Hagerty (HGTY): Valuation Check After Broad Arrow’s 97% Growth and $624 Million in Collector Car Transactions

Hagerty (HGTY) just reported that its Broad Arrow subsidiary handled over $624 million in collector car transactions in 2025, with 97% year over year growth. That sharp acceleration is getting investors’ attention.

See our latest analysis for Hagerty.

The strong Broad Arrow update lands while Hagerty’s share price sits at $13.13, and its year to date share price return of 32.89% signals building momentum, backed by a robust 3 year total shareholder return of 65.16%.

If this kind of growth story has your attention, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with the stock already up strongly and trading only slightly below analyst targets, investors now face a key question: Is Hagerty still flying under the radar, or is the market already pricing in Broad Arrow’s rapid growth?

Most Popular Narrative Narrative: 4.3% Undervalued

With Hagerty last closing at $13.13 against a narrative fair value near $13.71, the story leans slightly optimistic on where earnings power can go next.

The ramping State Farm partnership is expected to significantly accelerate new business growth, providing access to over 500,000 current program vehicles and thousands of motivated agents, materially expanding Hagerty's customer acquisition funnel and recurring commission revenues at attractive margins over the next several years.

Curious how modest revenue growth assumptions can still support sharply higher margins and a richer future earnings multiple than the sector standard? The narrative maps out a profitability reset that hinges on scaling partnerships, expanding ancillary revenue streams, and a powerful earnings step change later in the decade. Want to see exactly how those moving parts combine into today’s fair value call?

Result: Fair Value of $13.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on younger drivers embracing classic cars and on Hagerty successfully scaling new products and international expansion without margin disappointments.

Find out about the key risks to this Hagerty narrative.

Another Angle on Value

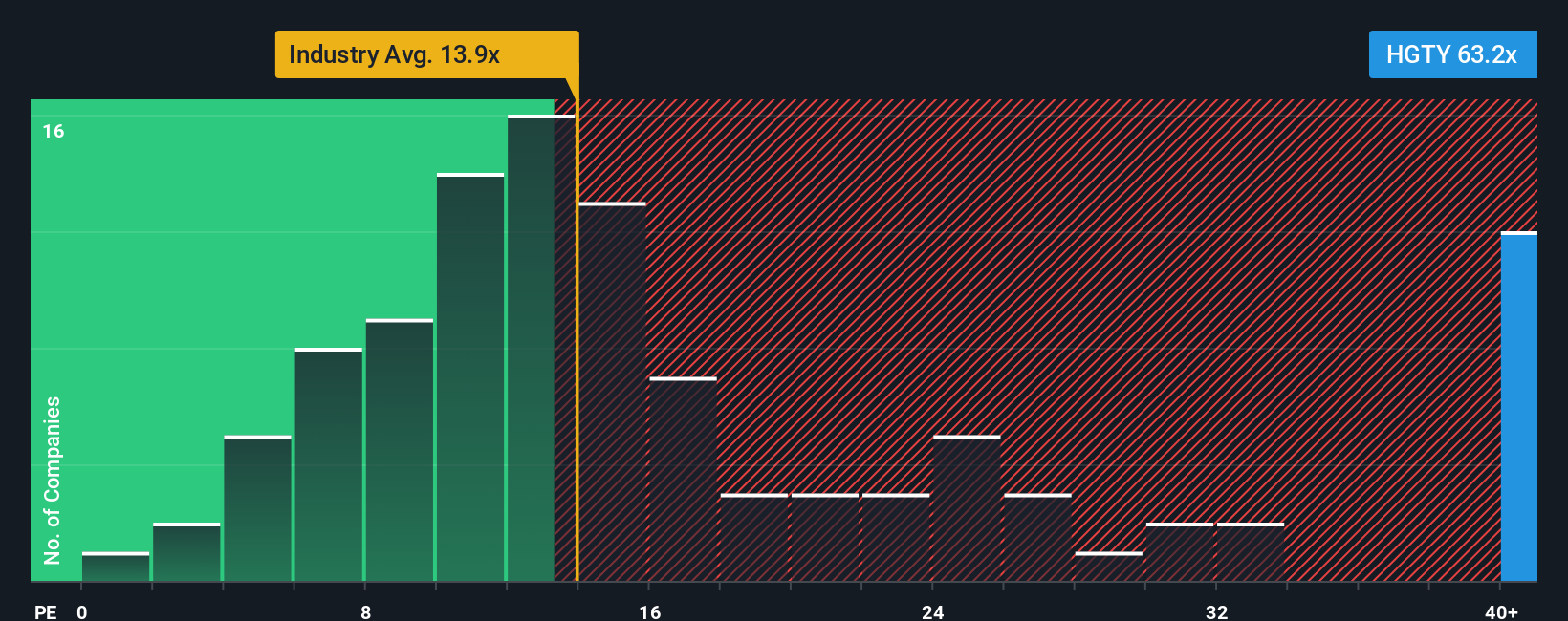

While the narrative fair value suggests Hagerty is modestly undervalued, its 39.6x earnings multiple tells a different story. That is cheaper than peers at 62.4x, but still richer than the Insurance industry at 13.4x and above a 30.5x fair ratio, hinting at real de rating risk if growth slips.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hagerty for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hagerty Narrative

If you are not fully aligned with this perspective or would rather dig through the numbers yourself, you can shape a custom view in minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Hagerty.

Ready for more investment ideas?

Before you move on, lock in your next edge by using the Simply Wall St Screener to uncover fresh, data driven opportunities that others are still overlooking.

- Capture potential bargain entries by scanning these 914 undervalued stocks based on cash flows that the market may be mispricing based on future cash flows and fundamentals.

- Position yourself ahead of the next technology wave by targeting these 24 AI penny stocks using real business metrics rather than hype alone.

- Strengthen your passive income strategy by pinpointing these 12 dividend stocks with yields > 3% that can help support long term, compounding returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal