Disc Medicine (IRON) Valuation Check as FDA Scrutiny and Bitopertin Trial Milestones Drive Volatility

Disc Medicine (IRON) is suddenly in the spotlight as questions from FDA officials, media scrutiny, and insider selling collide with management’s upbeat tone on bitopertin and its National Priority Voucher pathway.

See our latest analysis for Disc Medicine.

That tension is showing up in the tape: despite a 1 day share price return of minus 11.5 percent and a 7 day and 30 day share price pullback, the 90 day and year to date share price returns remain strongly positive. The 1 year total shareholder return of 24.09 percent still signals that optimism around Disc’s pipeline has not fully evaporated, but momentum is clearly cooling as regulatory risk gets repriced.

If this kind of regulatory drama has you rethinking concentration in a single name, it might be time to explore healthcare stocks as potential alternatives or complements.

With IRON now trading at a steep discount to consensus targets but facing louder questions about its flagship drug and fast track pathway, is this selloff a rare entry point or proof that future growth is already priced in?

Price to Book of 5.3x, Is it Justified?

Disc Medicine trades on a price to book ratio of 5.3 times, which screens as expensive versus the broader US biotechs space given its current 80.04 dollars share price.

The price to book ratio compares a company’s market value to its net assets, a useful lens for early stage biotechs that lack meaningful revenue or profits. For Disc, investors are clearly paying a premium over the value of its balance sheet, effectively placing a high price on future R&D potential rather than current financials.

That premium looks stretched when stacked against the wider US Biotechs industry average of 2.6 times. This highlights how much extra investors are being asked to pay for Disc’s pipeline and growth story. However, compared with a closer peer group that trades around 12.8 times book, Disc actually sits at a discount. This suggests sentiment has cooled without fully abandoning the higher growth narrative.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 5.3x (ABOUT RIGHT)

However, regulatory pushback on bitopertin or disappointing efficacy data in key hematology indications could quickly unwind the premium that Disc still commands.

Find out about the key risks to this Disc Medicine narrative.

Another View, Fair Value Gap

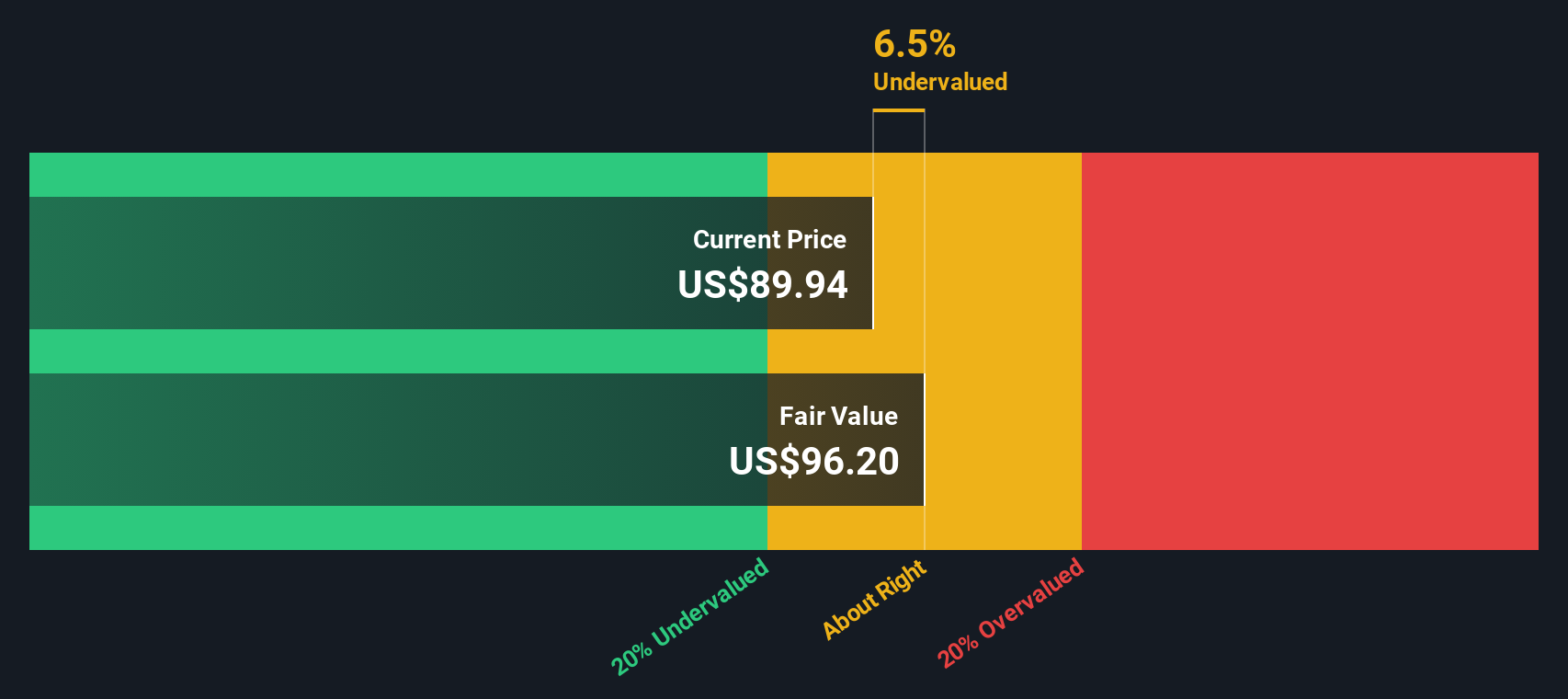

Our DCF model paints a gentler picture, suggesting Disc Medicine is trading only about 5.9 percent below its estimated fair value of 85.06 dollars, a mild undervaluation rather than a screaming bargain. If both book and cash flow signals are this finely balanced, which one should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Disc Medicine for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Disc Medicine Narrative

If you think the numbers tell a different story, or would rather dig into the filings yourself, you can build your own in under three minutes, Do it your way.

A great starting point for your Disc Medicine research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next moves by scanning fresh opportunities from our screeners, so you are not relying on just one story.

- Target income potential by reviewing these 12 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow when markets turn choppy.

- Capitalize on mispriced growth by acting on these 914 undervalued stocks based on cash flows where market pessimism may not match underlying cash flows.

- Ride the next wave of innovation by evaluating these 24 AI penny stocks that are pushing real world AI adoption, not just headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal