Is It Too Late To Consider Guardant Health After Its 215% Surge In 2025?

- For investors wondering whether Guardant Health is still a smart buy after its massive run up, or if new investors might be late to the party, this article will walk through what the current price is really baking in.

- The stock has surged an eye catching 214.9% over the last year and 213.9% year to date, even if the last week and month have been relatively flat at -2.3% and 0.2% respectively.

- Behind those moves, investors have been reacting to a steady drumbeat of news around Guardant's liquid biopsy platform gaining traction in cancer diagnostics and screening, along with new collaborations that expand access to its tests. At the same time, ongoing regulatory milestones and clinical study readouts have kept sentiment shifting as the market reassesses the long term adoption curve.

- On our framework, Guardant Health currently scores a modest 2 out of 6 on undervaluation checks, which makes it crucial to look beyond headline metrics. In the next sections we will break down multiple valuation approaches, then finish with a deeper way to think about what the market might really be pricing in.

Guardant Health scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Guardant Health Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth today by projecting its future cash flows and discounting them back to the present. For Guardant Health, the 2 Stage Free Cash Flow to Equity model starts from last twelve months Free Cash Flow of about -$259 million, reflecting the company’s heavy investment phase rather than mature profitability.

Analysts and extrapolated estimates see those cash flows improving sharply, moving from negative in the near term to around $316 million by 2029, and continuing to scale toward more than $1.6 billion by 2035 as the business grows. When all of these projected cash flows are converted into today’s dollars, the model arrives at an intrinsic value of about $208.37 per share.

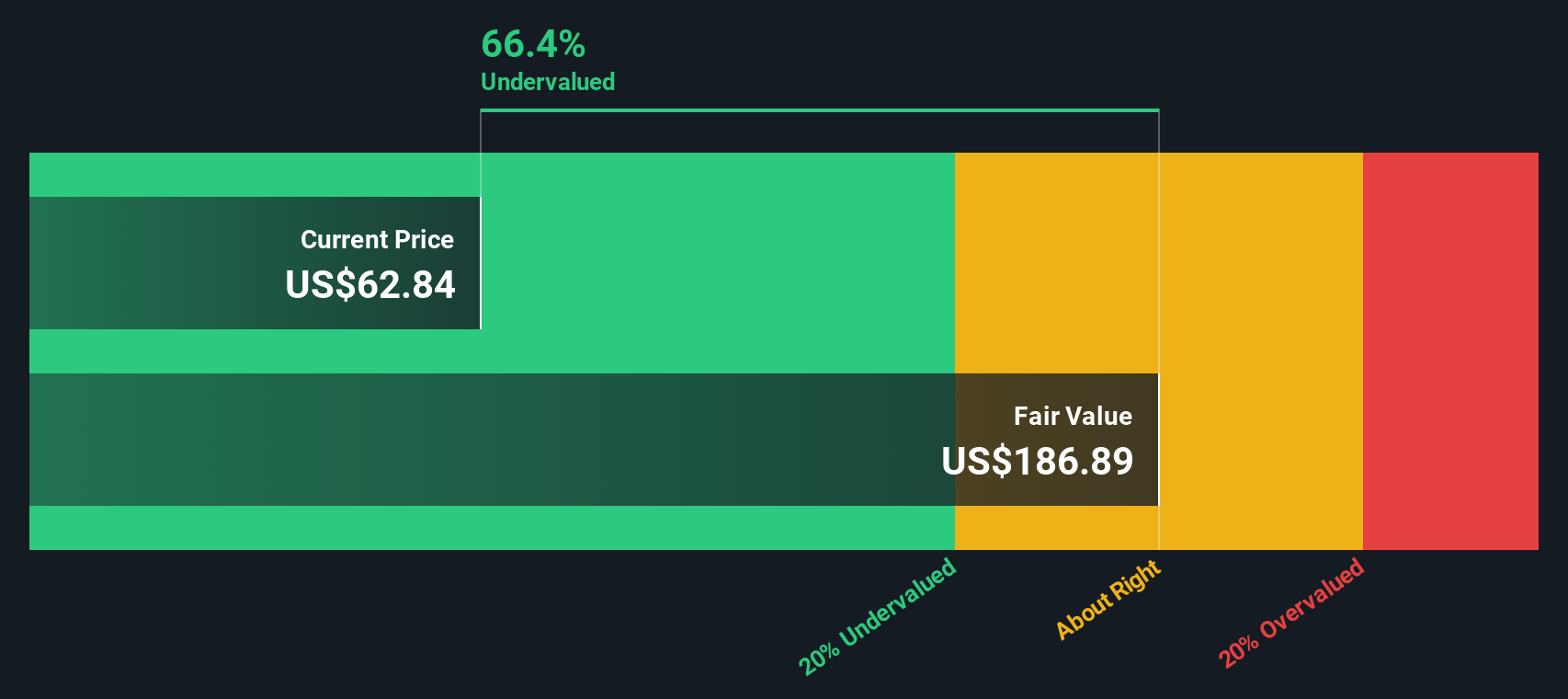

Compared with the current market price, this implies Guardant Health is trading at roughly a 52.1% discount to its estimated fair value. This indicates the market may not be fully pricing in the long term cash generation potential of its platform.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Guardant Health is undervalued by 52.1%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

Approach 2: Guardant Health Price vs Sales

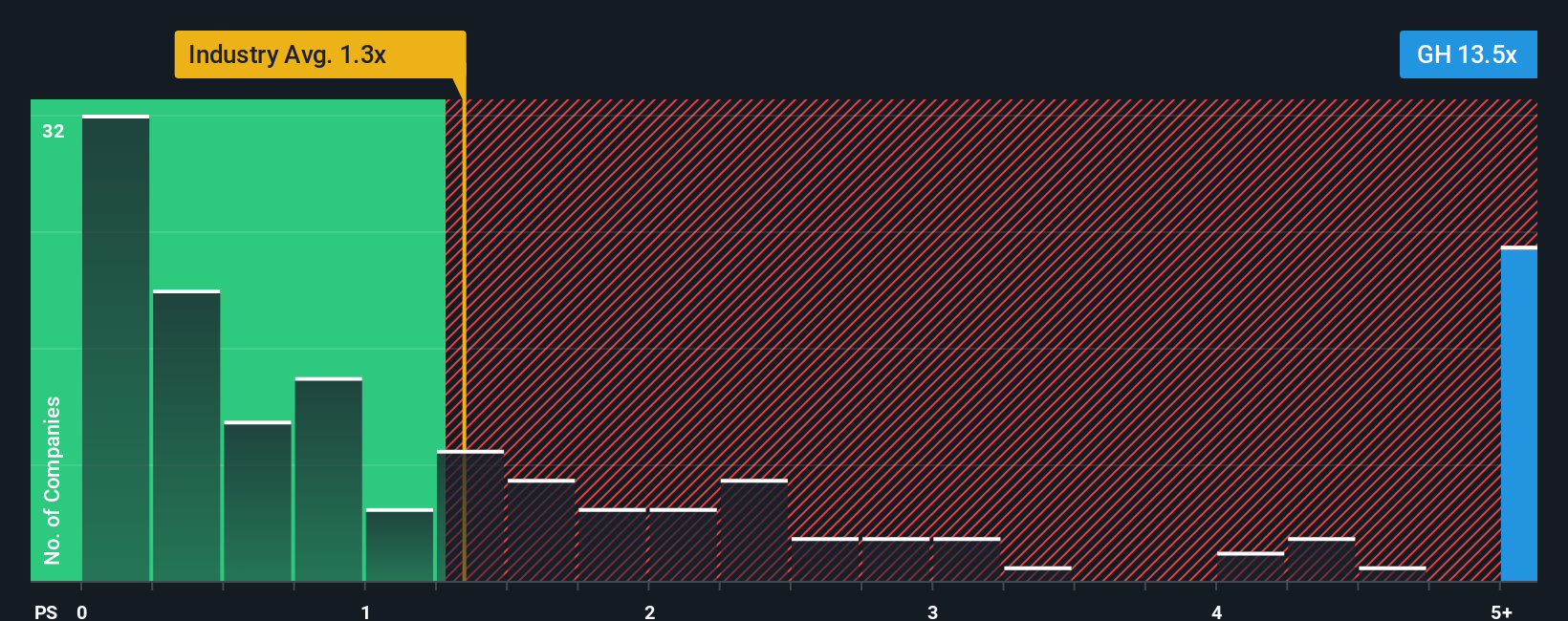

For companies like Guardant Health that are still loss making and investing heavily in growth, the Price to Sales, or P S, ratio is often a more useful yardstick than earnings based metrics. It focuses on what investors are paying for each dollar of current revenue, which is more stable than near term profits during a build out phase.

In general, faster growth and lower perceived risk justify a higher “normal” multiple, while slower growth or higher uncertainty call for a discount. Guardant currently trades on a P S of about 14.24x, which sits far above the broader healthcare industry average of roughly 1.33x and also well ahead of the peer group at around 1.13x. On the surface, that suggests the market is baking in very strong, differentiated growth.

Simply Wall St’s Fair Ratio framework refines this comparison by estimating what P S multiple Guardant should trade on, given its growth outlook, profit potential, risk profile, industry and size. That Fair Ratio is 6.97x, materially below the current 14.24x. On this lens, even after allowing for Guardant’s attractive long term story, the shares look richly valued on sales.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1465 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Guardant Health Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach a story, your view of a company’s future revenue, earnings and margins, to the numbers and connect that story to a clear fair value estimate.

On Simply Wall St, Narratives live in the Community page and are used by millions of investors as an easy, visual tool that links a company’s business story to a financial forecast and then to a fair value, which they can compare directly with today’s share price to decide whether to buy, hold or sell.

Because Narratives are refreshed as new information, like earnings reports, product launches or regulatory news arrives, they stay dynamic rather than static. This helps you continually reassess whether the market price still matches your thesis.

For Guardant Health, for example, one investor might build a bullish Narrative that assumes revenue climbing toward about 2.2 billion dollars by 2028 and a fair value near 100 dollars per share. A more cautious investor might assume slower adoption and lower margins that support something closer to the 47 dollar end of the analyst target range, and Narratives let you see and compare those viewpoints instantly.

Do you think there's more to the story for Guardant Health? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal