Has the Market Priced In BJ’s Strong Run and Expansion Plans in 2025?

- Wondering if BJ's Wholesale Club Holdings is still good value after its long run, or if most of the upside is already baked in? This breakdown is designed to help you decide without getting lost in the noise.

- Over the last week the stock has ticked up around 1.6%, is up 3.7% over the past month, and has gained 7.3% year to date, building on a longer term rise of 147.7% over five years. This has investors asking whether growth or risk is now in the driving seat.

- Recent headlines have focused on BJ's steady expansion strategy and competitive positioning in warehouse retail, including store rollouts and ongoing membership strength that help explain why the share price has been so resilient. At the same time, commentary around inflation, consumer spending, and warehouse club competition has added nuance to how the market is reassessing the stock's risk reward balance.

- On our scorecard BJ's Wholesale Club Holdings posts a valuation score of 3 out of 6, suggesting it looks undervalued on some metrics but not on others. Next we will walk through the main valuation methods, and then finish with a more complete way to think about what the stock is really worth.

Approach 1: BJ's Wholesale Club Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in $ terms.

For BJ's Wholesale Club Holdings, the 2 Stage Free Cash Flow to Equity model starts with last twelve months free cash flow of about $338.1 Million. Analysts then forecast cash flows over the next few years and Simply Wall St extends those projections further, with free cash flow expected to reach roughly $741 Million by 2030. These ten year projections gradually moderate growth as the business matures.

When all those future $ cash flows are discounted back to today, the model suggests an intrinsic value of about $119.56 per share. Compared with the current share price, that implies BJ's is trading at roughly a 20.8% discount, which indicates that the shares may be undervalued if the cash flow path plays out as expected.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BJ's Wholesale Club Holdings is undervalued by 20.8%. Track this in your watchlist or portfolio, or discover 913 more undervalued stocks based on cash flows.

Approach 2: BJ's Wholesale Club Holdings Price vs Earnings

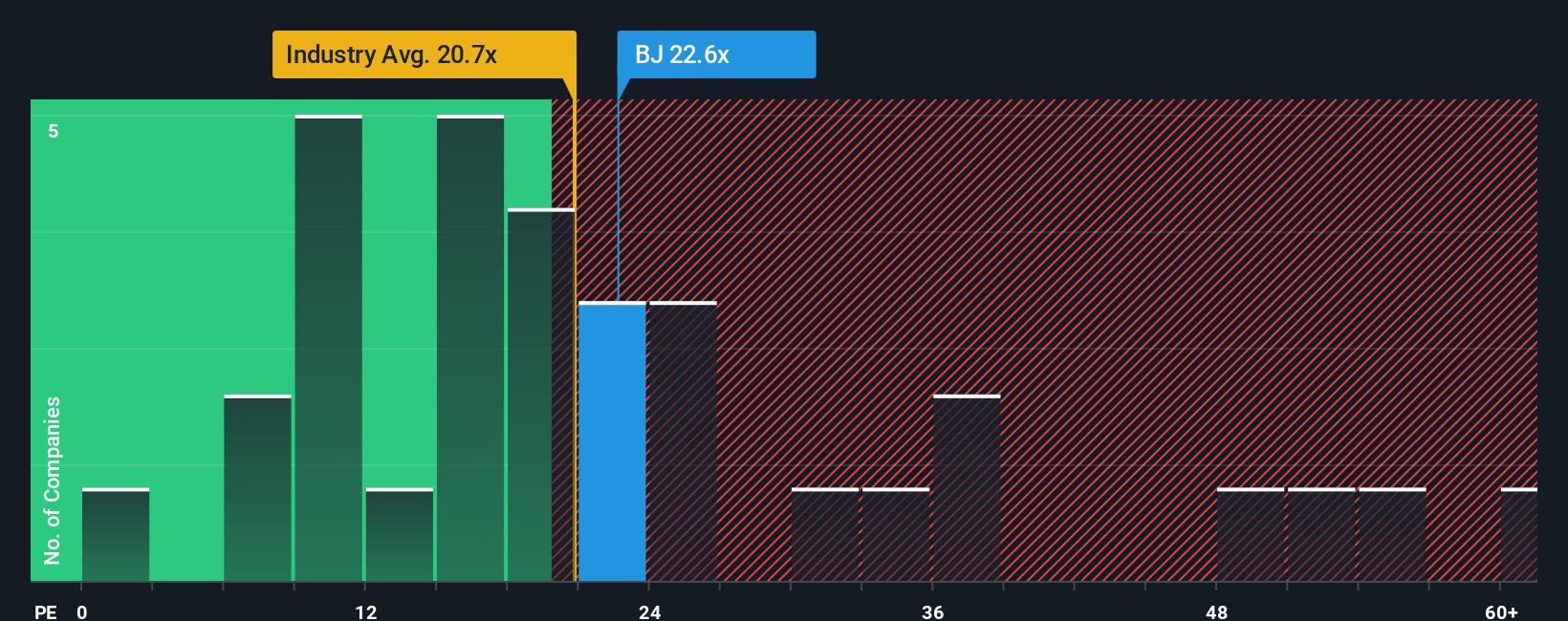

For profitable, established businesses like BJ's Wholesale Club Holdings, the price to earnings, or PE, ratio is a useful way to see how much investors are paying for each dollar of earnings. A higher PE can be justified when the market expects stronger growth or sees the business as relatively low risk, while slower growth or higher uncertainty usually calls for a lower, more conservative multiple.

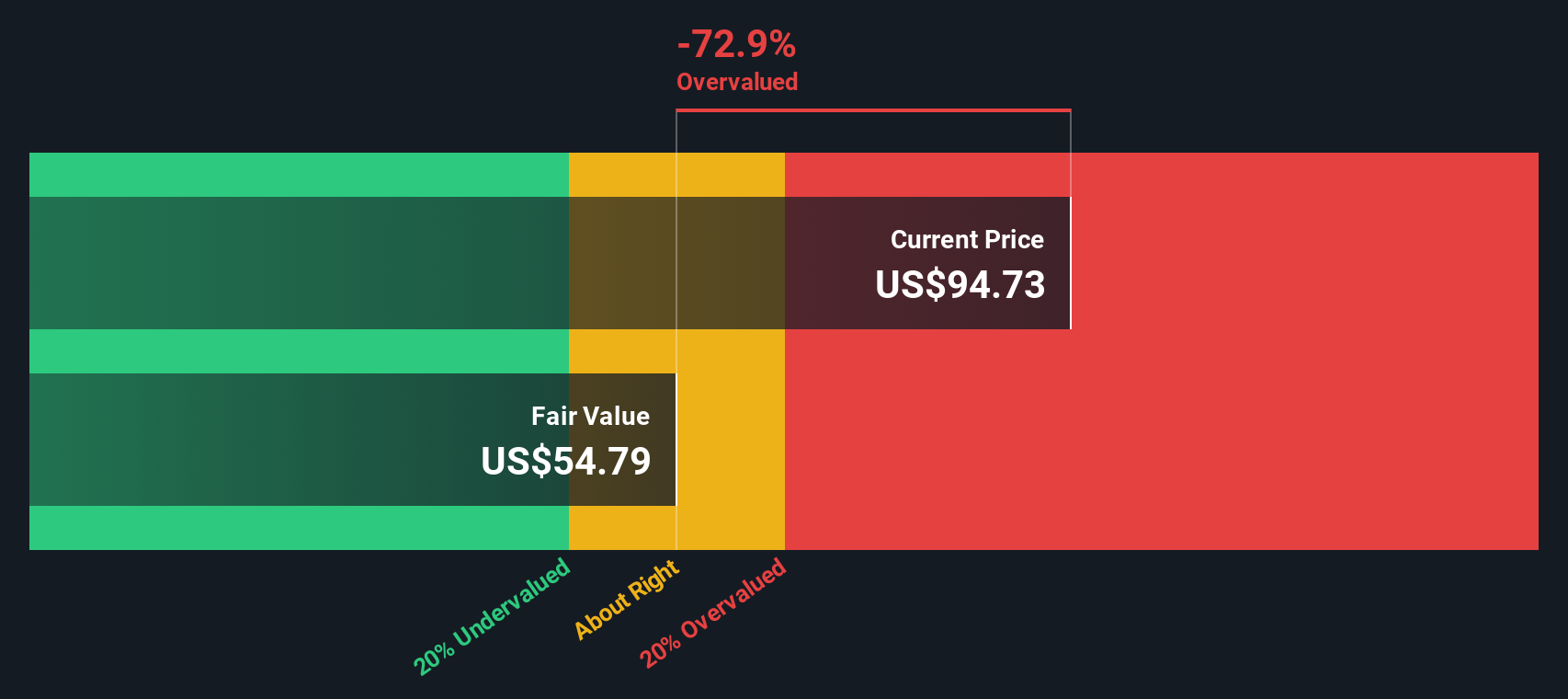

BJ's currently trades on a PE of about 21.53x, which is very close to the Consumer Retailing industry average of around 21.53x and broadly in line with the peer average of roughly 21.05x. Simply Wall St also calculates a proprietary Fair Ratio of 18.37x, which is the PE you might expect for BJ's once you factor in its earnings growth outlook, profitability, size, industry position and key risks.

This Fair Ratio provides a more tailored benchmark than simple industry or peer comparisons because it explicitly adjusts for BJ's own growth profile, risk characteristics and margins rather than assuming all retailers deserve similar valuations. Comparing the current 21.53x PE to the 18.37x Fair Ratio suggests the shares are trading somewhat above what would be considered fair based on these fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BJ's Wholesale Club Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework where you connect your view of BJ's story, like membership growth, digital expansion and competitive threats, to a concrete financial forecast and, ultimately, a fair value estimate that you can compare with the current share price.

On Simply Wall St's Community page, used by millions of investors, Narratives make this process accessible by letting you plug in assumptions about future revenue, earnings and margins. They then show you what fair value those numbers imply and whether that supports buying, holding or selling today.

Because Narratives automatically update as new information like earnings releases, guidance changes or major news comes in, they help you keep your thesis current rather than relying on static models or outdated opinions.

For example, one BJ's Narrative might lean bullish, assuming that club expansion, strong renewals and digital momentum justify a fair value closer to the optimistic 130 dollar target. A more cautious Narrative might focus on margin pressure, slower comps and structural risks to bulk retail, leading to a fair value nearer 70 dollars. Narratives make it easy to see where your own view sits on that spectrum and what that means for your next move.

Do you think there's more to the story for BJ's Wholesale Club Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal