Packaging Corporation of America (PKG): Rethinking Valuation After This Year’s 10% Share Price Pullback

Packaging Corporation of America (PKG) has quietly slipped about 10 % this year, even after a modest rebound over the past month. This sets up an interesting moment to reassess the stock.

See our latest analysis for Packaging Corporation of America.

That near 10 % year to date share price decline, despite a positive 30 day share price return and a strong three year total shareholder return above 70 %, suggests sentiment has cooled lately even as the longer term compounding story remains intact.

If PKG has you rethinking where the next leg of gains might come from, this could be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas.

With shares lagging despite healthy revenue and profit growth, plus a double digit discount to analyst targets and a sizable intrinsic value gap, is PKG quietly becoming a buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 10% Undervalued

With Packaging Corporation of America last closing at $202.82 versus a narrative fair value near $225, the current gap hinges on a handful of powerful assumptions.

The analysts have a consensus price target of $213.444 for Packaging Corporation of America based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $244.0, and the most bearish reporting a price target of just $152.0.

Want to see what kind of earnings ramp, margin lift, and future profit multiple are needed to support that valuation bridge? The full narrative lays out a precise profit roadmap, underpinned by modest growth assumptions and a carefully chosen discount rate that could surprise cautious investors.

Result: Fair Value of $225.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer packaging demand and rising operating costs could squeeze margins and delay the expected earnings ramp that supports the current fair value case.

Find out about the key risks to this Packaging Corporation of America narrative.

Another Angle On Valuation

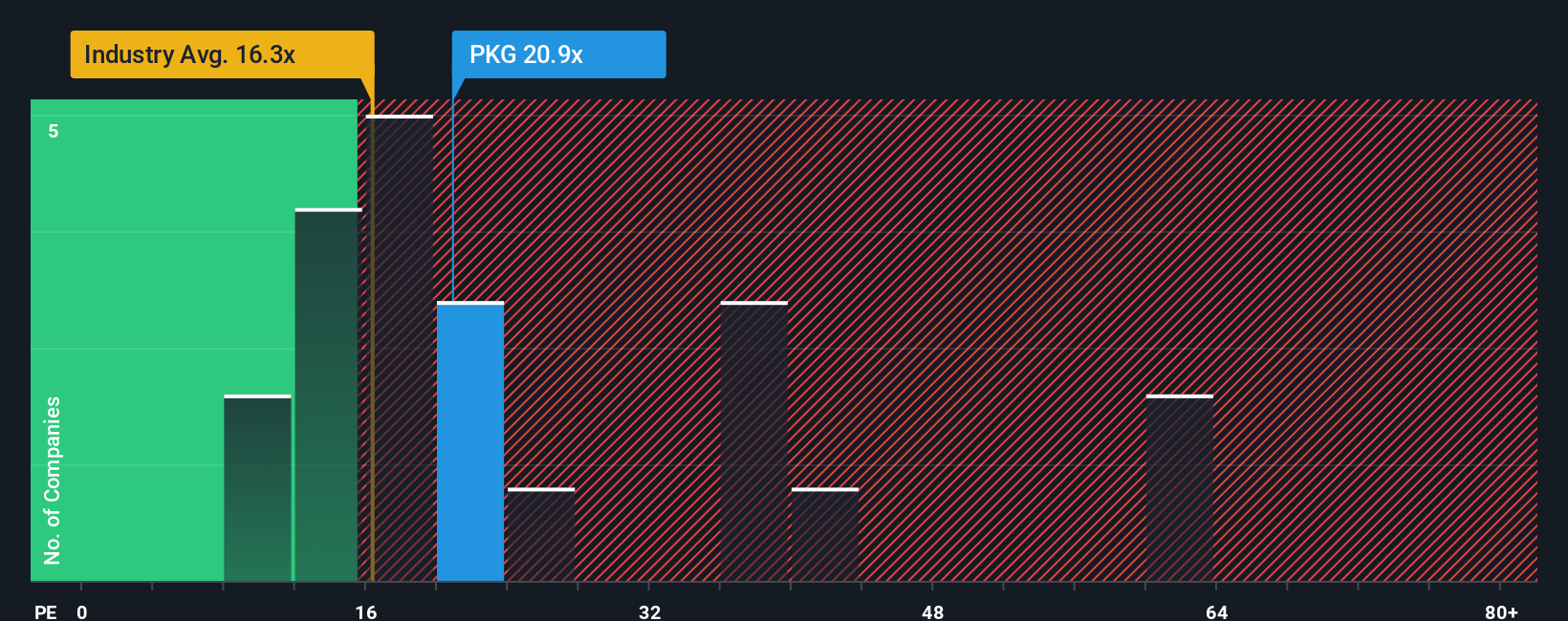

Our ratio based view paints a more measured picture. PKG trades on a 20.4x price to earnings ratio, which is slightly richer than the North American packaging group at 19.9x, but below peers at 23.7x and under our 21.8x fair ratio, hinting at limited downside yet only moderate upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Packaging Corporation of America Narrative

If you see the story differently or want to stress test your own assumptions, you can build a complete narrative in just a few minutes: Do it your way

A great starting point for your Packaging Corporation of America research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning focused shortlists that surface strong themes and potential opportunities you might otherwise overlook.

- Explore early stage growth potential with these 3633 penny stocks with strong financials that pair tiny market caps with relatively solid financial underpinnings and improving momentum.

- Follow structural shifts in medicine by targeting these 29 healthcare AI stocks that blend healthcare resilience with AI driven productivity gains and innovation pipelines.

- Enhance your income strategy with these 12 dividend stocks with yields > 3% that combine robust balance sheets, reliable cash flows, and yields that can help lift total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal