Copa Holdings (NYSE:CPA): Valuation Check After Strong November Traffic Growth and Improving Load Factors

Copa Holdings (NYSE:CPA) just released its November traffic update, showing capacity up 10% and passenger traffic up 10.2% year over year, with load factor nudging higher to 86.2%.

See our latest analysis for Copa Holdings.

The strong November traffic update fits neatly with Copa Holdings' recent momentum, with a 1 day share price return of 3.47 percent and a robust year to date share price return of 44.81 percent. The 1 year total shareholder return of 48.17 percent underscores that investors have been steadily rewarding its improving fundamentals.

If you are looking beyond airlines for your next idea, this could be a good moment to explore aerospace and defense stocks as another way to tap into travel and defense related demand trends.

With traffic still climbing, earnings expected to grow double digits and the share price sitting roughly 26 percent below consensus targets, is Copa Holdings quietly offering upside today or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 20.5% Undervalued

With Copa Holdings last closing at $124.12 against a narrative fair value near $156, the gap points to material upside if the projections hold.

The company's disciplined cost management, ongoing seat densification, and delivery of more fuel efficient Boeing 737 MAX aircraft enable Copa to maintain industry leading net and operating margins, giving it resilience and earnings growth potential even in a competitive environment with downward pressure on yields.

Want to see how steady network expansion, rising margins and a richer profit multiple combine into that higher value? The full narrative unpacks the revenue path, the earnings climb and the exact valuation bridge behind that upside call.

Result: Fair Value of $156.2 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent yield pressure and any disruption at Copa’s Panama hub could quickly erode margins and challenge the current upside narrative.

Find out about the key risks to this Copa Holdings narrative.

Another View: SWS DCF Signals Caution

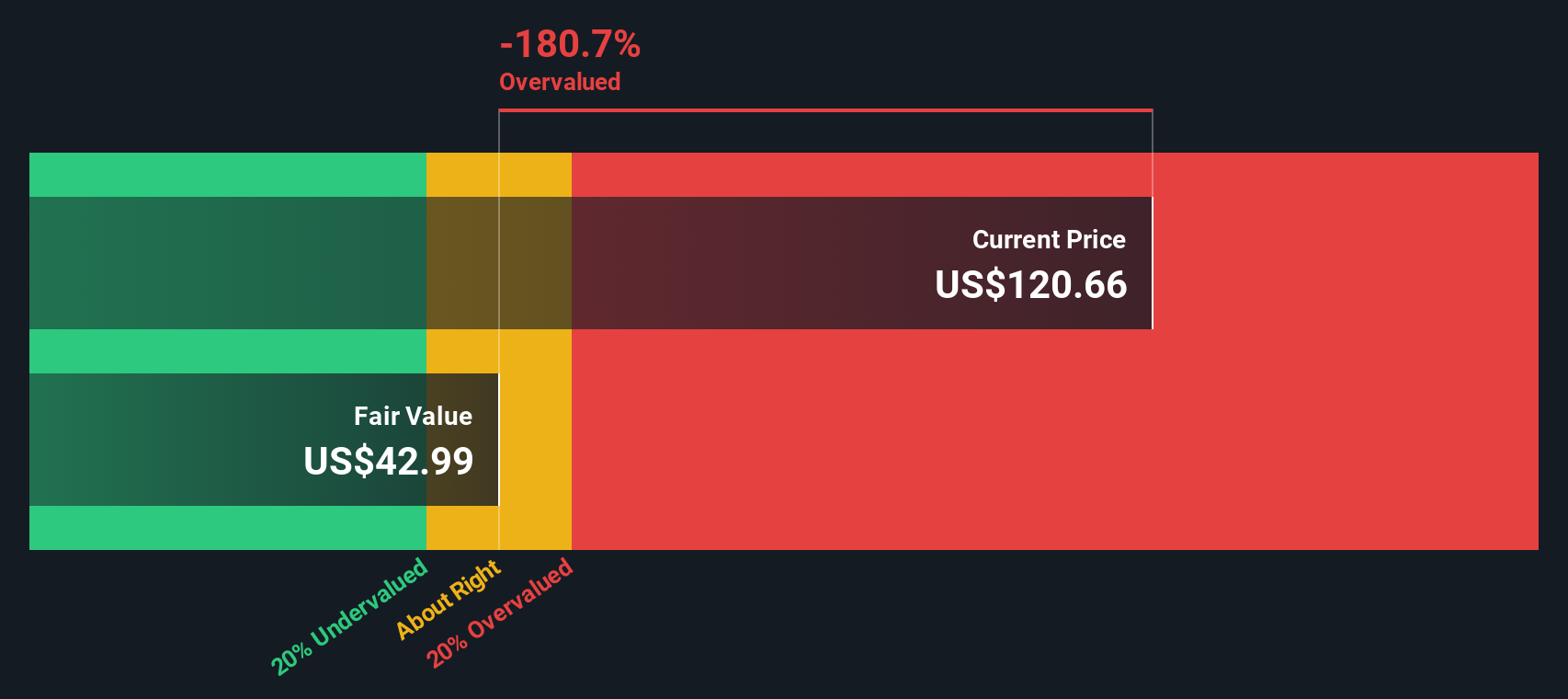

While the narrative fair value suggests upside, our DCF model paints a starkly different picture, pointing to fair value near $45 versus the current $124. That implies Copa might be significantly overvalued on cash flow terms, raising the question of which story investors should trust.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Copa Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Copa Holdings Narrative

If you see Copa’s story differently or want to stress test the assumptions yourself, build a custom view in just minutes with Do it your way.

A great starting point for your Copa Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Before you move on, consider locking in your next set of opportunities with targeted stock ideas from the Simply Wall St screener so you are not leaving potential returns on the table.

- Target potential income streams by reviewing these 13 dividend stocks with yields > 3% that can help support the yield profile of your portfolio.

- Explore possible mispriced opportunities with these 914 undervalued stocks based on cash flows that appear inexpensive relative to their cash flows.

- Position yourself in emerging AI trends with these 25 AI penny stocks that are developing the next generation of intelligent technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal