Phibro Animal Health (PAHC): Assessing Valuation After a Recent Pullback and Strong Year-to-Date Rally

Phibro Animal Health (PAHC) has quietly outperformed this year, and with the stock pulling back about 11% over the past month, investors are asking whether this is a healthy reset or an early warning.

See our latest analysis for Phibro Animal Health.

At a share price of $37.25, Phibro’s recent pullback, including a 1 month share price return of negative 10.52 percent, comes after a powerful run that has delivered a roughly 80 percent year to date share price gain and a standout multi year total shareholder return. This suggests momentum is cooling, but the bigger trend is still firmly positive.

If this kind of rerating has you wondering what else is moving in healthcare, it could be a good moment to explore healthcare stocks as potential next ideas.

With earnings growing faster than sales, a rich multi year shareholder return and the stock still trading below analyst targets and intrinsic value estimates, investors must decide: is this a fresh buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 13.4% Undervalued

With Phibro Animal Health last closing at $37.25 versus a narrative fair value of about $43, the valuation case hinges on how durable its earnings trajectory really is.

The analysts have a consensus price target of $35.75 for Phibro Animal Health based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $45.0, and the most bearish reporting a price target of just $27.0.

Want to know what kind of earnings ramp, margin lift and future valuation multiple could justify that fair value gap? The narrative spells out the full playbook.

Result: Fair Value of $43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could unravel if vaccine and specialty growth slows more sharply than expected, or if climate driven livestock policy changes curb long term demand.

Find out about the key risks to this Phibro Animal Health narrative.

Another Angle on Valuation

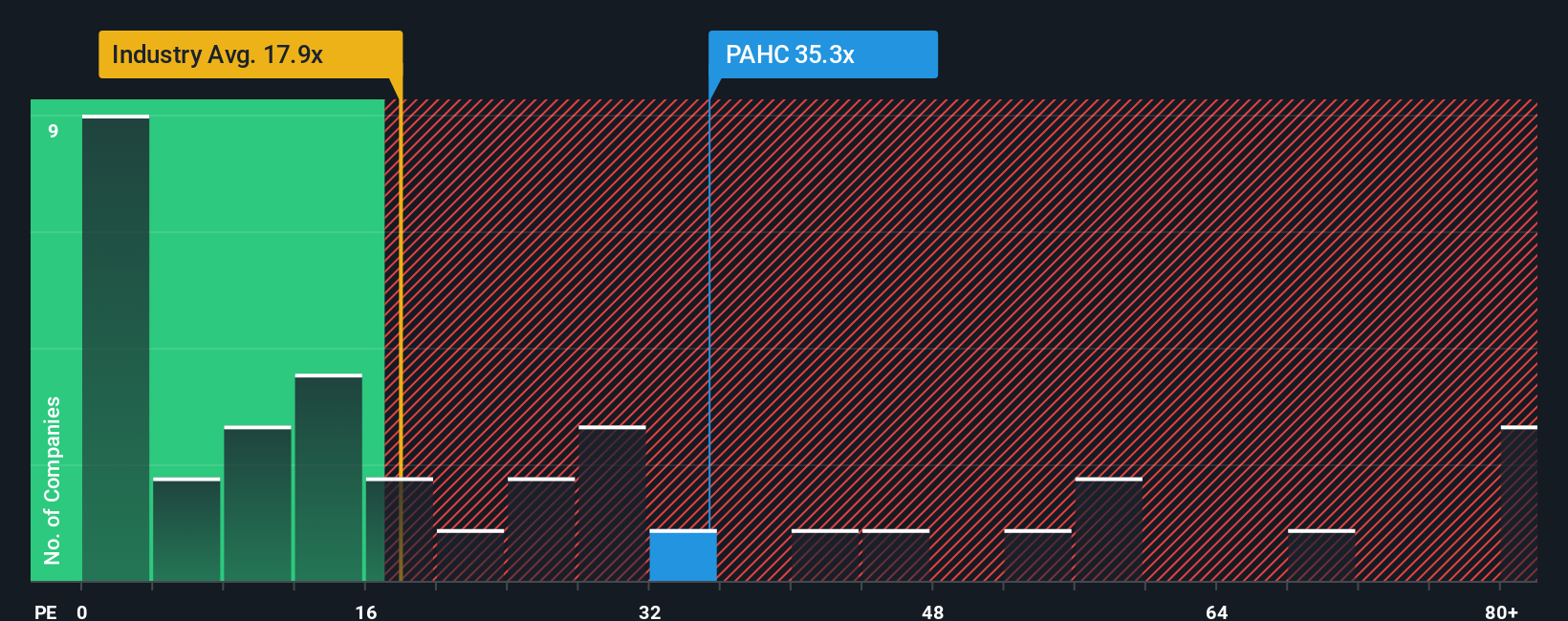

On earnings, the picture looks less generous. Phibro trades on about 22.3 times earnings versus 19.8 times for the US pharmaceuticals sector and roughly 13.2 times for peers, while our fair ratio is nearer 20.1 times. That premium suggests less margin for error if the growth story cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phibro Animal Health Narrative

If you would rather stress test the assumptions yourself and dig into the numbers, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your Phibro Animal Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before the market’s next move leaves you behind, put the Simply Wall St Screener to work and line up your next high conviction opportunities today.

- Capture potential mispricings by targeting companies that look cheap on cash flows with these 914 undervalued stocks based on cash flows, and position yourself ahead of a possible rerating.

- Tap into powerful growth themes by hunting for innovative firms reshaping industries through these 24 AI penny stocks, where small shifts in sentiment can drive big returns.

- Boost your income strategy by targeting reliable payers with these 12 dividend stocks with yields > 3%, so your portfolio works harder for you in every market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal