160.30, the most followed narrative points to a materially higher fair value anchored in durable earnings power.

Ongoing digitization and AI integration are driving high margin growth across trading, data, and mortgage platforms, supporting recurring revenues and improved profitability.

Expansion into global energy and data markets, plus investment in infrastructure, is creating new revenue streams and reinforcing operating scalability.

Want to see the profit engine behind that higher fair value, and why it leans on richer margins and future earnings power, not hyper growth headlines?

Result: Fair Value of $190.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower than expected mortgage tech adoption and volatility driven volume declines could challenge those upbeat margin assumptions and temper the upside from prediction market expansion.

Find out about the key risks to this Intercontinental Exchange narrative.

Another Lens on Value

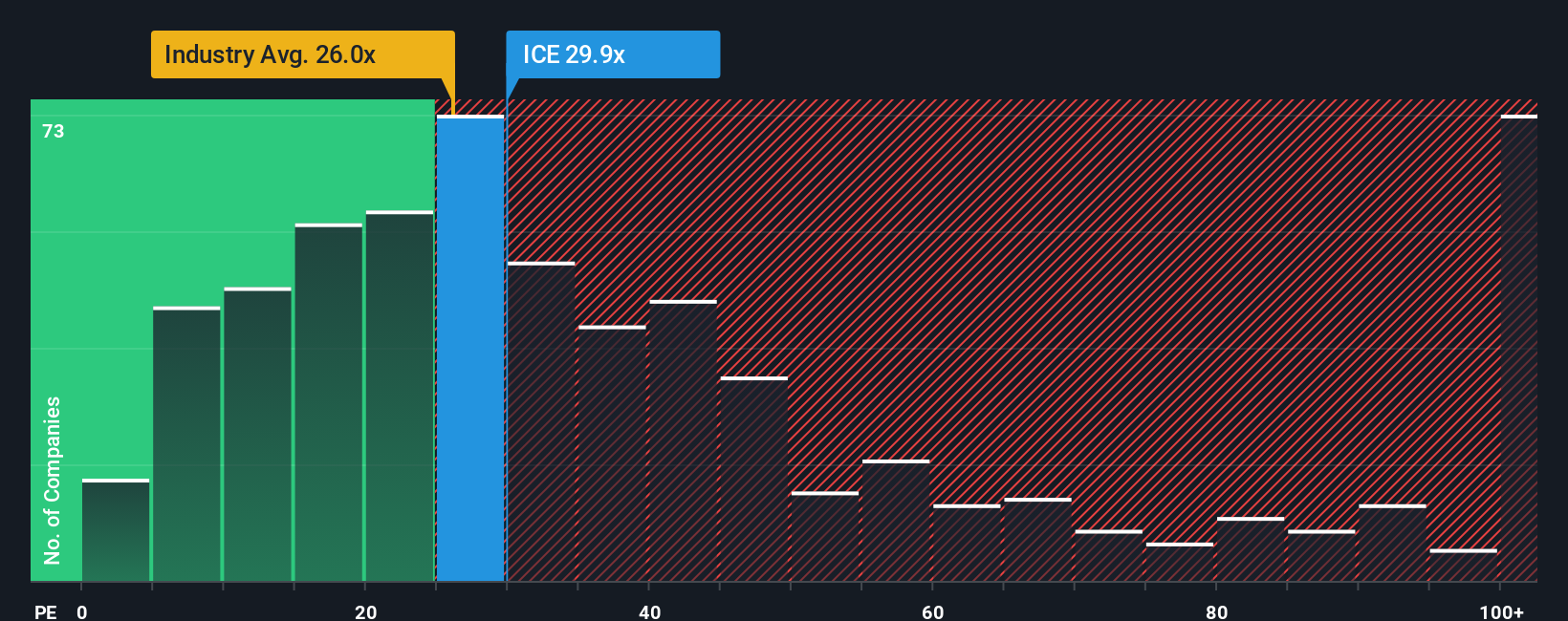

On simple valuation ratios, ICE looks far less forgiving. The shares trade on a 28.9x price to earnings multiple, richer than the US Capital Markets industry at 25.1x and well above a fair ratio of 16.1x, which implies meaningful downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intercontinental Exchange Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a personalized view in minutes: Do it your way.

A great starting point for your Intercontinental Exchange research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in fresh opportunities by scanning focused stock ideas built from real fundamentals, not hype, so the next move is truly intentional.

- Target income potential with these 12 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow while markets stay unpredictable.

- Capitalize on structural growth by reviewing these 29 healthcare AI stocks at the intersection of medicine, data, and automation.

- Position yourself early by tracking these 79 cryptocurrency and blockchain stocks reshaping payments, digital assets, and financial infrastructure worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal