STAG’s New Logistics Hub Acquisitions Might Change The Case For Investing In STAG Industrial (STAG)

- In recent months, STAG Industrial expanded its US industrial footprint by acquiring two warehouse buildings near Kansas City International Airport, including a DHL Express–leased facility, and an additional property in a high-demand Greater Cincinnati submarket.

- These acquisitions deepen STAG’s exposure to key logistics corridors, highlighting its focus on regional distribution hubs that serve e-commerce and supply chain needs.

- Next, we’ll explore how this latest expansion into key logistics hubs shapes STAG Industrial’s investment narrative and long-term portfolio positioning.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

STAG Industrial Investment Narrative Recap

To own STAG Industrial, you generally need to believe that demand for mid sized, single tenant industrial and logistics space will remain resilient, even as big box centers gain share. The recent Kansas City and Cincinnati acquisitions align with that thesis but do not meaningfully change the near term tension between solid leasing metrics and the risk that tenant consolidation into mega facilities could pressure occupancy and leasing spreads over time.

Among recent announcements, the ongoing affirmation of STAG’s monthly dividend at US$0.124167 per share stands out in this context. For many shareholders, a stable, roughly 4% yield is a key part of the appeal, but it also depends on the company successfully leasing up new assets in markets where supply and tenant preferences may not be uniformly favorable.

Yet behind the steady dividend, one issue investors should be aware of is the growing risk that major logistics users could increasingly concentrate activity in mega fulfillment centers, which could...

Read the full narrative on STAG Industrial (it's free!)

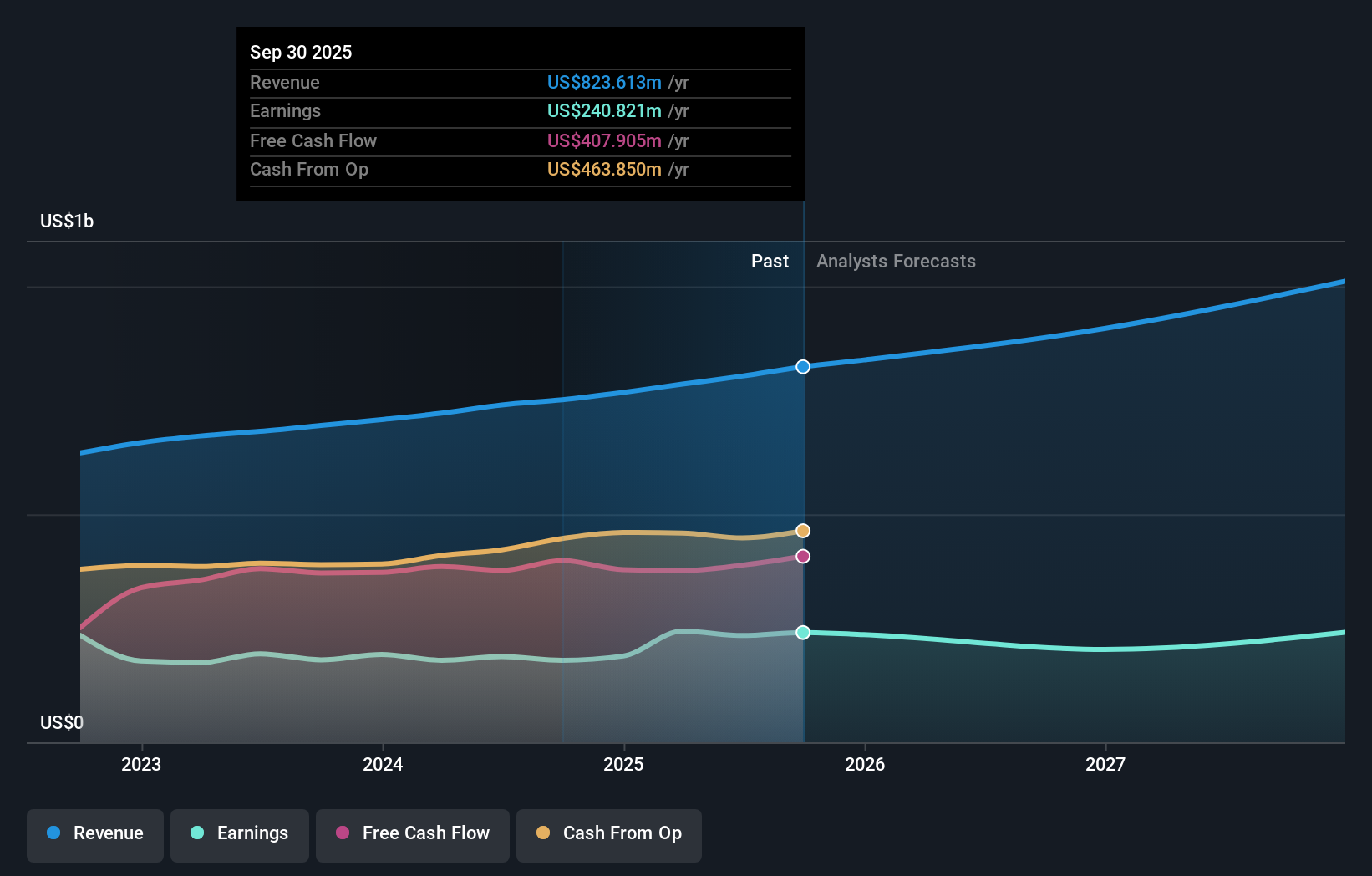

STAG Industrial's narrative projects $1.0 billion revenue and $215.4 million earnings by 2028.

Uncover how STAG Industrial's forecasts yield a $41.25 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly US$33 to US$53.64 per share, underscoring how differently people view STAG’s prospects. As you weigh those views, remember that any slowdown or consolidation in e commerce related logistics demand could have uneven effects across STAG’s mid sized, single tenant portfolio and ultimately shape how those valuations hold up.

Explore 8 other fair value estimates on STAG Industrial - why the stock might be worth as much as 44% more than the current price!

Build Your Own STAG Industrial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your STAG Industrial research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free STAG Industrial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate STAG Industrial's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal