Laureate Education (LAUR) Is Up 5.3% After Expanding Buybacks And Raising Guidance Has The Bull Case Changed?

- In recent months, Laureate Education reported revenue growth, raised its full-year guidance, expanded its share repurchase authorization to US$250 million, and attracted new institutional investment from Montreal-based Formula Growth, which acquired 111,000 shares worth about US$3.50 million.

- These developments, supported by solid enrollment trends, especially in Peru, and a net cash position, have reinforced confidence in Laureate’s business strength and capital allocation approach.

- With the expanded share repurchase authorization as a focal point, we’ll now examine how this news reshapes Laureate Education’s investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Laureate Education Investment Narrative Recap

To own Laureate Education, you need to believe that its focus on higher education in Mexico and Peru can keep translating into resilient enrollment, pricing power, and healthy cash generation, even as political and economic conditions shift. The recent revenue growth, higher full year guidance, and expanded buyback do not materially change the near term picture, where the key catalyst remains enrollment strength in those core markets, and the biggest risk is still how exposed revenues are to Mexico and Peru.

Among the recent announcements, the expansion of Laureate’s share repurchase authorization to US$250 million stands out in this context, because it directly links the company’s capital allocation to the same cash flows that depend on sustained enrollment and stable conditions in its core Latin American markets. If those catalysts hold, an enlarged buyback can amplify per share outcomes, but if country specific risks or currency swings in places like Mexico eventually bite, the room for similar actions could narrow.

Yet behind the buybacks and guidance upgrades, there is a country concentration risk that investors should be aware of if...

Read the full narrative on Laureate Education (it's free!)

Laureate Education's narrative projects $2.0 billion revenue and $343.9 million earnings by 2028. This requires 8.4% yearly revenue growth and about a $89.7 million earnings increase from $254.2 million today.

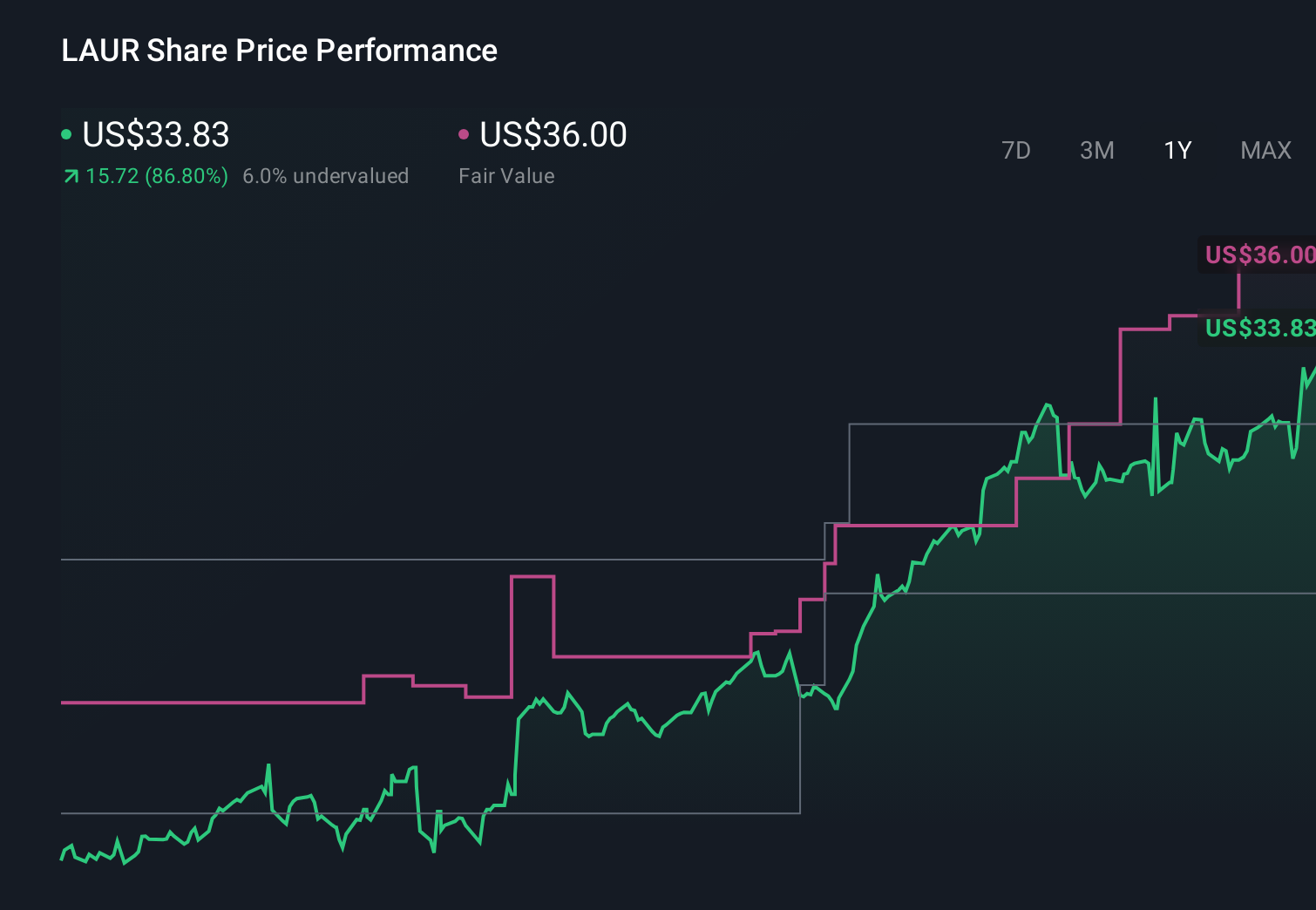

Uncover how Laureate Education's forecasts yield a $36.83 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span a wide range, from about US$17 to roughly US$72 per share, showing how far apart individual views can be. As you weigh those opinions, keep in mind that much of Laureate’s appeal and risk still hinges on how reliably Mexico and Peru can support future enrollment growth and earnings stability over time.

Explore 5 other fair value estimates on Laureate Education - why the stock might be worth over 2x more than the current price!

Build Your Own Laureate Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Laureate Education research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Laureate Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Laureate Education's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal