Did Mitsubishi Electric's New Safety-Focused AI Suite Just Shift Its (TSE:6503) Investment Narrative?

- Mitsubishi Electric recently unveiled several AI-powered innovations, including an in-vehicle intoxication detection system and a physics-embedded AI for equipment degradation, alongside research enhancing ozone-based hygiene using negative ions.

- Taken together with its first TNFD report, these advances highlight how Mitsubishi Electric is tying AI and environmental science to safety, productivity, and long-term sustainability themes.

- We’ll now examine how Mitsubishi Electric’s new AI-driven intoxication detection technology could influence its broader investment narrative and future positioning.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Mitsubishi Electric Investment Narrative Recap

To own Mitsubishi Electric, you need to believe it can convert its broad industrial and infrastructure footprint into durable, AI-enabled products and services, while defending margins against lower-cost rivals and cyclical demand. The new intoxication detection, physics-embedded AI, and hygiene research are directionally positive for its digital and safety credentials, but they do not materially change the key near-term catalyst of monetizing automation and AI solutions, or the core risk of competition and price pressure in factory automation and HVAC.

The physics-embedded AI for equipment degradation is especially relevant here, because it speaks directly to Mitsubishi Electric’s push into higher-value, data-driven factory automation at a time when customers are seeking more reliable preventive maintenance solutions. If this type of Maisart-based offering can scale across manufacturing clients, it could help offset pressure on traditional hardware margins and support the broader thesis that Mitsubishi Electric can stay competitive as automation demand shifts toward software and AI-enabled services.

Yet beneath this AI story, investors should also be aware that intensifying competition from lower cost Asian manufacturers could...

Read the full narrative on Mitsubishi Electric (it's free!)

Mitsubishi Electric's narrative projects ¥6044.2 billion revenue and ¥423.4 billion earnings by 2028.

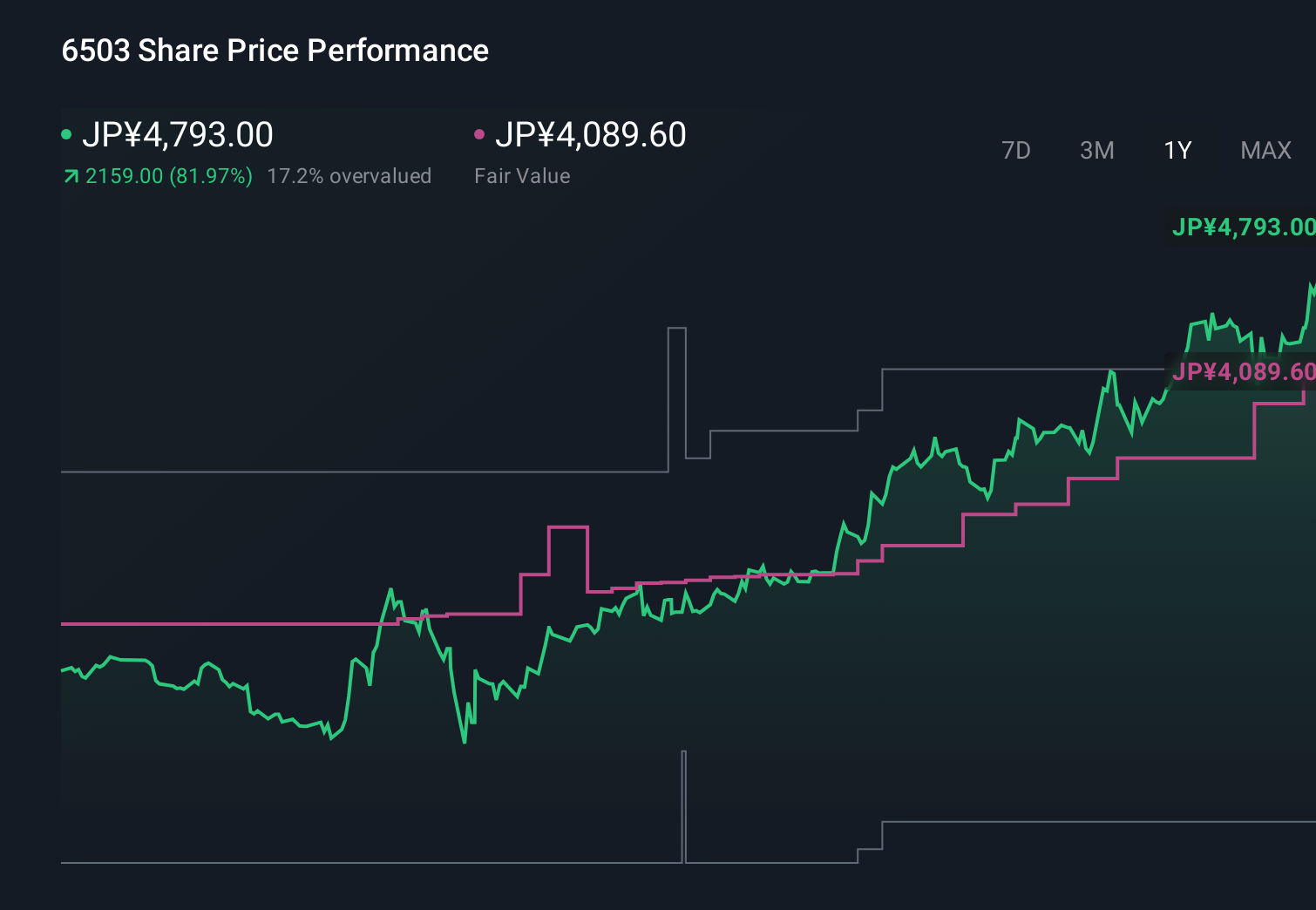

Uncover how Mitsubishi Electric's forecasts yield a ¥4210 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently value Mitsubishi Electric between ¥2,114 and ¥4,210 per share, reflecting a wide spread in expectations. Against this backdrop, the key catalyst many focus on is whether Mitsubishi Electric can turn its automation and AI investments into higher margin, recurring revenue streams, which could be critical for future performance.

Explore 4 other fair value estimates on Mitsubishi Electric - why the stock might be worth as much as ¥4210!

Build Your Own Mitsubishi Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi Electric research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Mitsubishi Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi Electric's overall financial health at a glance.

No Opportunity In Mitsubishi Electric?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal