Beyond Meat (BYND): Taking Stock of Valuation After a Recent Share Price Rebound

Recent stock move and setup

Beyond Meat (BYND) has quietly bounced about 14% over the past month, even after a steep 61% slide in the past 3 months, leaving shares around 1.11 and sentiment still fragile.

See our latest analysis for Beyond Meat.

That bounce comes after a bruising stretch, with the 90 day share price return still deep in negative territory and the one year total shareholder return also sharply lower. This suggests recent momentum is more of a tentative reset than a full turnaround.

If Beyond Meat’s volatility has you rethinking your watchlist, this could be a good moment to widen the lens and explore fast growing stocks with high insider ownership.

With the shares now trading near 1.11 and roughly 45% below the average analyst price target, investors face a key question: Is Beyond Meat genuinely undervalued here, or is the market rightly discounting its future growth?

Most Popular Narrative: 31.1% Undervalued

With Beyond Meat last closing at $1.11 against a narrative fair value of $1.61, the current setup implies meaningful upside if the projections play out.

Continued emphasis on manufacturing cost reduction and operational right sizing, aided by the newly appointed Interim Chief Transformation Officer, supports a path to structurally lower costs of goods sold and enhanced fixed cost absorption, directly improving gross and net margins.

Curious how shrinking revenues can still line up with a higher valuation? The narrative leans on margin repair, earnings recovery, and a future multiple that might surprise you.

Result: Fair Value of $1.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn category weakness and a heavy, still evolving capital structure could quickly overpower margin progress and derail the undervaluation thesis.

Find out about the key risks to this Beyond Meat narrative.

Another View on Valuation

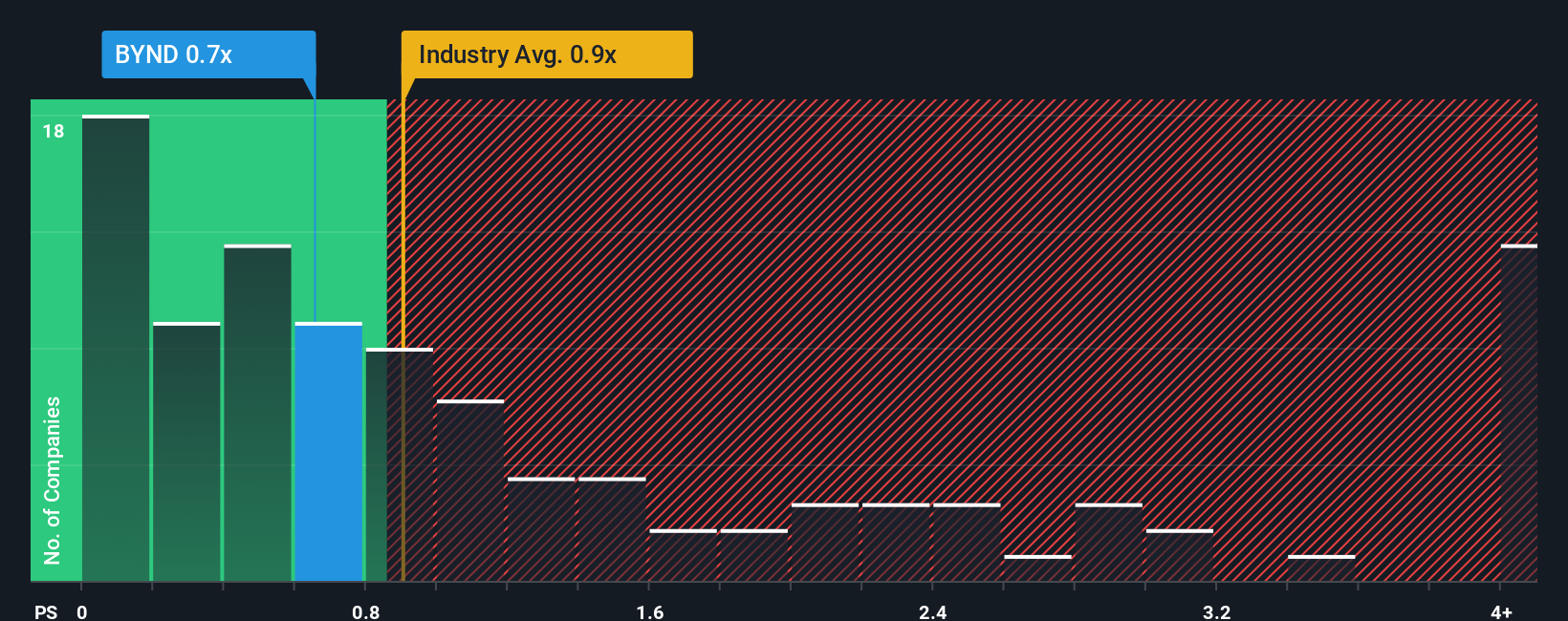

On a simple price to sales basis, Beyond Meat looks stretched, trading at about 1.7 times sales versus 1.5 times for peers and 0.7 times its own fair ratio. If sentiment turns again, could the market push that rich sales multiple back toward the fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beyond Meat Narrative

If you are not convinced by this viewpoint, or would rather dig into the numbers yourself, you can build a tailored narrative in just a few minutes: Do it your way.

A great starting point for your Beyond Meat research is our analysis highlighting 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, seize this moment to uncover fresh opportunities with the Simply Wall St Screener, so you are not relying on just one stock story.

- Tap into potential mispricings by reviewing these 912 undervalued stocks based on cash flows that may be trading far below what their cash flows suggest.

- Position yourself ahead of powerful tech shifts by scanning these 24 AI penny stocks that are building real businesses around artificial intelligence.

- Lock in income potential by focusing on these 13 dividend stocks with yields > 3% that can strengthen your portfolio with consistent cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal