Okta (OKTA): Reassessing Valuation After Strategic Board Additions in SaaS and Cybersecurity

The market is digesting fresh boardroom news at Okta (OKTA), where the company has added two heavyweight independent directors and seen one departure. This shift could subtly reshape the stock’s long term story.

See our latest analysis for Okta.

Those board additions land as the share price hovers around $90.21, with a solid year to date share price return suggesting momentum is rebuilding even though the five year total shareholder return remains deeply negative. This mix often signals investors are reassessing both growth potential and execution risk.

If Okta’s latest move has you thinking more broadly about where leadership and innovation could drive the next leg of returns, it is worth exploring high growth tech and AI stocks as potential next candidates for your watchlist.

With the stock trading around a 25 percent discount to analyst targets and showing improving fundamentals, is Okta still flying under the radar for long term investors, or is the market already pricing in its next wave of growth?

Most Popular Narrative: 19.2% Undervalued

With Okta closing at $90.21 versus a narrative fair value a little above $111, the current setup frames a sizeable upside gap for patient investors.

The proliferation of AI agents and nonhuman identities is creating new, urgent security use cases that require sophisticated identity governance, privileged access management, and policy controls, areas where Okta is innovating (Cross App Access, Auth0 for AI Agents, Axiom acquisition), opening incremental growth avenues and potential margin expansion through higher value and differentiated products.

Want to see how steady revenue expansion, rising margins and a punchy future earnings multiple all fit together into that upside case? The narrative spills the full playbook.

Result: Fair Value of $111.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying platform competition and potential execution missteps on complex product integrations could quickly challenge Okta’s growth assumptions and premium valuation narrative.

Find out about the key risks to this Okta narrative.

Another Lens on Valuation

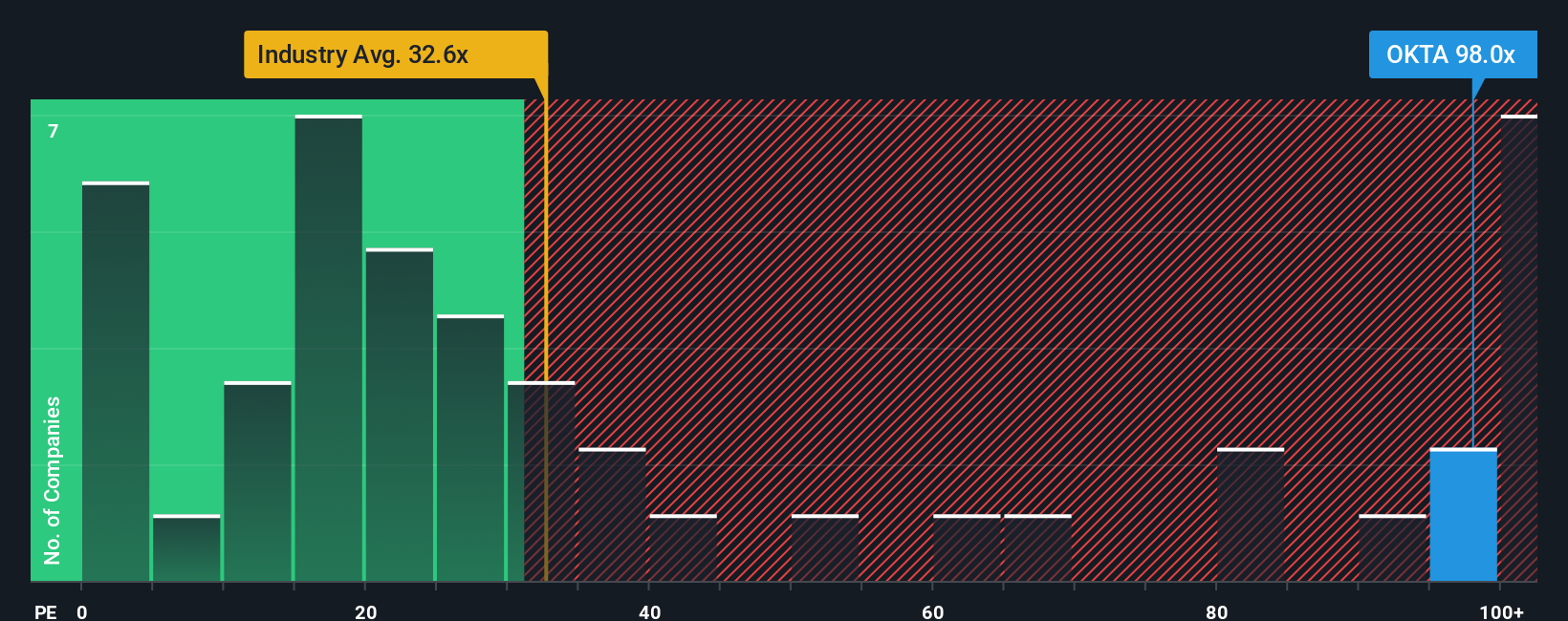

On earnings, Okta looks far from cheap. The stock trades on a P/E of about 82 times, versus roughly 30 times for the US IT sector and peers, and a fair ratio near 36 times suggests the market could easily compress that multiple if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Okta Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a bespoke view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Okta.

Looking for more investment ideas?

Before the market moves without you, put Simply Wall Street’s Screener to work and line up your next opportunities with clear data and focused themes.

- Capture thematic growth by scanning these 25 AI penny stocks that are reshaping industries with real world AI adoption and scalable business models.

- Explore income potential by zeroing in on these 13 dividend stocks with yields > 3% that balance yields with payout ratios and cash flows.

- Seek overlooked value by targeting these 914 undervalued stocks based on cash flows where current prices trail long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal