Japan Tobacco (TSE:2914): Reassessing Valuation After Major Counterfeit Cigarette Operation Exposed

Italian authorities just shut down a large illicit cigarette plant near Rome that was churning out counterfeit Camel and Winston, directly implicating Japan Tobacco (TSE:2914) in a high profile trademark and smuggling case.

See our latest analysis for Japan Tobacco.

For investors, this counterfeit bust lands at a time when Japan Tobacco’s 90 day share price return of 21.2 percent and 1 year total shareholder return of 46.27 percent already signal strong, building momentum rather than a late cycle spike.

If this news has you rethinking the broader tobacco and staples space, it can also be a good moment to look beyond the sector and explore fast growing stocks with high insider ownership.

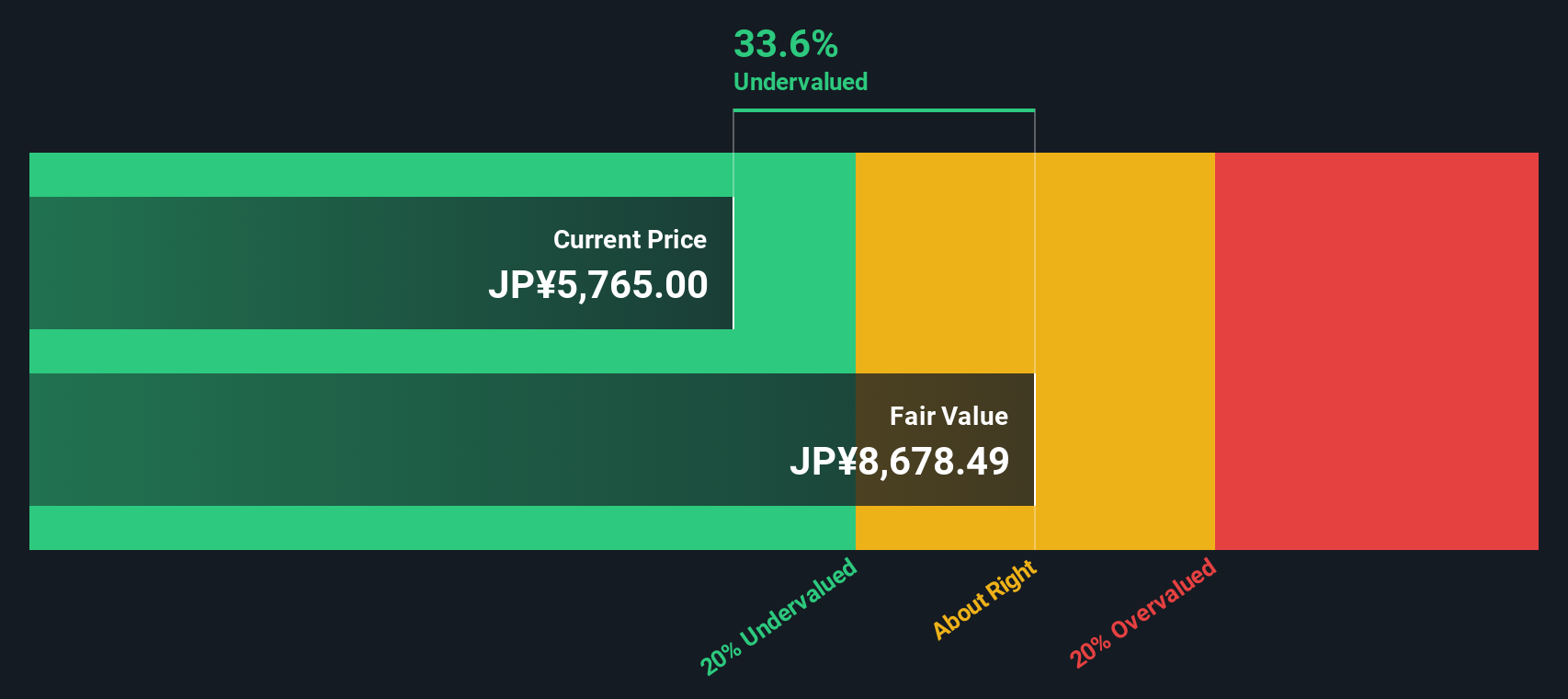

With earnings still growing, a solid value score and the shares trading below intrinsic value but slightly above analyst targets, is Japan Tobacco still mispriced to the upside, or is the market already baking in its next leg of growth?

Most Popular Narrative: 6.1% Overvalued

With Japan Tobacco last closing at ¥5,774 against a narrative fair value of ¥5,440, the most followed view sees the current rally slightly ahead of fundamentals, but still supported by steady, compounding earnings power.

Ongoing R&D investment and a targeted ¥650 billion global allocation for innovation in next-generation products and marketing are likely to support earnings and accelerate the path to profitability in the company's Reduced Risk Product segment, positively impacting margins and long-term earnings growth. Industry wide consolidation and a shifting regulatory landscape create barriers to entry and enable further scale efficiencies for large incumbents like Japan Tobacco, bolstering competitive positioning and enabling improved operating leverage and bottom line growth in less regulated, high potential regions.

Want to see the playbook behind this pricing call? The growth pace, margin reset and future earnings multiple all pull in different directions. Curious which assumption matters most.

Result: Fair Value of ¥5,440 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained domestic volume declines and ongoing losses in reduced risk products could compress margins faster than expected, which could force a rethink of that steady growth path.

Find out about the key risks to this Japan Tobacco narrative.

Another Take On Value

While the consensus narrative pegs Japan Tobacco as about 6 percent overvalued versus a ¥5,440 fair value, our DCF model points the other way and suggests the shares are roughly 28 percent undervalued at around ¥8,013. Which lens better reflects the next five years of cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Japan Tobacco for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Japan Tobacco Narrative

If you are not aligned with this view or would rather rely on your own work, you can quickly build a custom thesis in minutes, Do it your way.

A great starting point for your Japan Tobacco research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you could miss out on stronger opportunities, so use the Simply Wall St Screener to surface your next edge.

- Capture capital growth potential by targeting companies trading below their estimated cash flow value using these 913 undervalued stocks based on cash flows that could rerate as the market catches up.

- Secure steadier portfolio income by focusing on reliable payers through these 12 dividend stocks with yields > 3% that combine meaningful yields with healthier fundamentals.

- Ride structural shifts in digital assets by filtering for listed businesses exposed to blockchain innovation via these 79 cryptocurrency and blockchain stocks aligned with your risk appetite.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal