Visa (V): Valuation Check After New AI Agent Payments and USDC Settlement Milestones

Visa (V) just checked off two big boxes on the future of payments timeline, moving AI shopping agents into real world use and turning USDC settlement for U.S. partners from pilot to product.

See our latest analysis for Visa.

Investors seem to be warming to that story, with Visa’s 1 month share price return of 7.75 percent helping build momentum on top of an 11.08 percent year to date share price gain and a robust 3 year total shareholder return of 73.56 percent.

If Visa’s AI and stablecoin push has you thinking bigger about the future of payments, it is worth exploring high growth tech and AI stocks to see which other names are quietly positioning for the same structural shift.

With shares already up double digits this year and trading about 13 percent below the average analyst price target, investors face a crucial question: Is Visa still undervalued, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 11.8% Undervalued

With Visa shares last closing at $349.25 against a narrative fair value near $396, the market is being asked to believe this growth runway is far from finished.

Rapidly accelerating adoption of value added services (VAS), with VAS revenue up 26% year over year and expanding into areas such as AI, risk solutions, and open banking, is increasing Visa's mix of higher margin business lines, which should lift net margins and improve overall earnings quality.

Curious how steady double digit top line growth, rising margins, and a premium future earnings multiple all add up to that valuation call? The full narrative unpacks the precise growth, profitability, and capital return assumptions behind this price tag, and how a modest discount rate turns those projections into today’s fair value.

Result: Fair Value of $395.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural threats from real time account to account rails and ongoing interchange fee scrutiny could still erode Visa's pricing power and pressure margins.

Find out about the key risks to this Visa narrative.

Another View: Multiples Flash a Caution Signal

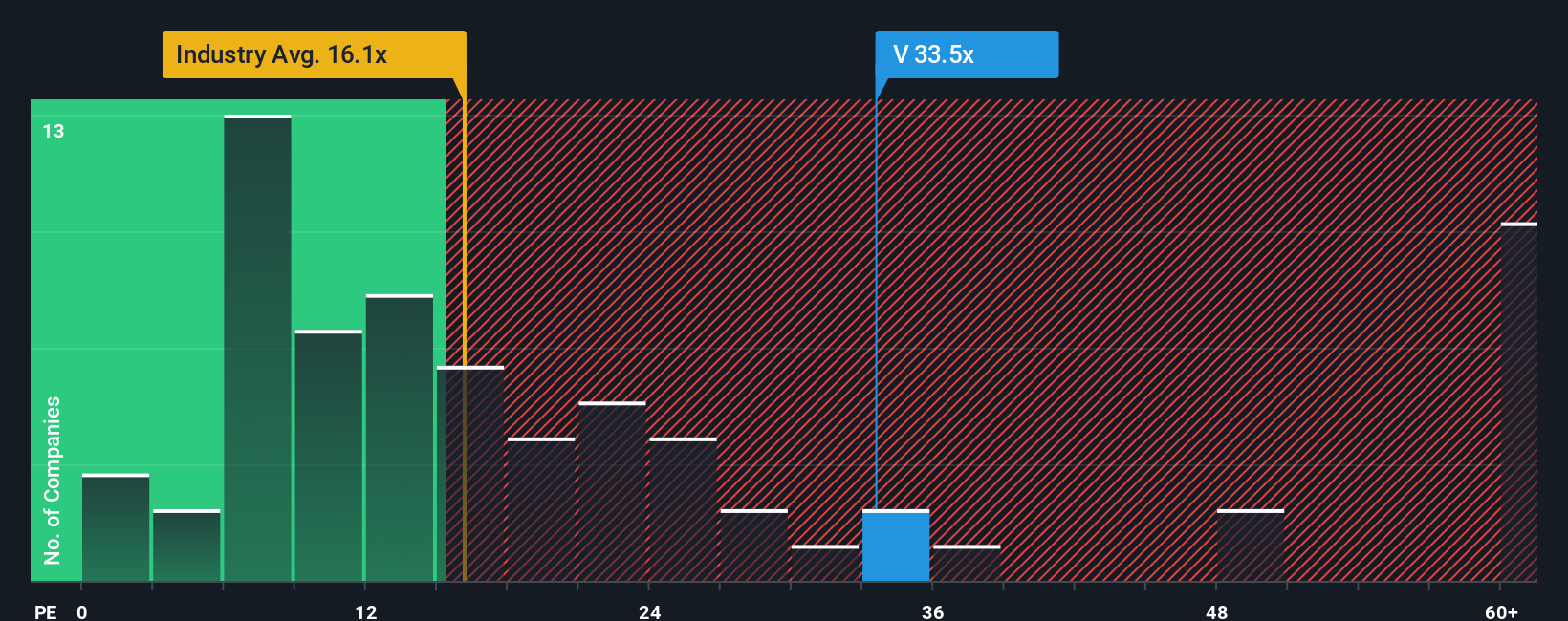

While the narrative fair value suggests Visa is 11.8 percent undervalued, the earnings multiple paints a tougher picture. At about 33.6 times earnings versus an industry average near 13.8 times and a fair ratio closer to 20 times, Visa looks richly priced. This raises the risk that any slowdown or regulatory hit could trigger a sharp de rating.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Visa Narrative

If you see the story differently, or want to stress test the assumptions with your own inputs, you can build a complete narrative in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Visa.

Ready for more high conviction ideas?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover fresh stocks that match your strategy before the market fully catches on.

- Capture potential multi baggers early by scanning these 3627 penny stocks with strong financials built around small companies with solid balance sheets and real business momentum.

- Target tomorrow's innovation leaders by filtering for these 24 AI penny stocks that blend powerful growth narratives with improving fundamentals in artificial intelligence.

- Lock in mispriced quality by using these 913 undervalued stocks based on cash flows to spot established businesses trading below what their long term cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal