How Pharmacy Administration And AI Push At Wesfarmers (ASX:WES) Has Changed Its Investment Story

- In recent months, more than 50 Priceline-branded pharmacies operated by Infinity Pharmacy Group entered administration, while Wesfarmers-owned Australian Pharmaceutical Industries stepped in as a key creditor and the group began rolling out ChatGPT Enterprise across its businesses through a partnership with OpenAI.

- Together, the pharmacy administration highlights execution risks in Wesfarmers’ growing health division, while the AI rollout underscores its push to lift productivity and customer service through technology.

- We’ll now examine how Wesfarmers’ AI rollout across its retail and health operations may influence the company’s existing investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Wesfarmers Investment Narrative Recap

To own Wesfarmers, you generally need to believe its core retail brands can keep compounding earnings while newer platforms like Health and lithium eventually justify their investment. The recent Priceline administration underlines execution risk in Health, but does not yet appear large enough to change the main short term catalyst, which remains how effectively Wesfarmers converts its scale and cost control into earnings resilience amid persistent cost inflation.

The rollout of ChatGPT Enterprise across Wesfarmers is the announcement that ties most directly to this news, because it targets the same pressure points the group faces in Health and retail: lifting productivity and customer service to offset rising costs. If AI tools can meaningfully improve how pharmacies and stores operate day to day, they could support margins and help manage risk in newer divisions that are still bedding down.

Yet while AI offers upside, investors should be aware that the real test lies in how Wesfarmers handles...

Read the full narrative on Wesfarmers (it's free!)

Wesfarmers' narrative projects A$51.6 billion revenue and A$3.5 billion earnings by 2028. This requires 4.1% yearly revenue growth and about A$0.6 billion earnings increase from A$2.9 billion today.

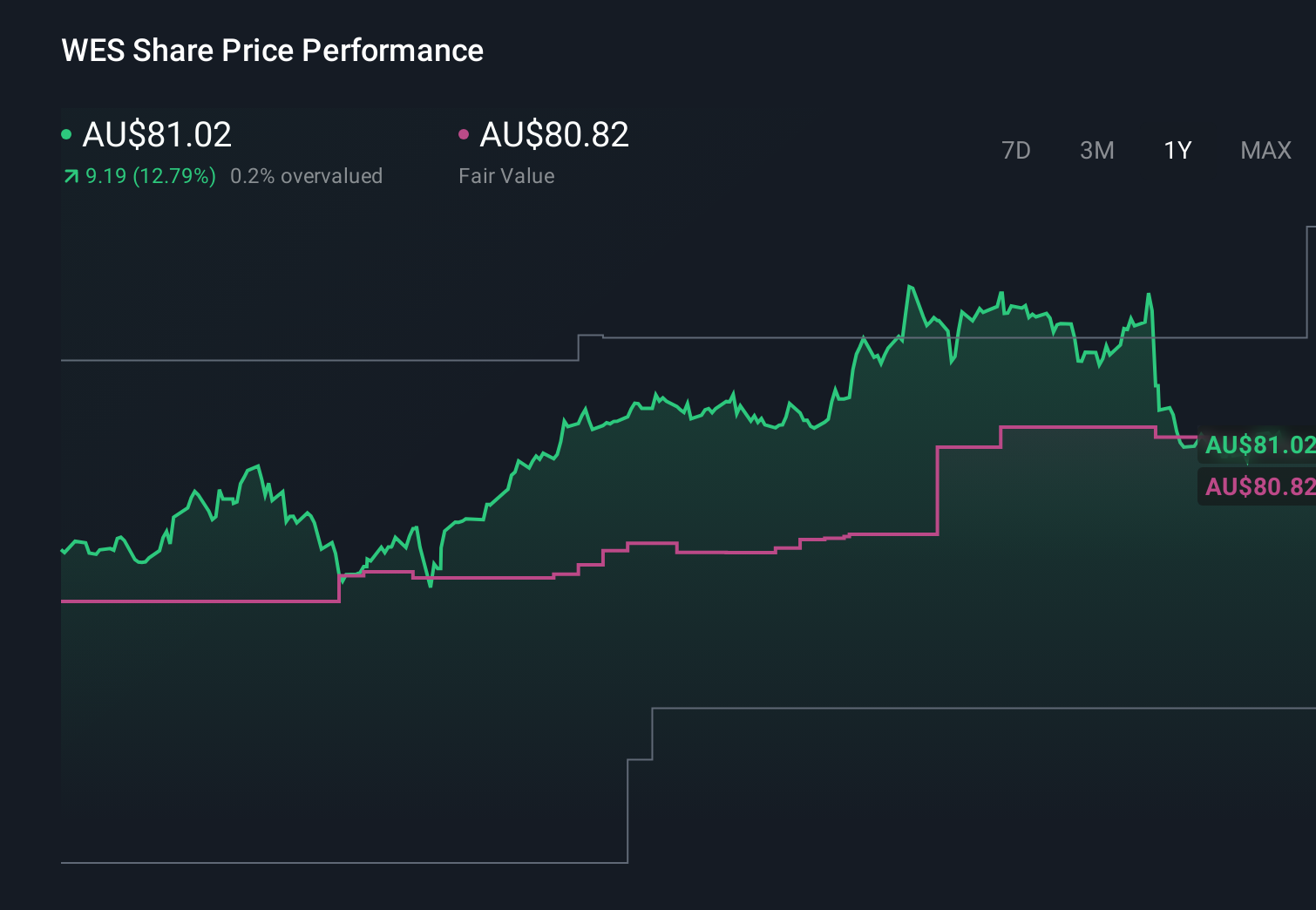

Uncover how Wesfarmers' forecasts yield a A$80.82 fair value, in line with its current price.

Exploring Other Perspectives

Ten members of the Simply Wall St Community currently see Wesfarmers’ fair value anywhere between about A$43.91 and A$100, showing just how varied individual expectations can be. Set against this spread, the highlighted execution risk in Health and newer ventures gives you an additional angle on how future performance might surprise to either side of those community estimates.

Explore 10 other fair value estimates on Wesfarmers - why the stock might be worth 46% less than the current price!

Build Your Own Wesfarmers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wesfarmers research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wesfarmers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wesfarmers' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal