IPO News | Huada Beidou once again submitted the Hong Kong Stock Exchange's 2024 shipment volume ranking sixth in the global GNSS chip and module market

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 19, Shenzhen Huada Beidou Technology Co., Ltd. (abbreviation: Huada Beidou) submitted a listing application to the main board of the Hong Kong Stock Exchange, and CMB International and Ping An Securities (Hong Kong) were co-sponsors. The company submitted its listing to the Hong Kong Stock Exchange on June 11, 2025.

Company profile:

According to the prospectus, Huada Beidou is a well-known spatial positioning service provider in China. It is headquartered in Shenzhen and provides chips, modules and related solutions supporting Beidou and other major GNSS. The company's R&D team specializes in the field of GNSS technology, focusing on integrated SoC chip design, chip-level dual-frequency high-precision positioning technology, ultra-low power consumption technology, and multi-source integrated navigation technology.

According to Insight Consulting data, in 2024, Huada Beidou ranked sixth in the global GNSS chip and module market in terms of shipment volume, with a market share of 4.8%. According to Insight Consulting data, in 2024, the company ranked 8th in the world in terms of revenue and ranked 3rd among mainland Chinese companies in the GNSS chip and module market, with a market share of about 1.1%. The GNSS chip and module sub-market accounts for about 2.1% of the revenue of the overall GNSS spatial positioning service market.

Huada Beidou provides a comprehensive product portfolio, including (i) GNSS chips, modules and related solutions tailored to various applications developed independently by the company, and (ii) comprehensive chips and module products purchased from third parties, including a broad portfolio of communication and storage products essential to various electronic devices. The company's core products include standard precision and high-precision chips and modules used in the fields of transportation (traffic management, bike sharing and intelligent driving), consumer electronics (smartphones, Internet of Things and wearable devices), and environmental monitoring and early warning (weather detection and deformation monitoring), as well as Beidou short message communication chips.

The company's GNSS chips, modules and related solutions can achieve accurate and efficient navigation and positioning, position tracking, displacement monitoring and satellite communication. The company's chips support multiple satellite systems, including Beidou, GPS, GLONASS, Galileo, QZSS and NaviC, to ensure coverage and accuracy.

Financial data

Revenue:

On the financial side, in 2022, 2023, 2024, 2024, and 2025 for the six months ended June 30, Huada Beidou achieved revenue of approximately RMB 698 million, RMB 645 million, RMB 840 million, RMB 335 million, and RMB 403 million respectively.

Profit:

In 2022, 2023, 2024, 2024, and 2025 for the six months ended June 30, Huada Beidou achieved profits of -92.612 million yuan, approximately -289 million yuan, approximately -141 million yuan, -54.782 million yuan, and -63.577 million yuan, respectively.

Industry Overview

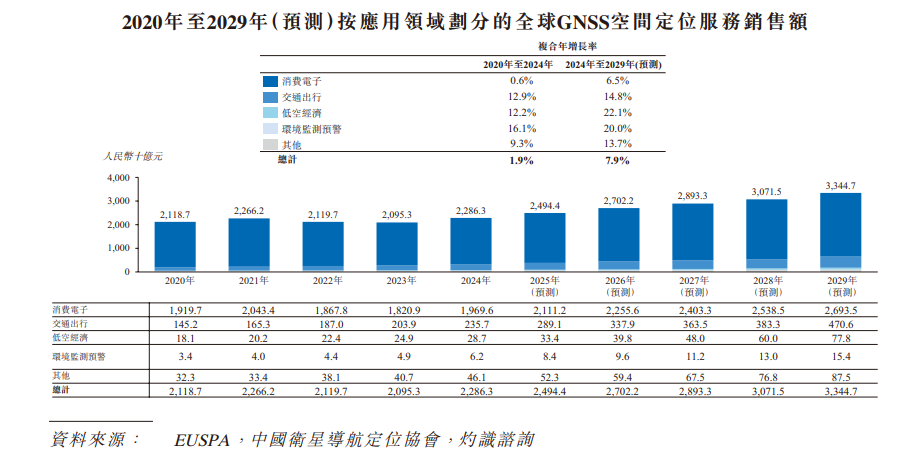

With the continuous development of mobile Internet and the Internet of Things, the global GNSS spatial positioning service market is expected to grow. In 2024, the global GNSS spatial positioning service market will be RMB 2,286.3 billion. Continued progress in artificial intelligence technology in consumer devices will drive a gradual upgrade cycle. At the same time, the steady development of intelligent automobiles and the low-altitude economy provide incremental support for the market demand for GNSS spatial positioning services. The global GNSS spatial positioning service market is expected to reach RMB 3,344.7 billion by 2029, with a compound annual growth rate of 7.9% from 2024 to 2029.

The global GNSS spatial positioning service market is expected to grow rapidly from 2024 to 2029, mainly due to continuous technology upgrades, expansion of application scenarios, and increasing policy support from major economies. As multi-frequency GNSS systems become more widely used, the overall accuracy, reliability and continuity of satellite positioning services continue to improve, creating conditions for their wider commercialization. At the same time, GNSS-related technology continues to penetrate emerging fields such as autonomous driving, drone systems, precision agriculture, smart logistics, and urban infrastructure, greatly expanding the downstream demand market. In addition, many countries are increasing investment in navigation-related infrastructure and promoting the integration of high-precision positioning services into national digital strategies, which has further accelerated their adoption.

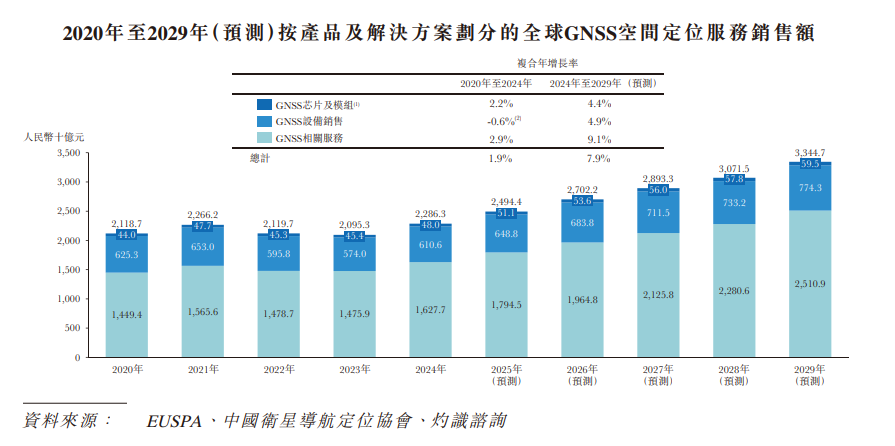

Global GNSS chip and module sales increased from RMB 44 billion in 2020 to RMB 48 billion in 2024, with a compound annual growth rate of 2.2% during the period. Global sales of GNSS equipment and related services increased from RMB 625.3 billion and RMB 1,449.4 billion in 2020 to RMB 610.6 billion and RMB 1,627.7 billion in 2024, with CAGR of -0.6% and 2.9% respectively. Looking forward to the future, with the further expansion and application of spatial positioning services in precision equipment and emerging downstream scenarios such as autonomous driving and precision agriculture, the global GNSS chip and module market, GNSS equipment and GNSS-related service markets are expected to grow at CAGR 4.4%, 4.9%, and 9.1%, respectively.

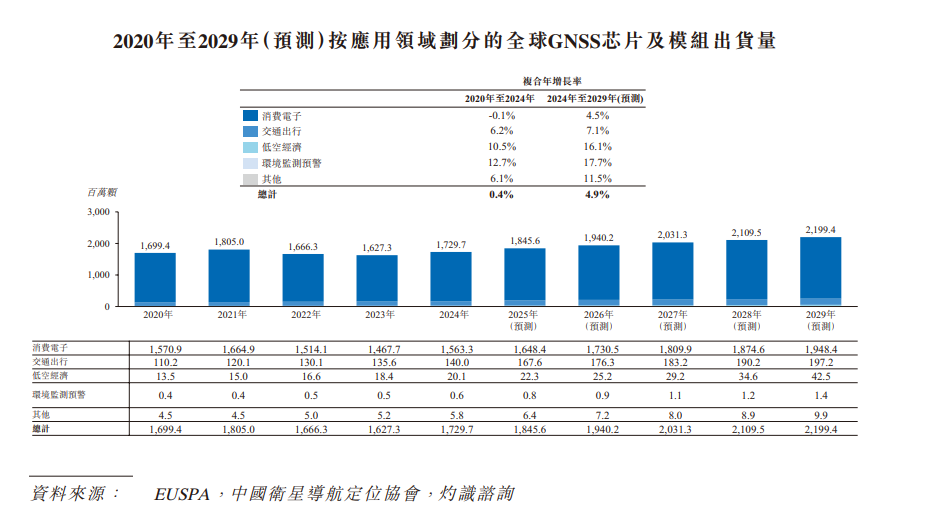

As chip localization accelerates, the influence of geopolitical factors on GNSS chips has become relatively limited, and the balance between supply and demand for GNSS chips is gradually improving. With the iterative upgrading of electronic products brought about by the development of artificial intelligence, demand for products such as smartphones and wearable devices is expected to recover in the next five years. At the same time, with the rapid spread of smart cars and drones, the penetration rate of GNSS applications in the field of environmental monitoring and early warning continues to increase. Demand for GNSS equipment in other application fields such as precision agriculture and smart electricity has been rising steadily. Global GNSS chip and module shipments are expected to grow to 2,199.4 million units by 2029, with a CAGR of 4.9% from 2024 to 2029.

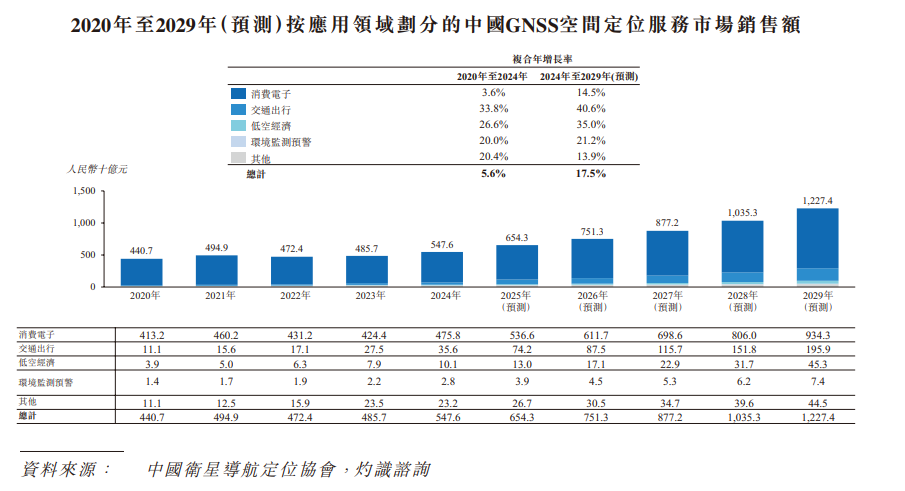

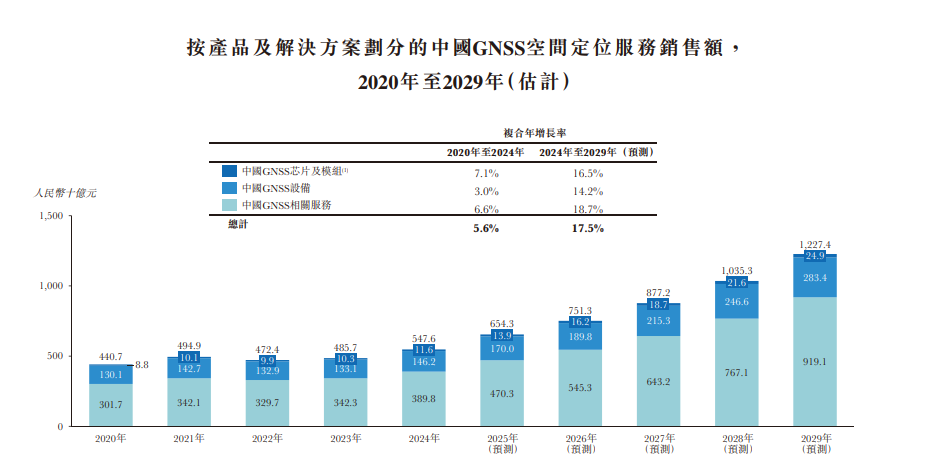

Thanks to the rapid development of industries such as mobile internet, intelligent driving, and shared mobility, and the Chinese government's active promotion of the Beidou industry, the GNSS spatial positioning service market in China grew from RMB 440.7 billion in 2020 to RMB 547.6 billion in 2024, with a compound annual growth rate of 5.6%. As the Beidou industry gradually integrates into the digital economy, application fields such as traffic management, low-altitude economy, precision agriculture, and intelligent water conservancy in the digital economy will provide a broad market for Beidou products and strongly promote the growth of China's GNSS spatial positioning service market. China's GNSS spatial positioning service market is expected to reach RMB 1,227.4 billion by 2029, with a compound annual growth rate of 17.5% from 2024 to 2029.

Sales of China's GNSS chips and modules in China increased from RMB 8.8 billion in 2020 to RMB 11.6 billion in 2024, with a CAGR of 7.1%. Sales of GNSS equipment and related services in China increased from RMB 130.1 billion and RMB 301.7 billion in 2020 to RMB 146.2 billion and RMB 389.8 billion respectively in 2024, with CAGR of 3.0% and 6.6% respectively. Looking ahead, sales of GNSS chips and modules as well as equipment and related services in China are expected to grow at CAGR 16.5%, 14.2% and 18.7% respectively, reaching RMB 24.9 billion, RMB 283.4 billion and RMB 919.1 billion respectively by 2029.

From 2020 to 2024, China's GNSS chip and module shipments increased from 361.7 million to 446.3 million units, with a compound annual growth rate of 5.4%. As the downstream penetration rate of GNSS increases, Beidou's emerging application scenarios are expanding. It is estimated that by 2029, China's GNSS chip and module shipments will reach 999.4 million units, with a compound annual growth rate of 17.5% from 2024 to 2029.

Board Information

The Board currently consists of nine directors, including 2 executive directors, 4 non-executive directors and 3 independent non-executive directors.

Shareholding structure

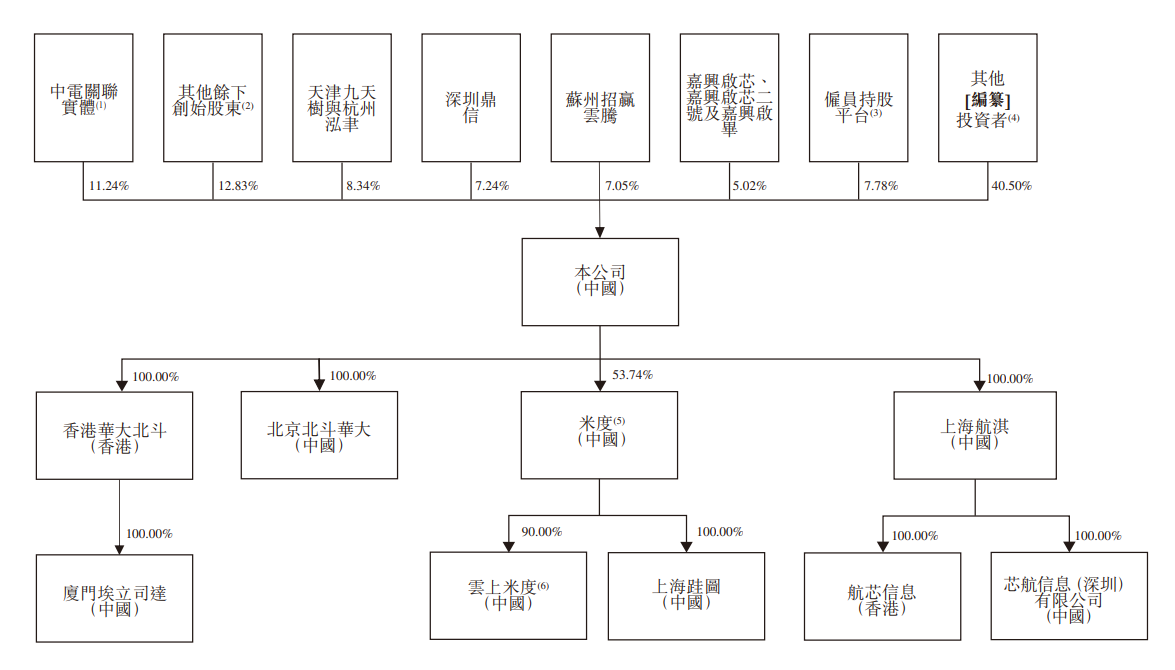

Huada Beidou's shareholding structure is quite scattered. CLP related entities hold 11.24% of the shares, with the CLP Group background; the remaining founding shareholders hold 12.83% of the shares, Tianjin Jiutianshu and Hangzhou Hongyu hold 8.34% of the shares, while Shenzhen Dingxinyi and Suzhou Zhaowin Yunteng hold 7.24% and 7.05% of the shares respectively.

Intermediary team

Co-sponsors: CMB International Finance Co., Ltd., China Ping An Capital (Hong Kong) Limited

The company's legal advisors: Hong Kong law: Han Kun Law Firm Limited Liability Partnership; Hong Kong law relating to the operation of certain subsidiaries in Hong Kong: Cowichan Law Firm; relevant Chinese law: Jingtian Gongcheng Law Firm; matters relating to international sanctions compliance: Junhe Law Firm New York Branch; matters relating to Chinese sanctions compliance: Junhe Law Firm Shanghai Branch

Co-sponsor Legal Adviser: Relevant Hong Kong Law: Shengde Law Firm; Related Chinese Law: Commerce Law Firm

Auditor and reporting accountant: KPMG

Industry Advisor: Insight Industry Consulting Co., Ltd.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal