Curbline Properties (CURB): Assessing Valuation After New Regular and Special Dividend Declarations

Curbline Properties (CURB) just doubled down on shareholder payouts, pairing its regular fourth quarter dividend with a small special dividend that hints at healthy cash generation and disciplined capital returns.

See our latest analysis for Curbline Properties.

The steady dividend news appears to be reinforcing confidence in Curbline. A recent 90 day share price return of 3.76% and a 1 year total shareholder return of 7.47% suggest gradually building momentum from a foothold of stable income.

If this kind of steady income story appeals, it might be worth scanning for other real estate like dynamics by exploring fast growing stocks with high insider ownership as a way to spot the next potential compounder.

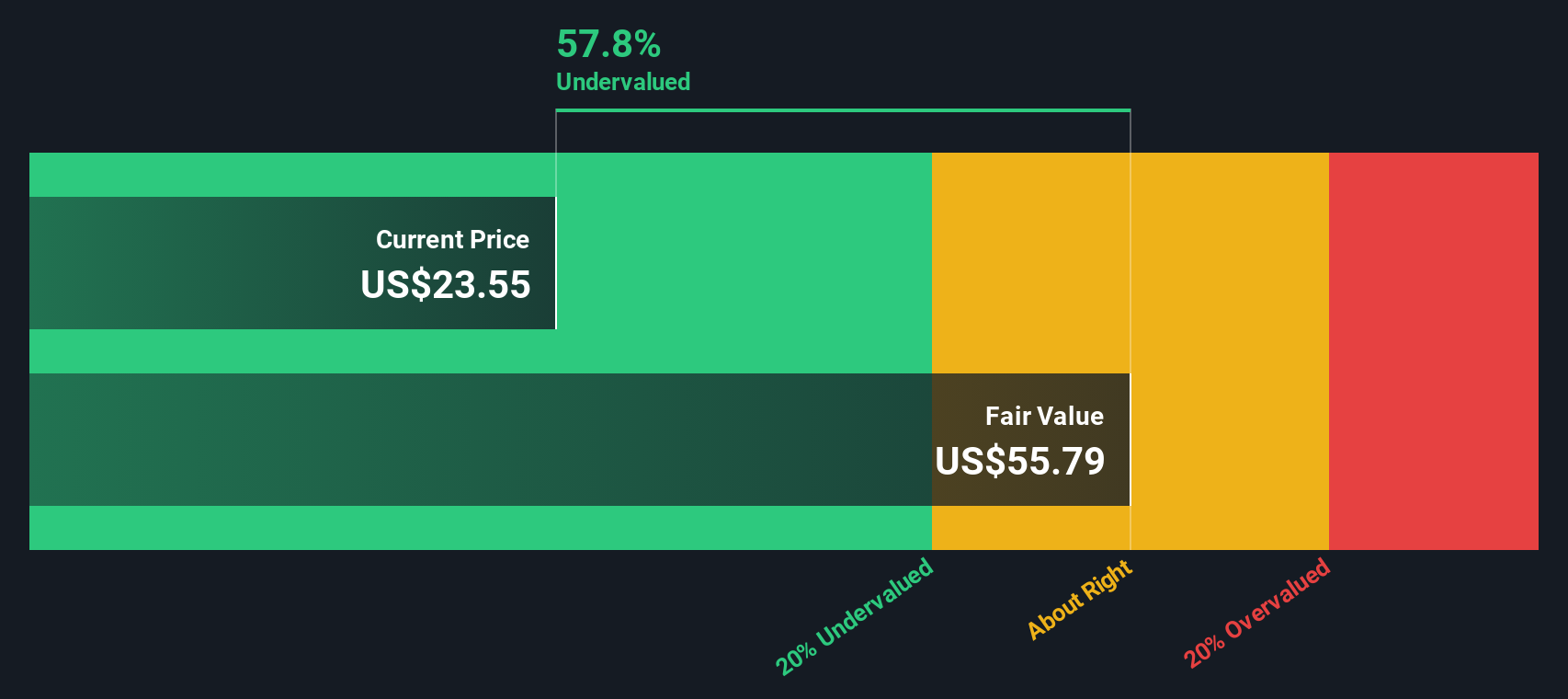

With shares still trading below analyst targets but boasting double digit revenue growth and a chunky implied intrinsic discount, is Curbline quietly undervalued, or has the market already priced in its next leg of growth?

Price-to-Earnings of 60.1x: Is it justified?

Curbline Properties last closed at $23.43, and its valuation looks rich when viewed through the lens of a 60.1x price-to-earnings ratio.

The price-to-earnings multiple compares what investors are paying today to each dollar of current earnings, a particularly important yardstick for income focused, mature REITs.

At 60.1x earnings, the market is assigning Curbline a premium that exceeds both its estimated fair price-to-earnings ratio of 30.7x and the peer and industry benchmarks. This suggests investors are either overpaying for its recent earnings rebound or banking on growth that consensus forecasts do not fully support.

That premium stands out even more against the US Retail REITs industry average multiple of 27.2x, as well as the peer group average of 59.3x. This reinforces how aggressively the market is pricing each dollar of Curbline earnings relative to comparable landlords.

Explore the SWS fair ratio for Curbline Properties

Result: Price-to-Earnings of 60.1x (OVERVALUED)

However, softer net income trends and a lofty valuation multiple mean any stumble in leasing demand or rental growth could quickly puncture today’s optimism.

Find out about the key risks to this Curbline Properties narrative.

Another View on Value

While the 60.1x earnings multiple looks stretched, our DCF model paints a very different picture. It suggests Curbline is trading around 58.5% below an estimated fair value of $56.52. If the cash flows are right, is the market being too harsh, or is the model too generous?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Curbline Properties for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Curbline Properties Narrative

If you see the story differently, or want to dig into the numbers yourself, you can easily build a custom thesis in minutes: Do it your way.

A great starting point for your Curbline Properties research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next opportunity by using the Simply Wall Street Screener to uncover focused stock ideas that match your investing style.

- Capture potential mispricings by targeting companies trading below their estimated worth through these 914 undervalued stocks based on cash flows, and position yourself ahead of a possible re-rating.

- Ride structural growth in automation and machine learning with these 24 AI penny stocks, where established and emerging businesses are racing to monetise real world AI demand.

- Strengthen your income stream by hunting for reliable payers using these 12 dividend stocks with yields > 3%, narrowing in on businesses offering yields above 3% without abandoning quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal