Jack Henry (JKHY) Valuation Check After Analyst Upgrades, Raised 2026 Guidance and Strong Operating Momentum

Jack Henry and Associates (JKHY) has quietly turned into a momentum story, with upbeat earnings, higher 2026 guidance, and fresh client wins now backed by a wave of supportive analyst upgrades.

See our latest analysis for Jack Henry & Associates.

Those stronger earnings, upgraded ratings, and steady client wins have clearly reset expectations, with the share price now at $184.5 and a roughly 22% 3 month share price return signaling building momentum despite a more modest 1 year total shareholder return.

If Jack Henry's recent run has you thinking about what else could surprise to the upside, this is a good moment to explore fast growing stocks with high insider ownership.

Yet with the stock hovering near its price targets and growth expectations marching higher, the key question now is whether Jack Henry is still undervalued or whether the market has already priced in the next leg of growth.

Most Popular Narrative Narrative: 1.9% Undervalued

With the narrative fair value of $188.15 sitting just above the $184.5 last close, markets are already leaning toward a premium growth story.

The analysts have a consensus price target of $185.091 for Jack Henry & Associates based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $206.0, and the most bearish reporting a price target of just $173.0.

If you want to see what kind of steady growth and expanding margins justify this near premium valuation, and why the projected earnings multiple keeps creeping higher, dig into the full narrative to uncover the exact assumptions behind that fair value call.

Result: Fair Value of $188.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, consolidation among regional banks and intensifying fintech competition could slow core growth, pressure pricing, and challenge the premium multiple now implied.

Find out about the key risks to this Jack Henry & Associates narrative.

Another Angle on Valuation

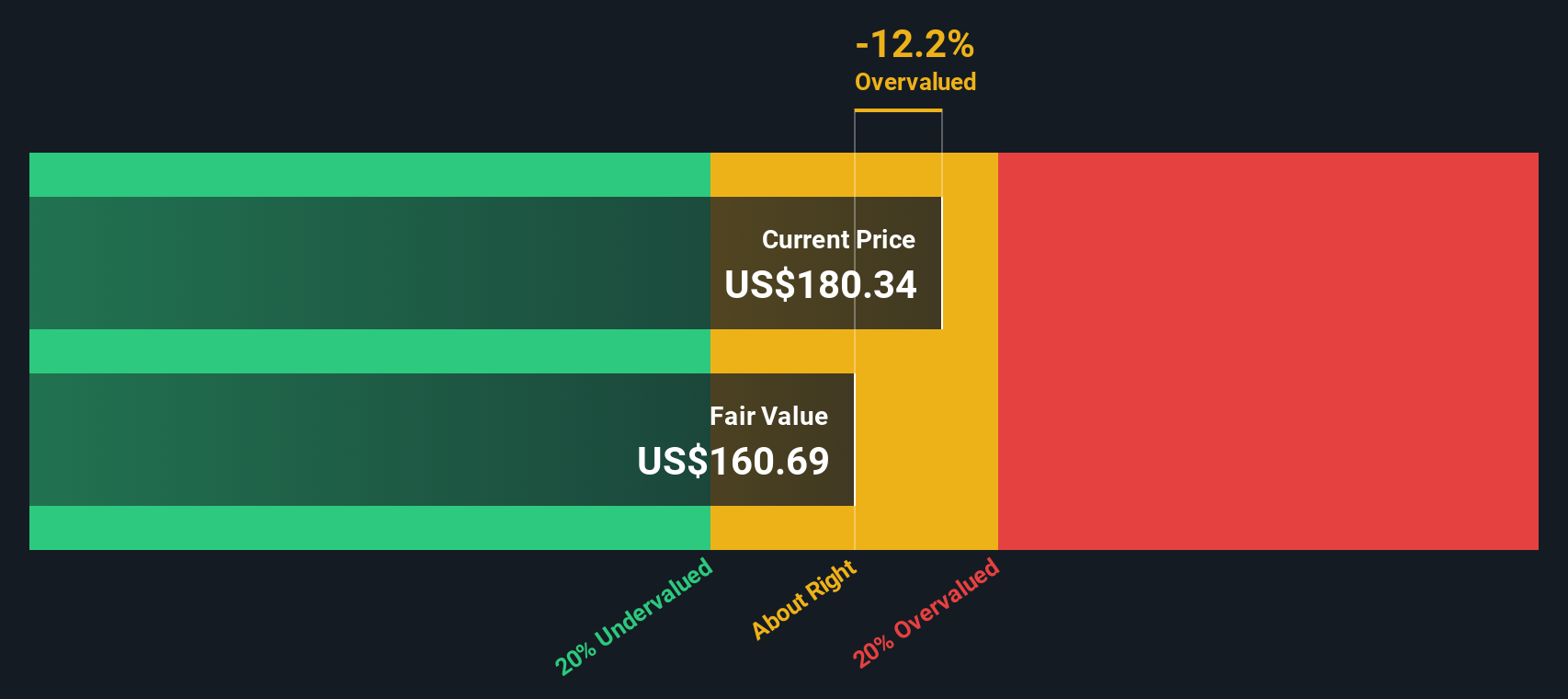

Our SWS DCF model paints a more cautious picture, putting fair value nearer $160.36, which suggests Jack Henry might now be trading at a premium rather than a discount. Is the market simply front running future upgrades, or is it getting ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jack Henry & Associates for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jack Henry & Associates Narrative

If you see the story differently or prefer to test your own assumptions against the numbers, you can shape a fresh narrative in minutes: Do it your way.

A great starting point for your Jack Henry & Associates research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at Jack Henry, you could miss other opportunities. Use Simply Wall Street's powerful screener tools to keep your research process efficient and focused.

- Tap into notable cash flow stories by reviewing these 913 undervalued stocks based on cash flows that the market may be overlooking right now.

- Explore innovation-focused opportunities by targeting these 24 AI penny stocks positioned at the center of developments in artificial intelligence.

- Strengthen your income strategy by scanning these 12 dividend stocks with yields > 3% that aim to deliver consistent, meaningful yield.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal