Endeavour Silver Corp.'s (TSE:EDR) Shares Leap 30% Yet They're Still Not Telling The Full Story

Endeavour Silver Corp. (TSE:EDR) shares have had a really impressive month, gaining 30% after a shaky period beforehand. The annual gain comes to 148% following the latest surge, making investors sit up and take notice.

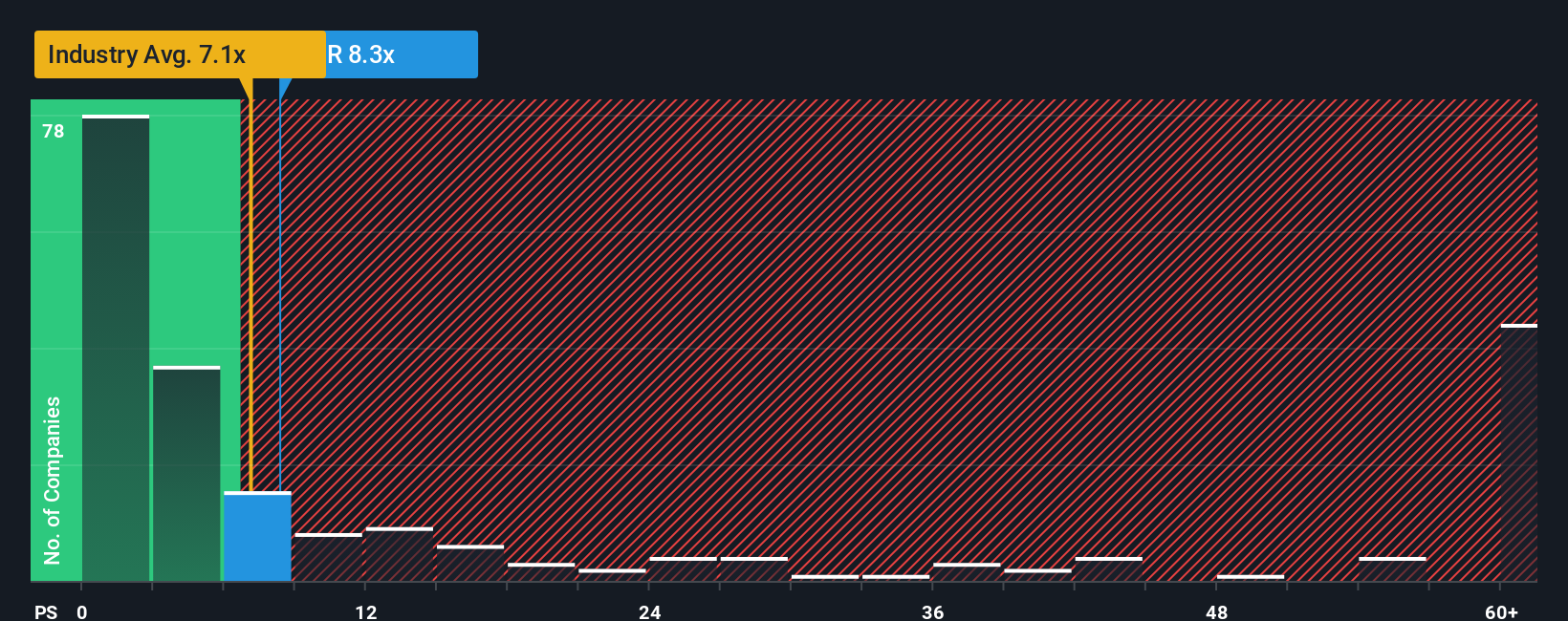

Although its price has surged higher, there still wouldn't be many who think Endeavour Silver's price-to-sales (or "P/S") ratio of 8.3x is worth a mention when the median P/S in Canada's Metals and Mining industry is similar at about 7.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Endeavour Silver

How Has Endeavour Silver Performed Recently?

Recent revenue growth for Endeavour Silver has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Endeavour Silver.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Endeavour Silver would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 49% last year. The latest three year period has also seen an excellent 91% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 29% each year over the next three years. With the industry only predicted to deliver 25% per annum, the company is positioned for a stronger revenue result.

In light of this, it's curious that Endeavour Silver's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Endeavour Silver's P/S?

Endeavour Silver's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Endeavour Silver currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 2 warning signs for Endeavour Silver that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal